Income support

1 in 5

(21%) of all income support payment recipients aged 16–64 receive the Disability Support Pension (DSP) at June 2020

1 in 25

(4.0%) people aged 16–64 get DSP at June 2020, including 1 in 10 (9.7%) Indigenous Australians

4 in 5

(81%) DSP recipients aged 16–64 have received it for at least 5 years, and 3 in 5 (56%) for 10 or more years at June 2020

On this page:

Introduction

People with disability may receive financial assistance to help with activities of daily life. This section looks at income support payments for people with disability, focusing on those aged 16–64 receiving the DSP. The DSP is the main income support payment available specifically to people with disability.

Disability Support Pension

The Disability Support Pension (DSP) is a means-tested income support payment for people who are aged 16 and over but under Age Pension age (at claim) and who have reduced capacity to work because of their disability.

This includes those who:

- are permanently blind

- have a physical, intellectual or psychiatric condition resulting in functional impairment making the person unable to work for 15 hours or more per week for the next 2 years due to their disability or medical condition

- are unable, as a result of impairment, to undertake a training activity which would equip them for work within the next 2 years.

DSP recipients are also encouraged to participate in employment where they have the capacity to, and can gain from the benefits of working, including improved wellbeing.

On becoming qualified for the Age Pension, those already on DSP may remain on it but the payment is closed to new entrants.

DSP is administered through Services Australia. It assists recipients to meet the everyday costs of living.

For more information see DSP – Qualification & Payability, Disability Support Pension – Participation Requirements, and Disability Support Pension.

While section focuses on DSP, people with disability may also be eligible for other payments, allowances or supplements, such as Mobility Allowance, government concession cards (which discounts selected goods and services), and more general financial support (such as to assist with study, housing or finding work). For analysis of government payments received by people with disability, see also 'Government payments'.

Other financial assistance for people with disability

Mobility Allowance

The Mobility Allowance helps with transport costs for people aged 16 and over who have disability, illness or injury, who cannot use public transport without substantial assistance, and who are participating in approved activities (such as studying, training, working, or looking for work).

The allowance is affected by the roll-out of the National Disability Insurance Scheme (NDIS). Current Mobility Allowance recipients assessed as eligible for the NDIS will receive support for reasonable and necessary transport costs as part of their NDIS package and will no longer receive the Mobility Allowance. People not eligible for the NDIS will continue to receive the Mobility Allowance.

At June 2020 around 13,500 people received the Mobility Allowance – down from 16,800 at June 2019, 32,800 at June 2018, 45,200 at June 2017 and 60,000 at June 2016 (DSS 2020a).

Supporting carers of people with disability

Financial support for people caring for people with disability is available through the following payments:

- Carer Payment – income support payment for people who, due to caring responsibilities, are unable to support themselves through substantial paid employment

- Carer Allowance – supplementary payment for people who provide daily care and attention at home to a person with disability, a severe medical condition or who is frail and aged

- Carer Supplement – an annual payment for carers in receipt of Carer Allowance and/or Carer Payment

- Child Disability Assistance Payment – an annual payment for those receiving Carer Allowance for a child

At June 2020, around:

- 41,200 children aged under 16 qualified their carer for Carer Payment, compared with 130,000 people aged 16–64 and 120,000 people aged 65 and over

- 181,000 children aged under 16 qualified their carer for Carer Allowance, compared with 224,000 people aged 16–64 and 271,000 people aged 65 and over

- 639,000 carers received Carer Supplement

- 158,000 carers received Child Disability Assistance Payment (DSS 2020a, 2021a).

Centrelink data

Disability Support Pension (DSP) data in this section are sourced from unpublished data provided by the Department of Social Services (DSS) based on Services Australia administrative data, unless otherwise specified. Data are point-in-time at the last Friday of each month. Data are available from July 2000.

The size of the DSP population

Around 754,000 people aged 16 and over received the DSP at 26 June 2020 (3.7% of the Australian population in this age group). Of these, the vast majority (88%) were aged 16–64 (660,000 or 4.0% of the Australian population in this age group).

The DSP is one of Australia’s largest income support payments for people of working age. Recipients aged 16–64 account for more than 1 in 5 (21%) of all income support payment recipients aged 16–64, the second largest payment type after unemployment benefits for this age group.

