Philanthropy and charitable donations

Citation

AIHW

Australian Institute of Health and Welfare (2023) Philanthropy and charitable donations, AIHW, Australian Government, accessed 28 April 2024.

APA

Australian Institute of Health and Welfare. (2023). Philanthropy and charitable donations. Retrieved from https://www.aihw.gov.au/reports/australias-welfare/philanthropy-and-charitable-giving

MLA

Philanthropy and charitable donations. Australian Institute of Health and Welfare, 07 September 2023, https://www.aihw.gov.au/reports/australias-welfare/philanthropy-and-charitable-giving

Vancouver

Australian Institute of Health and Welfare. Philanthropy and charitable donations [Internet]. Canberra: Australian Institute of Health and Welfare, 2023 [cited 2024 Apr. 28]. Available from: https://www.aihw.gov.au/reports/australias-welfare/philanthropy-and-charitable-giving

Harvard

Australian Institute of Health and Welfare (AIHW) 2023, Philanthropy and charitable donations, viewed 28 April 2024, https://www.aihw.gov.au/reports/australias-welfare/philanthropy-and-charitable-giving

Get citations as an Endnote file: Endnote

On this page

In Australia, philanthropy and giving to charity occur in many ways. Philanthropy Australia defines philanthropy as the giving of money, time, information, goods and services, influence and voice to improve the wellbeing of humanity and the community. Donations to registered charities can be tax deductible if the Australian Taxation Office (ATO) has endorsed the entity as a deductible gift recipient (DGR) (ATO 2023a). Fewer than half of charities in Australia have DGR status.

Some charities are set up primarily to deliver structured philanthropy such as ancillary funds. For others, distributing grants may be only one element of their operations (Cortis et al. 2018).

The legal environment in Australia for making financial donations is complex; hence the information on this page is a broad overview of key elements only.

The not-for-profit sector consists of approximately 30% charities; the remainder of the sector largely consists of self-assessed income tax exempt entities and a small percentage of taxable not-for-profit entities. The self-assessed income tax exempt entities fall into 8 purpose-based categories, such as community service and sporting. These entities play an integral role, along-side charities, to improve the wellbeing of the community (ATO 2020).

Volunteering – time willingly given for the common good and without financial gain (VA 2015) – is also considered to be philanthropy and/or charitable giving but is not directly covered here. For more information see Volunteers.

For more detail on financial philanthropic and charitable donations, see the in-focus report Philanthropy and charitable donations.

Definition of Structured Giving

Structured giving refers to relatively large‑scale giving or philanthropy, for example, through corporate cash donations, or larger scale private contributions that are made on a planned periodic basis.

Structured giving is important to charities and not-for-profit organisations as it provides a regular source of income. Structured giving can involve using a financial vehicle designed to enable giving, including:

- private or public ancillary funds

- sub-funds and giving circles

- testamentary or other legacy trusts.

Structured giving can also occur without using a dedicated financial vehicle from individuals and families (Philanthropy Australia).

Giving by source

Charities receive funding from various sources. In 2021, charities generated approximately $190 billion in revenue, including:

- $97.2 billion from government (including JobKeeper and other government stimulus initiatives related to COVID-19 and disaster recovery plans)

- $59.2 billion from funds raised from sales of goods or services

- $13.4 billion from donations and bequests

- $6.4 billion from investments

- $13.7 billion from other revenue sources (ACNC 2023b).

Donations made to non-deductible gift recipients (non-DGRs) or through buying items at a charity auction or gifts made under a will are not captured in income tax returns but are included in the total revenue generated by charities (ATO 2023c).

How to account for inflation?

To account for the impact of inflation over time, the Consumer Price Index (CPI) was used to adjust the nominal amount of donations made to charities to their equivalent real value. This conversion from nominal to real values allows for more accurate comparisons of the value of donations made across different periods. To calculate the real price of an item, the current price is divided by the CPI of the base year and then multiplied by 100. This provides an adjusted price that reflects the purchasing power of the currency in the base year.

