Employment services

Citation

AIHW

Australian Institute of Health and Welfare (2023) Employment services, AIHW, Australian Government, accessed 26 April 2024.

APA

Australian Institute of Health and Welfare. (2023). Employment services. Retrieved from https://www.aihw.gov.au/reports/australias-welfare/employment-services

MLA

Employment services. Australian Institute of Health and Welfare, 07 September 2023, https://www.aihw.gov.au/reports/australias-welfare/employment-services

Vancouver

Australian Institute of Health and Welfare. Employment services [Internet]. Canberra: Australian Institute of Health and Welfare, 2023 [cited 2024 Apr. 26]. Available from: https://www.aihw.gov.au/reports/australias-welfare/employment-services

Harvard

Australian Institute of Health and Welfare (AIHW) 2023, Employment services, viewed 26 April 2024, https://www.aihw.gov.au/reports/australias-welfare/employment-services

Get citations as an Endnote file: Endnote

On this page

The Australian Government funds employment services so that people receiving income support have access to support that will help them find and keep a job. The kinds of services typically included in employment services programs include:

- services that help individuals during their job search, such as helping to find jobs or writing resumés

- training programs aimed at helping to improve the employability of people who are unemployed

- services that help unemployed individuals start their own business

- work experience programs that place unemployed people in work-like activities (such as Work for the Dole).

Employment services primarily support people who receive specific income support payments, such as those receiving unemployment and parenting payments (see Unemployment payments and Parenting payments). To continue to receive such payments, an individual may need to participate in an employment services program to meet mutual obligation (activity-testing) requirements.

This page focuses on the main employment services programs administered by the Australian Government. These data are sourced from the Department of Employment and Workplace Relations for mainstream employment services (unpublished data for the period June 2005 to January 2023, and published data for February-March 2023) and Department of Social Services for Disability Employment Services (from June 2011 to March 2023; DSS 2023).

Other government labour market policies that have a direct impact on employment are wage subsidy programs that incentivise employers to employ jobseekers. One example of these was the JobKeeper Payment, which ended in March 2021 (see ‘Chapter 4 The impacts of COVID-19 on employment and income support in Australia’ in Australia’s welfare 2021: data insights for further details).

See the glossary for definitions of terms used on this page.

Main employment service programs

There are many different employment service programs, tailored to different support needs. Some of the main employment services include:

Mainstream employment services:

- Workforce Australia: is the Australian Government’s key mainstream program to support individuals to find and keep a job, change jobs or create their own job. It includes an online service and a network of providers to deliver personalised support. In July 2022, Workforce Australia replaced jobactive as the mainstream employment services program.

- Transition to Work: aims to assist 15–24 year olds into work (including apprenticeships and traineeships) or education through practical intervention and work experience.

Disability Employment Services (DES) program: supports people with disability to prepare them to find – and keep – a job (includes help with resumé preparation and interview skills, in-workplace support for employers, and workplace modifications).

JobAccess: provides tailored employment information to employers, employment service providers, and people with disability, connecting them with free government disability employment supports, and content to help people with disability find long-term employment.

ParentsNext: aims to help parents of children over 9 months and under 6 years of age (in particular, those receiving a Parenting Payment) to plan and prepare for employment. Note, the May 2023 budget announced the ParentsNext program will be abolished from 1 July 2024.

Community Development Program: aims to support jobseekers in remote Australia to build skills, address barriers to employment and contribute to their communities through a range of flexible activities.

There are also several smaller targeted programs and complementary services. Complementary services (such as Work for the Dole and Youth Jobs PaTH) may be accessed through general employment services programs and form part of the package of services accessed by the participant.

Mainstream employment service outcomes

This section also reports on employment outcomes for a sample of jobseekers who have previously participated in, or are currently participating in, Workforce Australia (or jobactive before 4 July 2022) or Transition to Work. These jobseekers are selected to respond to a survey at the end of a given month and their employment outcomes are measured around three months after being selected (the outcome being their employment status at the time). Data are aggregated over 12 month periods, and this page reports on participants selected for the survey between January 2021 and December 2021.

Employment services and labour force measures

The total number of employment service participants does not necessarily align with the total number of people who are unemployed, based on the Australian Bureau of Statistics Labour Force definition (that is, people who looking for work, and available to start work, but who did not work any hours at all in the reference week). Employment service participants includes people who are unemployed, but also people who are employed and eligible for income support as they are not earning enough or not working enough hours. It also includes some people who would otherwise be defined as not in the labour force. This includes Australians aged 55 and over who volunteer full time to meet their mutual obligation requirements, and individuals with temporary exemptions from mutual obligation requirements due to illness, caring responsibilities, and other personal circumstances.