Disability Support Pension recipients aged 65 and over

While this section focuses on DSP recipients aged 16–64, a small proportion (12%) are aged 65 and over (at 26 June 2020). This box looks at these recipients.

The number of people aged 65 and over receiving DSP is relatively small (93,800 or 2.2% of the population aged 65 and over).

The number and proportion of those aged 65 and over receiving DSP has increased over the past 15 years – from 0.2% of the population in this age group (or 6,200) in 2005 to 0.6% (or 16,500) in 2010, 1.2% (or 41,200) in 2015, and 2.2% (or 93,800) in 2020.

The numbers of men and women aged 65 and over receiving DSP were similar in 2020 (47,000 and 46,800 or 2.4% and 2.1% of the population aged 65 and over respectively).

The vast majority of those aged 65 and over receiving DSP were aged 65–69 (70% or 32,900 of females aged 65 and over receiving DSP, 68% or 31,700 of males).

The proportion of income support recipients receiving DSP declines with age, from 10% (or 64,600) of income support recipients aged 65–69 to 2.9% (or 21,400) aged 70–74.

Changes over time in DSP

Changes over time in DSP can be seen in overall numbers and as a proportion of:

- the Australian population

- income support recipients.

Key changes to income support eligibility that affect DSP

Between 2000 and 2020, the social security system has undergone significant reforms likely to influence trends in income support payments and recipients.

Key changes likely to influence DSP trends include:

- Eligibility criteria for DSP have tightened over recent years – for example, a change to the eligibility criteria for the DSP of being unable to work 30 hours a week, decreased to 15 hours per week from 2006. A new category for the unemployment payment for Newstart Allowance (now called JobSeeker Payment) was created for those with work capacity of less than 30 hours a week – Newstart Partial Capacity to Work. In 2012, significantly revised impairment tables were introduced.

- Age Pension – the qualifying age for the Age Pension for females increased from 60 in 1995 at the rate of 6 months every 2 years and reached 65 in 2013, the same qualifying age as for males. From 1 July 2017, the pension qualifying age for males and females rose again by 6 months every 2 years from 65, increasing from 66 on 1 July 2019 until it reaches 67 in 2023.

- Reduction in number of income support payments – various payments now closed to new recipients including Mature Age Allowance and Sickness Allowance ceased in 2008, and wife pensions ceased in 2020 (Age Pensioners and Disability Support Pensioners).

DSP, Newstart Allowance (NSA) and JobSeeker Payment

Around 754,000 people received the DSP in June 2020 and around 1.4 million received the JobSeeker Payment (DSS, 2021a). Historically, the DSP was one of the fastest-growing government social assistance programs. Recent policy changes, including the 2012 compliance and assessment measures, seem to have slowed this growth. These changes were followed by a fall in the number of new DSP applicants who were granted payment from 63% in 2001–02 to 43% from 2011–12 to 2014–15 (PBO 2018).

In parallel, the proportion of NSA recipients assessed as having a partial capacity to work steadily increased until June 2019. In June 2020, the proportion of JobSeeker Payment recipients with partial capacity was lower than the proportion of NSA recipients in 2019, but the total number increased, most likely due to the impact of COVID-19 on the total number of JobSeeker recipients:

- 26% (or 181,000) in June 2014 (NSA)

- 31% (or 230,000) in June 2016 (NSA)

- 42% (or 289,000) in June 2019 (NSA)

- 25% (or 366,000) on 26 June 2020 (JobSeeker Payment) (DSS 2021a).

Numbers of recipients

Overall, the number of DSP recipients aged 16–64 grew by 7.2% over the 2 decades to 2020. From about 623,000 in 2001 the number reached a peak of around 802,000 in 2012 (29% increase), then steadily declined to 660,000 in 2020 (18% decrease between 2012 and 2020).