Giving by individuals

The Charities Aid Foundation report on World Giving Index 2022 ranked Australia as the fourth most generous country among 119 countries with 3 in 5 Australians making a financial donation to a charity (CAF 2022). People choose to give for a variety of reasons, including to align with values and cultural identity, for personal satisfaction and caring about ‘doing the right thing’, and ‘giving back’ (McGregor-Lowndes et al. 2017).

The Australia Giving 2019 study reported the top 3 reasons why people give are that they:

- care about the cause (54%)

- want to help people less fortunate than them (41%)

- want to make a difference (33%) (CAF 2019).

The study also found that of the majority (68%) of respondents who donated to charity, 63% reported donating money to non-profit organisations and 30% to religious organisations. Around one-third (35%) reported providing volunteering services.

The majority of donors give a one-off donation to charities without intending to make regular or planned ongoing donations to that organisation (Scaife et al. 2016).

Approximately 40% of registered charities have Deductible Gift Recipient (DGR) endorsement from the ATO. Organisations endorsed as deductible gift recipients are entitled to receive gifts which are deductible from the donor’s income tax. To be DGR endorsed a charity must meet the specific criteria of one of the DGR categories based on the charities purpose. DGR endorsed charities are more likely to be the recipients of donations (ACNC 2023a).

Donors in Australia favoured charities that support children. Almost one-third (30%) of respondents reported giving to charities who support seriously ill children or children with disability, followed by helping the poor (25%) and medical research (21%) (CAF 2019).

In order to inspire greater philanthropy across Australia and encourage future giving, the 2022–2025 Philanthropy Australia Strategic Plan was launched in December 2021 by Philanthropy Australia. Philanthropy Australia has also implemented a national framework to double structured giving from $2.5 billion in 2020 to $5 billion by 2030. See Philanthropy Australia’s Blueprint to Grow Structured Giving.

Furthermore, in March 2023, the Government established a Productivity Commission review to analyse motivations for philanthropic giving in Australia and identify opportunities to grow it further. The Government is set to receive the Final Inquiry Report by 11 May 2024 (Productivity Commission 2023).

Tax-deductible donations

Donations by individuals of $2 or more to a DGR endorsed charity are deductible from an individual taxpayer’s assessable income. If the donation is property, a tax deduction may be claimed if the property is purchased and donated to a DGR within 12 months (ATO 2017).

When an individual adds a gift or donation in their tax return, they enter a description, which usually indicates where the donation has been made (ATO 2022a). Tax-deductible donations obtained from tax returns represent only a subset of individual giving, as not all donations made can be (or have been) deducted from income tax. Such non-deductible donations might include non-tax deductible contributions (raffle ticket, donations made directly to people), volunteering, donations to non-DGRs endorsed organisations or donations made by those who are not required to lodge a tax return.

In 2019–20:

- individual taxpayers claimed a total amount of $3.85 billion as a tax-deductible donation, a decrease of 3.4% in real terms from the previous year’s total of $3.98 billion (AIHW analysis of ATO 2023b)

- 2.08 million male taxpayers claimed tax-deductible donations totalling $2.18 billion, accounting for 56.7% of all tax-deductible donations claimed; 2.26 million female taxpayers claimed tax-deductible donations totalling $1.67 billion

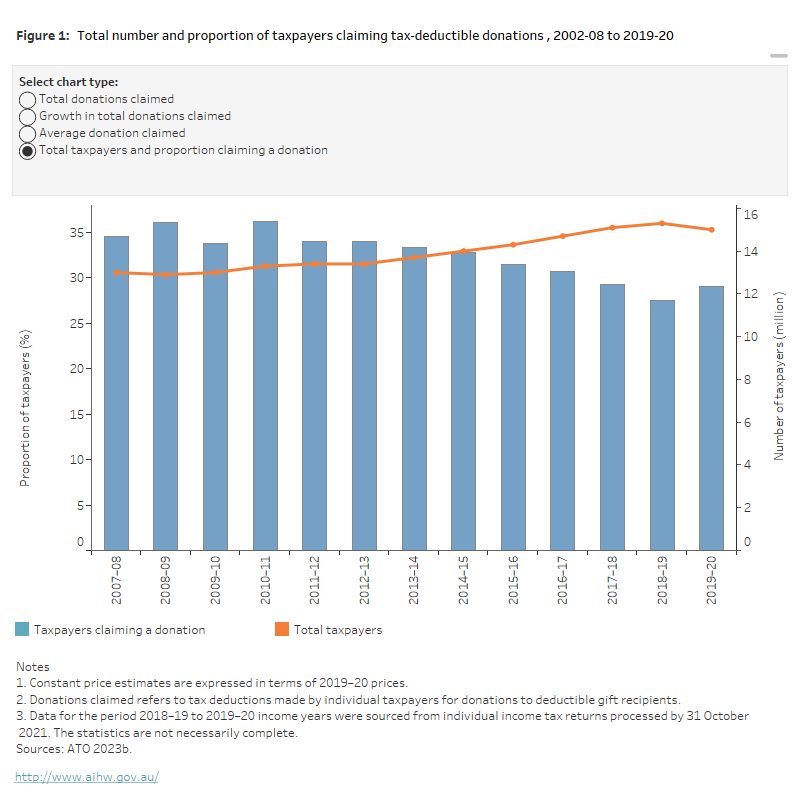

- 29.0% (4.34 million) of all Australian taxpayers claimed an average deduction of $887. This is in contrast with the previous year where a smaller number of taxpayers (27.5% or 4.21 million) made a greater average tax deduction of $945, in real terms (ATO 2023b; Figure 1).

Between 2007–08 and 2019–20:

- total donations increased from $3.02 billion to $3.85 billion in real terms

- the proportion of individual taxpayers claiming donations fell (from 34.5% to 29.0%; Figure 1).

From 2007–08 to 2009–10 there was a yearly average decrease of 11.0% in donations when adjusted for inflation. However, from 2010–11 to 2019–20, the yearly average growth in donations in real terms was 4.4% based on 2019–20 dollars (Figure 1).

The interactive data visualisation shows the total donations claimed by taxpayers from 2007-08 to 2019-20. Individual taxpayers claimed a total amount of $3.85 billion as a tax-deductible donation in 2019–20, a real decrease of 6.3% from the previous year’s total of $4.11 billion.

Business giving

Business giving is often driven by an ethical desire to give back to the community and the belief the donations will make a difference. Businesses also recognise the benefits a giving culture has on employee recruitment, retention and engagement (Burns et al. 2017).

Giving from the corporate sector in Australia plays an important role. In addition to cash donations, corporates also engage in community investment by providing services at no or substantially reduced cost with no expectation of a commercial return, for example legal and accounting firms. Additionally, corporates contribute to skilled volunteering activities and in-kind donations (WGA 2023a).

Many companies are joining the ‘Pledge 1% movement’ – wherein companies can pledge any combination of product, equity, profit, or time to whatever charity of their choice. Pledge 1% partners are leading organisations, committed to encouraging the early stage companies they work with, to make giving back a priority.

The Corporate Support Report from JBWere reported that in 2021:

- The top 50 companies contributed $1.37 billion into community investment, a 4% increase from the previous year. This represented 0.8% of pre-tax profit in 2021.

- The average contribution was $26.5 million, with the largest contribution being $234.1million and the smallest $3.5 million (WGA 2023a).

Workplace giving

Workplace giving is a joint relationship between employers, employees and charities that enables individuals to donate a proportion of their pre-tax salary to charity and claim a tax deduction equal to the amount of donations. From the employer perspective, workplace giving enhances staff engagement, increases employee pride and demonstrates the company’s commitment to the community. A further incentive is that some employers match staff donations (ATO 2021; WGA 2023b).