This trend varied by sex. For example:

- female DSP recipients

- increased by 60% from 232,000 in 2001 to 373,000 in 2012

- decreased by 18% from 373,000 in 2012 to 305,000 in 2020

- male DSP recipients

- increased by 11% from 391,000 in 2001 to 433,000 in 2011

- decreased by 18% from 433,000 in 2011 to 355,000 in 2020

The trend also varied by age. For example:

- DSP recipients aged 16–24

- increased by 41% from 39,600 in 2001 to 55,900 in 2014

- decreased by 14% from 55,900 in 2014 to 47,800 in 2020

- DSP recipients aged 25–49

- increased by 24% from 247,000 in 2001 to 307,000 in 2012

- decreased by 17% from 307,000 in 2012 to 256,000 in 2020

- DSP recipients aged 50–64

- increased by 31% from 336,000 in 2001 to 440,000 in 2012

- decreased by 19% from 440,000 in 2012 to 356,000 in 2020.

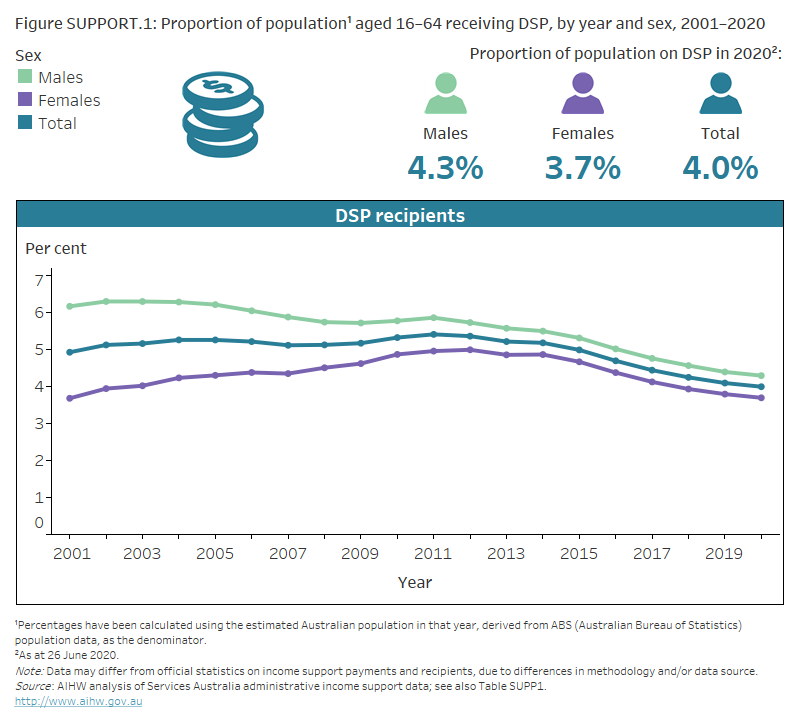

Proportion of the Australian population

When accounting for population growth, the proportion of the Australian population aged 16–64 receiving DSP remained relatively stable, increasing slightly from 2001 to 2011 (4.9% or 623,000 to 5.4% or 798,000) and then decreasing to 4.0% (or 660,000) in 2020.

This trend differs for males and females:

- The proportion of males aged 16–64 receiving DSP steadily declined from 6.2% (or 391,000) in 2001 to 4.3% (355,000) in 2020.

- The proportion of females aged 16–64 receiving DSP

- increased from 3.7% (or 232,000) in 2001 to 5.0% (or 373,000) in 2012

- decreased to 3.7% (or 305,000) in 2020 (Figure SUPPORT.1).

These declines are likely largely a result of changes over this period in how eligibility for DSP was assessed. Further, the large increases in female DSP recipients coincided with increases in the qualifying age for the Age Pension, and closure of some payments.

Figure SUPPORT.1: Proportion of population aged 16–64 receiving DSP, by year and sex, 2001–2020

Line graph showing the proportion of 16–64 year olds who received the Disability Support Pension (DSP), from 2001 to 2020, for males, females and everyone. The chart shows the difference in the proportion of males receiving DSP compared with the proportion of females has decreased from 2001 (6.2% of males and 3.7% of females) to 2020 (4.3% of males and 3.7% of females).