Data from the ATO showed that in 2019–20:

- about 211,300 Australians donated through workplace giving programs. This represented 5.1% of employees employed by workplace giving employers. The proportion of employees enrolled in these programs has remained constant over the last 10 years.

- the total donations by employees using workplace giving were $52 million, compared with $43 million in 2018–19.

- the average donation was $247.

Ancillary funds

Ancillary funds are charitable trusts created by deed for the purpose of making grants for public benefit in Australia. Ancillary funds cannot operate programs or deliver services, but they play a supporting role by funding eligible non-profit entities. Hence ancillary funds act as an intermediary between donors and DRGs (McGregor-Lowndes et al. 2022).

Private ancillary funds (PAFs) enable individuals, families or organisations to put aside money or property in a trust to support charities over the long term. PAFs cannot raise funds from the general public but can be endorsed as a DGR.

Public ancillary funds (PuAFs) are communal and philanthropic structures that must establish a public fund and raise funds from the general public. A PuAF can be a DGR and therefore donations are tax deductible. Common PuAF categories include community foundations, corporate foundations or fundraising foundations for individual charities.

Ancillary Fund Guidelines

The Public Ancillary Fund Guidelines 2022 mandate a minimum annual distribution rate. During each financial year, a PuAF must distribute at least 4% of the market value of the fund's net assets as valued at the end of the previous financial year, with a minimum annual distribution of $8,800, unless the expenses of the fund are being met outside the fund (ATO 2022b).

The Private Ancillary Fund Guidelines 2019 mandate a minimum annual distribution rate. During each financial year, a PAF must distribute at least 5% of the market value of the fund's net assets as valued at the end of the previous financial year, with a minimum annual distribution of $11,000 unless the expenses of the fund are being met outside the fund (McGregor-Lowndes 2022).

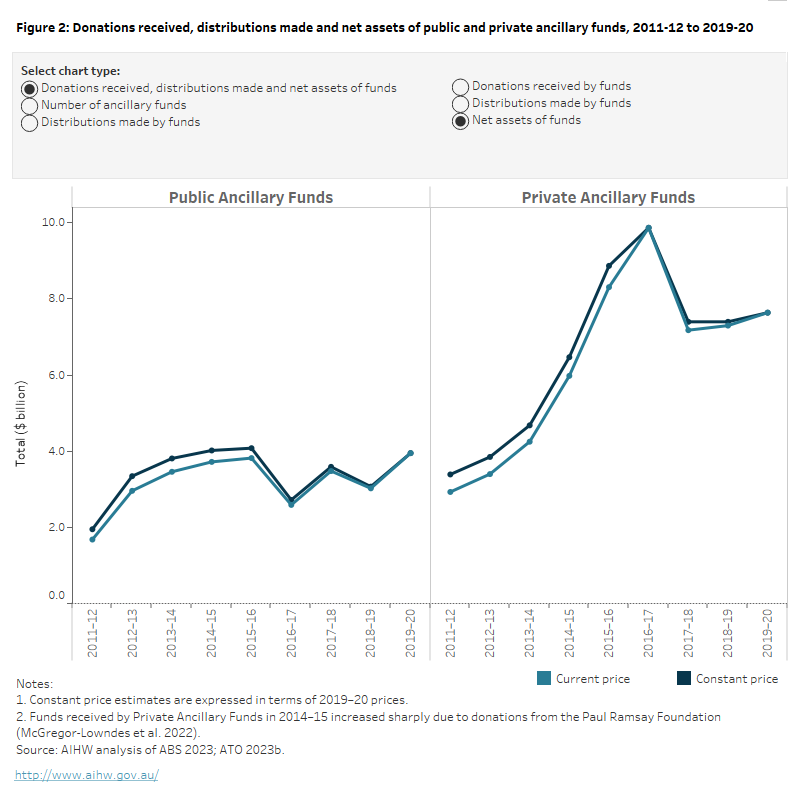

In 2019–20:

- There were 1,373 PuAFs and 1,819 PAFs, which received donations of around $1.31 billion and $0.81 billion, respectively.