Source data tables: Income support (XLSX, 136kB)

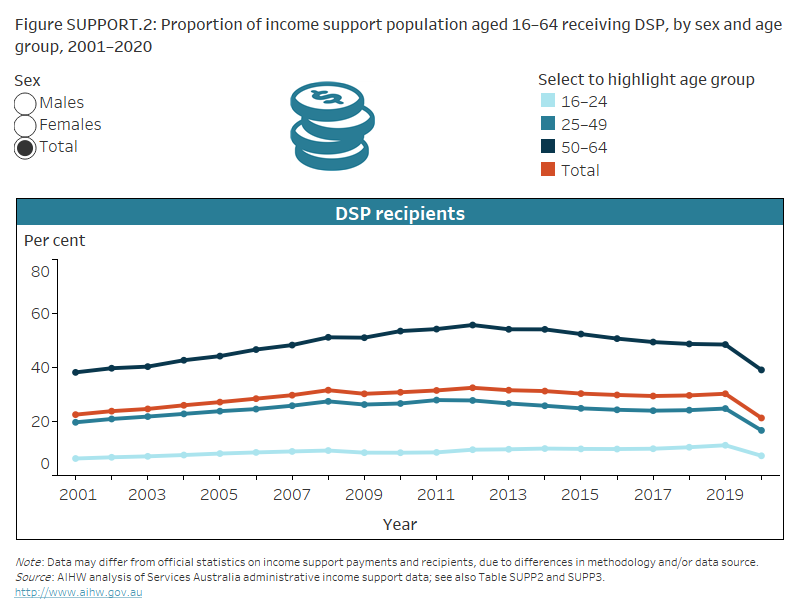

Proportion of the income support population

Between 2001 and 2019 there was an overall increase in the proportion of income support recipients aged 16–64 receiving DSP – from 23% (or 623,000) in 2001 to a peak of 32% (or 802,000) in 2012, declining to 30% (or 668,000) in 2019. In 2020, the proportion of DSP recipients decreased to 21% (or 660,000), mainly because of an increase in the number of recipients of other income support payments caused by the impacts of COVID-19.

The rate of increase has been steeper for females than males:

- The proportion of female income support recipients on DSP almost doubled between 2001 and 2012, rising from 14% (or 232,000) in 2001 to 26% (or 373,000) in 2012, before declining to 24% (or 345,000) in 2016 and to 18% (or 305,000) in 2020.

- The proportion of male income support recipients on DSP increased steadily, from 34% (or 391,000) in 2001 to 45% (or 405,000) in 2008, before declining to 39% (or 358,000) in 2019 and 25% (355,000) in 2020.

The rapid growth in female income support recipients receiving DSP from 2001 to 2014 was largely driven by the mature-aged population (aged 50–64), with the proportion of females receiving DSP more than doubling in this age group from 22% (or 117,000) in 2001 to 48% (or 218,000) in 2014. The proportion then declined to 36% (or 177,000) in 2020. This compares with a small increase from 62% (or 220,000) in 2001 for males aged 50–64 to 71% (or 220,000) in 2008 and then a decrease to 43% (or 180,000) in 2020.

These differing rates of increase have resulted in the gender gap converging over the last 20 years. In 2001, the proportion of male income support recipients aged 50–64 receiving DSP was almost 3 times that for females. It reduced to 1.2 times as high in 2020 (Figure SUPPORT.2).

This trend is largely influenced by the consolidation of payments provided to those of mature age. This has particularly affected females and it coincided with decreasing proportions receiving the Age Pension and payments closed to new entrants.

Figure SUPPORT.2: Proportion of income support population aged 16–64 receiving DSP, by sex and age group, 2001–2020

Line graph showing the proportion of 16–64 year old recipients of income support payments who received the Disability Support Pension (DSP), from 2001 to 2020, for 4 age group categories. The reader can select to display the graphs by sex. The chart shows males aged 25–49 receiving an income support payment are more likely (21%) in 2020 to receive the DSP than females (13%).

Source data tables: Income support (XLSX, 136kB)

Changes to income support payments due to coronavirus

In late March 2020, short-term policy measures were introduced by the Australian Government to protect people whose income was adversely affected by coronavirus (COVID‑19). The measures most relevant to people with disability included:

- expanding eligibility and qualification for JobSeeker Payment and Youth Allowance (other) to assist people who satisfy eligibility requirements and have lost their job, or whose income has reduced as a result of COVID-19, or who need to care for someone affected by COVID-19

- payment of a $550 fortnightly Coronavirus supplement (until 24 September 2020 then stepped down to $250 a fortnight until 31 December 2020 then $150 a fortnight to 31 March 2021) to recipients of some payments, allowances and benefits, including JobSeeker Payment and Youth Allowance but not DSP

- payment of 2 Economic Support Payments of $750 to eligible recipients of some payments, allowances and benefits, including DSP, Carer Payment and Carer Allowance

- temporary suspension of DSP participation requirements and JobSeeker Payment and Youth Allowance (other) mutual obligation requirements (DSS 2020b).

In June 2021, the COVID-19 Disaster Payment was announced for those whose income was affected by state and territory government restrictions on movement or lockdowns following COVID-19 outbreaks. People receiving an income support payment and in lockdown could claim the payment of $200 a week (Parliamentary Library 2021).

Increases in recipients of JobSeeker Payment and Youth Allowance (other)

From March 2020 to June 2020, the number of people receiving JobSeeker Payment increased by 82%, from 793,000 to 1.4 million, then decreased by 8.1% to 1.3 million in December 2020 and by 24% to 1.0 million in June 2021. In the same period, the number of people receiving Youth Allowance (other) increased by 85% from 93,400 to 173,000 in June 2020, then decreased by 13% to 150,000 in December 2020 and by 28% to 108,000 in June 2021 (DSS 2021b).

The large increase in 2020 in the total income support payment population due to COVID-19 affects the proportion of the income support population who receive DSP.

Note: JobSeeker Payment replaced Newstart Allowance, from 20 March 2020, as the main income support payment for recipients aged between 22 and Age Pension qualification age who have capacity to work. Youth Allowance (other) is an income support payment for people aged 16–21 who are looking for work or temporarily unable to work.

More information

For information on receipt of COVID-19 economic stimulus payments by people with disability, see ‘Income and housing'.

For more information see JobSeeker Payment, Coronavirus Supplement, COVID-19 Impact on DSP and CP and JobKeeper Recipients, Australian Government COVID-19 disaster payments.

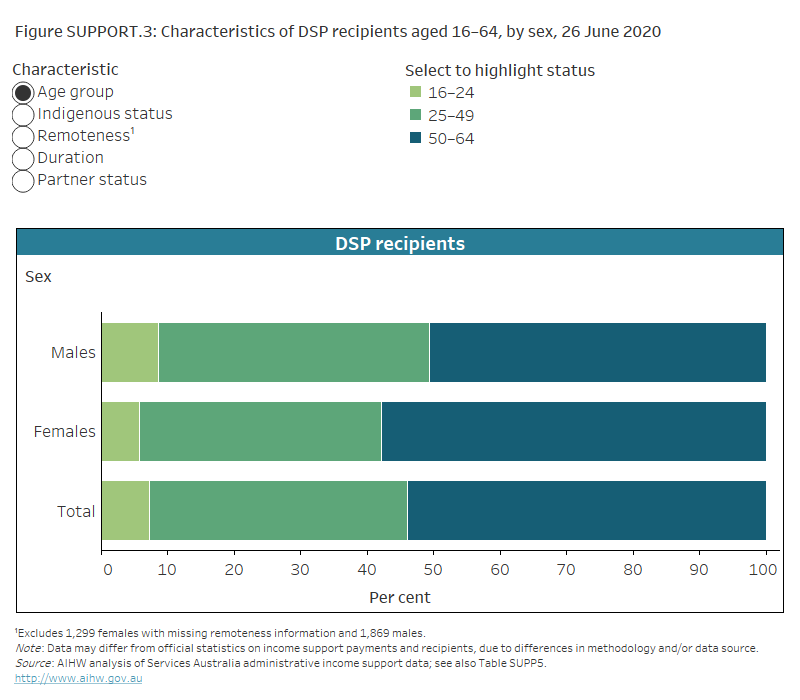

Characteristics of DSP recipients

This section examines the demographic characteristics and income support attributes of DSP recipients aged 16–64.

Age and sex

DSP recipients are typically in older age groups (at 26 June 2020):

- more than half (54% or 356,000) are aged 50–64

- 39% (or 256,000) are aged 25–49

- 7.2% (or 47,800) are aged 16–24.