- PuAFs distributed around $350 million and PAFs distributed around $521million, which represent 8.8% of net assets for PuAFs and 7% for PAFs.

- Charities receiving the highest proportion of distribution from PuAFs were those with multiple purposes (34%), health organisations (25%) and welfare and rights organisations (22%) (ATO 2023b; Figure 2).

From 2011–12 to 2019–20:

- The total number of PAFs increased from 1,002 to 1,819; an average growth of 7.8%.

- PuAFs donations increased on average by 18.1% per year in real terms, with the highest increase (53%) between 2018–19 to 2019–20.

- Donations to PAFs increased, on average, by 31.0% per year in real terms, driven by a large donation in 2014–15 from the Paul Ramsay Foundation (McGregor-Lowndes et al. 2022).

- On average, net assets for both PuAFs and PAFs grew by 13.2% and 12.5% in real term respectively, with assets for PuAFs remaining below those for PAFs over the period.

- PuAFs distributed an average of 14.3% of assets annually and PAFs distributed 6.9% on average (ATO 2023b; Figure 2).

The interactive data visualisation shows the donations received and the distribution of funds by PAFs and PuAFs. In 2019–20, PuAFs distributed around $350 million and PAFs distributed around $521 million which represent 8% of net assets for PuAFs and 7% for PAFs.

Recipients of giving

The donations made by individuals and businesses are used for different causes. These include advancing health, education, social or public welfare, environment, religion and culture as well as promoting or protecting human rights.

Charities

In December 2021, there were approximately 60,000 registered charities in Australia (ACNC 2023b). The charity sector is made up of charities of varying sizes, from tiny local community groups to large universities and international aid organisations. Most charities conduct a range of activities or programs working across Australia and internationally in a broad range of areas, including health, education, social welfare, religion, culture, human rights, the environment and animal welfare. The charity sector employed 1.42 million people in 2021; equating to the third largest workforce in Australia after Retail trade and Health care and social assistance sector (ABS 2023). However, volunteering is still a vital part with charities reporting 3.2 million volunteers helped deliver services in 2021 (ACNC 2023b).

In 2021:

- charities generated around $190 billion in revenue, a 7.9% increase from the previous year

- $13.4 billion came from donations and bequests, an increase of $700 million (5.3%) from the previous year. Donations and bequests represent 7% of the total charity revenue

- revenue received from government ($97.2 billion) was more than half of the total revenue for charities, an increase of more than $8.5 billion from the previous reporting period. Much of this increase in revenue was likely attributable to JobKeeper and other government stimulus initiatives

- total expenses for charities increased to $175 billion, 4.2% higher compared to 2020. In 2021 the increase in expenses was less than the increase in revenue, this is in contrast to the 2020 reporting period, where the increase in revenue was less than the increase in expenses

- $9.7 billion was spent on grants and donations and $99 billion on employee expenses

- net assets for charities increased by $26.7 billion to $281 billion which is an increase of 10.5% from the previous year. This increase is higher than growth of Australians’ personal financial assets wealth (3.8%)

- the most common activities for charities were religious activities and education (ACNC 2023b).

What are bequests?

Bequests are gifts made as part of a will or trust and are one of the most popular and flexible ways to support the causes that are important to you and your family. A bequest can be to a person or a trust, or it can be a charitable bequest to a non-profit organisation (CDC 2023).

Disaster relief and recovery fund

Australians have been impacted by climate change related emergencies in the past several years, from bushfires to floods and cyclones. The consequences of such events have substantial impacts on people, communities, the economy, infrastructure and the environment. The total cost of natural disasters in Australia is forecast to increase from $18.2 billion to $39 billion per year by 2050 (ARC 2023a). Charities have supported individuals, households and communities during those difficult times.