The proportion of DSP recipients in these age groups varies by sex:

- 3 in 5 (58% or 177,000) female DSP recipients are aged 50–64, compared with 51% (or 180,000) of males

- 36% (or 111,000) of female DSP recipients are aged 25–49, compared with 41% (or 145,000) of males

- 5.7% (or 17,300) of female DSP recipients are aged 16–24, compared with 8.6% (or 30,500) of males.

One in 12 (7.8%, or 356,000) people aged 50–64 receive DSP. People in this age group are 3 to 5 times as likely to receive this payment as those aged 25–49 and 16–24 (2.9% or 256,000 and 1.6% or 47,800 respectively) (Figure SUPPORT.3).

Males aged 16–64 were more likely to receive DSP than females – 4.3% (or 355,000) and 3.7% (or 305,000) respectively.

Relationship (partner) status

Eight in 10 (80% or 529,000) DSP recipients aged 16–64 reported their partner status as single (at 26 June 2020):

- 81% (or 289,000) of males

- 79% (or 240,000) of females (Figure SUPPORT.3).

This proportion decreased with age of the DSP recipient:

- almost all (98% or 46,600) aged 16–24 reported their partner status as single

- 86% (or 220,000) aged 25–49

- 74% (or 262,000) aged 50–64.

Aboriginal and Torres Strait Islander people

At 26 June 2020, 49,900 Aboriginal and Torres Strait Islander people aged 16–64 were receiving DSP. A higher proportion of Indigenous Australians aged 16–64 receive DSP than non-Indigenous Australians:

- 9.7% (or 49,900) of Indigenous Australians aged 16–64 receive DSP, compared with 3.8% (or 610,000) of non-Indigenous Australians.

One in 13 (7.6%) DSP recipients aged 16–64 are Indigenous Australians (Figure SUPPORT.3). The proportion of DSP recipients aged 16–64 who are Indigenous Australians is about the same for males (7.5% or 26,700) and females (7.6% or 23,300).

The proportion of DSP recipients who are Indigenous (7.6%) is higher than the proportion of the total Australian population aged 16–64 who are Indigenous (3.1% or 517,000). For more information about income support for Indigenous Australians, see AIHW (2019).

Figure SUPPORT.3: Characteristics of DSP recipients aged 16–64, by sex, 26 June 2020

Bar chart showing the proportion of Disability Support Pension (DSP) recipients aged 16–64, males, females and total, in June 2020. The reader can select to display the chart by age group, by Indigenous status, by remoteness, by duration on DSP, and by partner status. The chart shows female DSP recipients are more likely (58%) to be aged 50–64 than males (51%).

Source data tables: Income support (XLSX, 136kB)

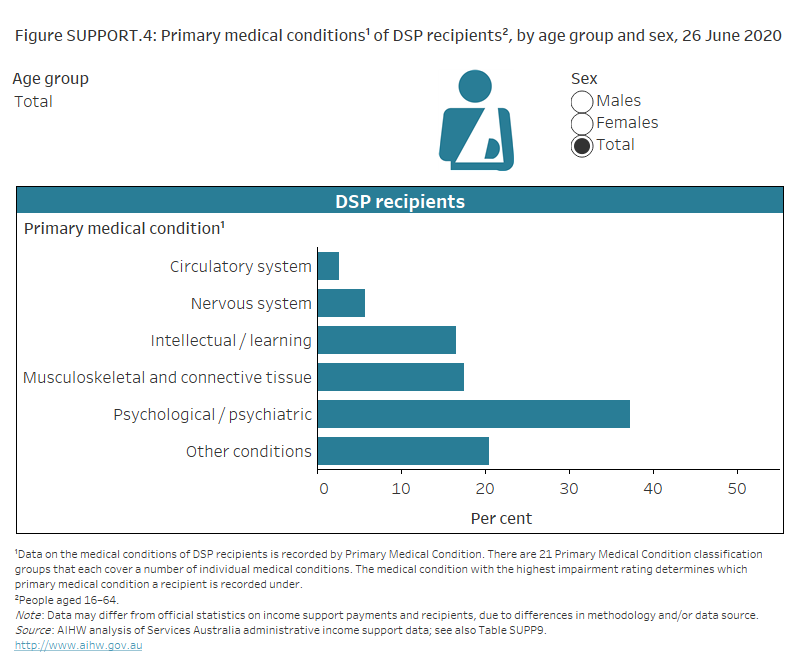

Primary medical condition

The most common primary medical conditions of DSP recipients aged 16–64 at 26 June 2020 were:

- psychological or psychiatric conditions (37% or 246,000)

- musculoskeletal and connective tissue conditions (18% or 116,000)

- intellectual or learning conditions (17% or 109,000) (Figure SUPPORT.4).

What is meant by primary medical condition?

Data on the medical conditions of DSP recipients are recorded by primary medical condition. Twenty-one primary medical condition classification groups each cover a number of individual medical conditions. The medical condition with the highest impairment rating determines under which primary medical condition a recipient is recorded.

Figure SUPPORT.4: Primary medical conditions of DSP recipients, by age group and sex, 26 June 2020

Bar chart showing the proportion of Disability Support Pension (DSP) recipients with 6 categories of conditions as their primary medical condition, in June 2020. The reader can select to display the chart by age group, including 16–24, 25–54, 55–64 and all ages, and by sex. The chart shows people aged 16–24 receiving DSP are more likely (48%) to have an intellectual or learning disability than those aged 55–64 (5.8%).

Source data tables: Income support (XLSX, 136kB)

The most common primary medical conditions vary by age. For DSP recipients:

- aged 16–24

- almost half (48% or 22,800) have intellectual or learning conditions

- 1 in 3 (34% or 16,200) have psychological or psychiatric conditions

- 1 in 100 (1.0% or 463) have musculoskeletal and connective tissue conditions

- aged 25–54

- 1 in 5 (20% or 71,200) have intellectual or learning conditions

- 2 in 5 (43% or 149,000) have psychological or psychiatric conditions

- 1 in 10 (11% or 39,200) have musculoskeletal and connective tissue conditions

- aged 55–64

- 1 in 17 (5.8% or 15,300) have intellectual or learning conditions

- 3 in 10 (31% or 80,400) have psychological or psychiatric conditions

- 3 in 10 (29% or 76,000) have musculoskeletal and connective tissue conditions (Figure SUPPORT.4).

The most common primary medical conditions also show some variations by sex:

- Male DSP recipients aged 16–64 are more likely (18% or 64,300) to have intellectual or learning conditions than females (15% or 45,000). However, in the 16–24 age group males are less likely (46% or 14,100) to have these conditions than females (50% or 8,690).

- Male DSP recipients aged 16–64 are more likely (38% or 136,000) to have psychological or psychiatric conditions than females (36% or 110,000). However, in the 55–64 age group males are less likely (29% or 38,000) to have these conditions than females (32% or 42,400) (Figure SUPPORT.4).

Earning an income while receiving DSP

People receiving DSP who report income from work, investments, superannuation and/or substantial assets, may have their benefit payments reduced, resulting in a part‑rate payment.

This income test is designed so that, at low incomes, an individual will not have their benefit payment reduced, but once past a threshold, the payment will decrease with increasing income. Income support recipients are required to report earnings from all sources.

At 26 June 2020:

- 1 in 8 (12% or 80,200) DSP recipients aged 16–64 received a part-rate payment. This was similar for males (12% or 41,800) and females (13% or 38,400).

- 1 in 13 (7.5% or 49,700) declared earnings. This was similar for males (7.9% or 28,200) and females (7.0% or 21,500).

Duration on DSP

Most DSP recipients had been on the DSP for several years. At 26 June 2020:

- more than 4 in 5 (81% or 536,000) DSP recipients aged 16–64 had been on DSP for at least 5 years

- more than half (56% or 373,000) for 10 or more years.

People receiving DSP also tend to be long-term income support recipients:

- 9 in 10 (88% or 663,000) had been receiving income support payments for at least 5 years

- 7 in 10 (70% or 527,000) for 10 or more years.