Flooding in Queensland and New South Wales

In late February 2022, southeast Queensland and New South Wales experienced multiple rounds of devastating flooding. The estimated total costs from the southeast Queensland floods were $7.7 billion (DAC 2023).

To address the immediate and long-term impacts from these floods, a range of assistance has been activated through charities, as well as state and commonwealth disaster recovery funding arrangements.

Between February and April 2022, the Australian Red Cross raised $53.9 million through the Australia Unites Telethon Appeal ($27.2 million) and Queensland and New South Wales Floods Appeal ($26.7 million). All proceeds from the Telethon Appeal were distributed as direct cash assistance to people impacted by the floods. In addition, $1.6 million was spent to deliver 24/7 support during the floods (ARC 2023b).

As at September 2022, the Salvation Army Strategic and Disaster Management team has distributed $13.44 million in financial assistance and in-kind support such as food parcels, clothing and household items.

The Australian and Queensland governments have funded the 2021–22 Southern Queensland Floods – Exceptional circumstances package. This package, with a total value of $1.5 billion, includes funding for housing, business, agriculture, community development and health and wellbeing assistance.

Bushfires

In the summer of 2019–20, Australia experienced severe bushfires. During that time, charities raised more than $640 million for relief and recovery efforts. It is estimated that 53% of Australians had donated to a bushfire appeal, with a median value of $50 (ACNC 2023c).

As at 31 July 2020:

- Australian Red Cross had received $232 million in donations and dispensed $167 million of the funds to its emergency services team, direct relief cash grants, recovery programs and administration costs.

- NSW Rural Fire Service Trust received donations of more than $100 million to support volunteer fire brigades.

- NSW Wildlife Information Rescue and Education Service (WIRES) had received $91 million in donations for rescue, rehabilitation and recovery of wildlife (ACNC 2023c).

Impact of COVID-19 on giving

‘There was unprecedented disruption with the emergence of the COVID-19 pandemic, causing many charities to change, reduce or cease operations for varying periods. Nearly 2,000 charities of the 49,165 charities who provided an annual information statement to Australian Charities Not-for-profits Commission (ACNC) did not operate, with 650 citing COVID-19 as a reason’ (ACNC 2023a).

The economic downturn, triggered by the COVID-19 pandemic, put financial stress on the non-profit sector (PA 2023). Many fundraising events were also cancelled or postponed (Boseley 2020).

In April 2020, 47% of 366 charities surveyed reported that they had experienced a substantial drop in donation fundraising income, with another 20% reporting a slight decrease (Institute of Community Directors Australia 2020). The pandemic has also affected the ability of charities to engage and retain the services of volunteers. In 2021, the number of volunteers dropped to 3.2 million, a decrease of around 180,000 compared with the previous year (ACNC 2023b).

However, during the pandemic, the Australian government provided a range of support to charities; these included 2 tax-free cash payments of between $20,000 and $100,000 to eligible charities and JobKeeper payments (ACNC 2023d). The support from the government helped relieve the financial stress for many charities and, as a result, in 2021 the total revenue generated by charities rose to $190 billion, an increase of $14 billion on the previous year. Revenue from government totalled $97.2 billion, an increase of $8.4 billion from the previous year (ACNC 2023b).

Where do I go for more information?

For more information on philanthropy and charitable giving in Australia, see:

ABS (Australian Bureau of Statistics) (2023) Labour account Australia, ABS, Australian Government, accessed 25 February 2023.

ACNC (Australian Charities and Not-for-profits Commission) (2023a) Australian charities report, 8th edition, ACNC, accessed 15 January 2023.

ACNC (2023b) Australian charities report, 9th edition, ACNC, accessed 29 June 2023.