This contrasts with other income support payments:

- 3 in 5 (58% or 828,000) JobSeeker Payment recipients had been receiving income support payments for less than one year, compared with 2.4% (or 18,200) of DSP recipients

- 1 in 5 (21% or 307,000) JobSeeker Payment recipients had been receiving income support payments for at least 5 years

- 1 in 10 (10% or 145,000) JobSeeker Payment recipients had been receiving income support payments for 10 or more years.

Movement of DSP recipients through the income support system

Understanding the movement of Disability Support Pension (DSP) recipients between different payment types and on and off income support provides insights into their income support pathways, exits and entries.

Research and Evaluation Database

Data in this section are sourced from the Research and Evaluation Database (RED), a researchable longitudinal database constructed from Services Australia administrative income support data. RED is ideally suited for pathways analysis.

RED captures data on anyone who has received a social security payment since 1 July 1998. Data from RED may differ from official statistics on income support payments and recipients, including income support data presented elsewhere in this section.

To examine the movement of DSP recipients through the income support system, all recipients at June 2009 were tracked through the data to investigate what income support payment (if any) they were receiving 9 years before (2000) or 9 years after (2018). This analysis does not capture all changes, only payments an individual was on at measurement points for each year.

This analysis shows that most DSP recipients aged 16–64 tended to stay on this payment for a long time, with very few moving onto other income support payments or exiting the income support system (Figure SUPPORT.5).

Figure SUPPORT.5: Flow analysis of DSP recipients aged 16–64 in 2009 compared with where they were in the income support system in 2000 and 2018, by age group

Diagram showing the flow of Disability Support Pension (DSP) recipients aged 16–64 in 2009 compared with where they were in the income support system in 2000 and 2018. The reader can select to display the chart by age group 16–24, 25–49, 50–64 years and all ages. The chart shows DSP recipients aged 25–49 in 2009 were most likely to be receiving DSP in 2018 (84%).

Source data tables: Income support (XLSX, 136kB)

Looking forward to 2018, of DSP recipients aged 16–64 in 2009:

- over half (58%) still received DSP and almost one-quarter (23%) had moved onto the Age Pension

- for those aged 16–24 and 25–49, most (both 84%) still received DSP

- for those aged 50–64, 38% still received DSP and 42% had moved onto the Age Pension

- 13% had died by 2018 – increasing with age from 3.1% to 8.7% to 17% across the 3 age groups

- 1% had moved to another income support payment (other than the Age Pension) and 4.2% were not on income support.

Looking back to 2000, of DSP recipients aged 16–64 in 2009:

- 41% had received DSP

- 24% had received another type of income support payment, mainly unemployment payment and parenting payment – 13% and 7.0% respectively

- 35% were not on income support.

Nearly all DSP recipients aged 16–24 in 2009 were too young to qualify for DSP in 2000. Some of the parent(s) or carer(s) of these children may have been receiving Carer Payment.

Where can I find out more?

Data tables for this report.

ABS Disability, Ageing and Carers, Australia: Summary of Findings, 2018

This report: Income of people with disability

Income support (including DSP) in Australia’s Welfare 2019

Australian Government income support payments – Services Australia, and Department of Social Services

AIHW (Australian Institute of Health and Welfare) (2019) Australia’s welfare 2019: data insights, Cat. no. AUS 226, AIHW, doi:10.25816/5d5e14e6778df, accessed 28 July 2021.

DSS (Department of Social Services) (2020a) Annual report 2019–20, DSS, Australian Government, accessed 28 July 2021.

DSS (2020b) COVID-19 Impact on DSP and CP and JobKeeper Recipients - Fact Sheet, DSS, Australian Government, accessed 28 July 2021.

DSS (2021a) DSS Payment Demographic Data – June 2020, DSS, Australian Government, accessed 23 July 2021.

DSS (2021b) JobSeeker Payment and Youth Allowance recipients – monthly profile – June 2021, DSS, Australian Government, accessed 29 July 2021.

PBO (Parliamentary Budget Office) (2018) Disability Support Pension: historical and projected trends, Report no. 01/2018, PBO, accessed 28 July 2021.

Parliamentary Library (2021) Australian Government COVID-19 disaster payments: a quick guide, Parliamentary Library, Canberra, accessed 28 July 2021.