ACNC (2023c) Bushfire response 2019-20 -reviews of three Australian charities, ACNC, accessed 15 January 2023.

ACNC (2023d) Major rise in Australia’s charity sector revenue and expenses, ACNC, accessed 15 January 2023.

ARC (Australian Red Cross) (2023a) How to save billions on disaster recovery, ARC, accessed 28 February 2023.

ARC (2023b) The road to recovery: Queensland and New South Wales floods 2022 12-month report, ARC, accessed 28 February 2023.

ATO (Australian Taxation Office) (2017) Donating recently purchased property to a DGR, ATO, Australian Government, accessed 21 June 2023.

ATO (2020) Types of NFP organisations, ATO, Australian Government, accessed 9 May 2023.

ATO (2021) Workplace giving programs, ATO, Australian Government, accessed 9 May 2023.

ATO (2022a) myTax 2022 gifts or donations, ATO, Australian Government, accessed 9 May 2023.

ATO (2022b) Taxation administration (public ancillary fund) guidelines 2022, ATO, Australian Government, accessed 9 May 2023.

ATO (2023a) Gifts and donations, ATO, Australian Government, accessed 1 June 2023.

ATO (2023b) Taxation statistics 2019–20, ATO, Australian Government, accessed 22 February 2023.

ATO (2023c) Is it a gift or contribution?, ATO, Australian Government, accessed 9 May 2023.

Boseley M (2020) Really struggling: Covid-19 puts Australian charities at risk just when they are needed most, the Guardian, accessed 6 July 2023.

Burns W, Wang S and Arias D (2017) Giving Australia 2016: Business giving and volunteering, Department of Social Services, Australian Government, accessed 21 June 2023.

CAF (Charities Aid Foundation) (2019) Australia Giving 2019: An overview of charitable giving in Australia, CAF, accessed 26 February 2023.

CAF (2022) CAF world giving index 2022: A global view of giving trends, 10th edn, Kent, United Kingdom, CAF, accessed 26 February 2023.

CDC (Centre for Disease Control) (2023), What is a Bequest?, CDC Foundation, accessed 15 March 2023.

Cortis N, Powell A, Ramia I and Marjolin A (2018) Australia’s grant-making charities in 2016: an analysis of structured philanthropy and other grant-makers, Centre for Social Impact and Social Policy Research Centre, University of New South Wales.

DAC (Deloitte Access Economics) (2022) The social, financial and economic costs of the 2022 South East Queensland Rainfall and Flooding Event, DAC, accessed 26 February 2023.

McGregor-Lowndes M, Crittall M, Conroy D, Keast R, Baker C, Barraket J and Scaife W (2017) Giving Australia 2016: Individual giving and volunteering, Department of Social Services.

McGregor-Lowndes M, Crittall M and Williamson A (2022) Ancillary funds 2000–2022, Australian Centre for Philanthropy and Nonprofit Studies and Queensland University of Technology, accessed 9 February 2023.

Productivity Commission (2023) Philanthropy, Productivity Commission, Australian Government, accessed 10 May 2023.

PA (Philanthropy Australia) 2023 Insights from Australian Philanthropy’s response to the COVID-19 Crisis, Philanthropy Australia, accessed 25 July 2023.

Scaife W, McGregor-Lowndes M, Barraket J and Burns W (eds) (2016) Giving Australia 2016: literature review summary report, Australian Centre for Philanthropy and Nonprofit Studies, Queensland University of Technology, the Centre for Social Impact Swinburne, Swinburne University of Technology, and the Centre for Corporate Public Affairs.

VA (Volunteering Australia) (2015) Volunteering Australia Project: the review of the definition of volunteering, VA, accessed 11 February 2023.

WGA (Workplace Giving Australia) (2023a) JBWere Corporate Support Report 2022, WGA, accessed 26 February 2023.

WGA (2023b) Why workplace giving?, WGA, accessed 26 February 2023.