Employment service data provides insights into the characteristics of people who have been able to move closer to the labour market, and people experiencing longer-term unemployment. It provides a different perspective on the scale and composition of unemployment and underemployment in Australia than that based on the ABS Labour Force measures as presented in Employment and unemployment.

Overview of main employment service programs

The number of people registered with the main employment service programs were:

- 645,600 in mainstream employment service programs (including Workforce Australia Services, Workforce Australia Online and Transition to Work) as at 31 March 2023 (DEWR 2023)

- 273,600 in Disability Employment Services (DES) program as at 31 March 2023 (DSS 2023)

- 79,600 in ParentsNext as at 31 March 2023 (DEWR 2023)

- 33,900 Community Development Program participants as at 30 September 2022 (NIAA 2022).

The rest of this page is focussed on mainstream employment services and the DES program, due to data availability. Together, these programs cover the majority of job seekers using employment services.

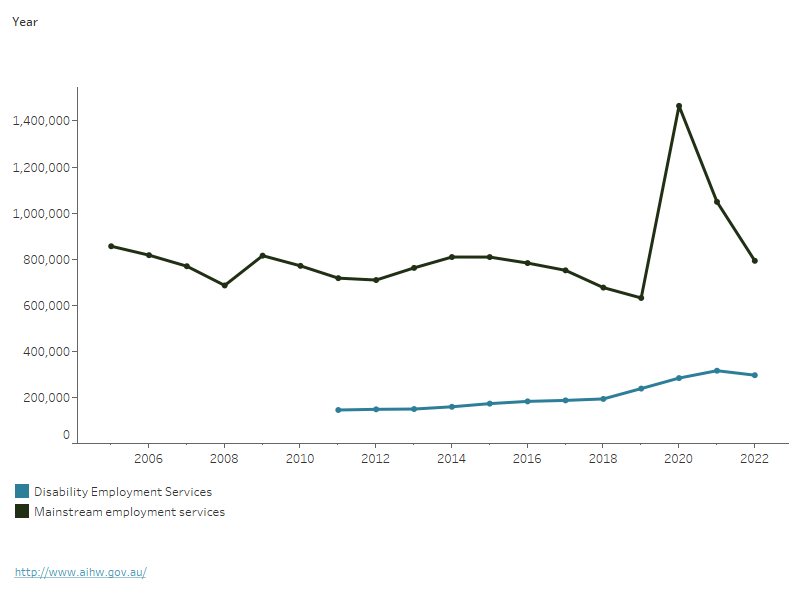

Trends in mainstream employment services

Overall, between June 2005 and March 2023, the number of people participating in mainstream employment services declined by 25%, from 856,200 to 645,600 (Figure 1). As a proportion of the number of people in the labour force (ABS 2023), this represents a decline from 8.2% to 4.5% over this period.

Very different trends were observed, however, before and after the onset of the COVID-19 pandemic in March 2020:

- Before the pandemic, participant numbers were falling – from 856,200 to 653,600 between June 2005 and February 2020.

- Between February and September 2020, the number of participants more than doubled (from 653,600 to 1.5 million), following the introduction of social distancing and business-related restrictions in March 2020.

- From September 2020 to January 2023, the number of participants steadily declined to 641,000, which was 1.9% lower (12,600 fewer participants) than in February 2020, before increasing slightly to 645,600 by March 2023.

These changes are broadly consistent with patterns observed for people receiving Unemployment payments in the 12 months to March 2021.

Figure 1: Trends in people participating in mainstream employment services (2005 to 2022) and disability employment services (2011 to 2022)

The line chart shows that the number of mainstream employment service participants declined between June 2005 and June 2019, from 856,200 to 631,700 participants. It then shows a steep increase to 1.5 million participants in June 2020 before declining to 793,000 by June 2022. The number of disability employment service participants steadily increased from June 2011 to June 2021 (from 145,400 to 315,900), and declined slightly to 296,500 by June 2022.

Note: Data are as at 30 June in each year.

Source: AIHW analysis of unpublished mainstream employment service data from the Department of Employment and Workplace Relations from June 2005 to June 2022; Department of Social Services Disability Employment Services – monthly profile (June 2011 – June 2022) for disability employment service data.

Outcomes of employment services

Despite a large increase in the number of mainstream employment service participants in the early months of the pandemic, the proportion of participants able to secure employment declined, based on a monthly survey of respondents of their employment outcomes 3 months later (see box above for further details). Around 42% of all people who responded to the survey in 2020 were employed when outcomes were measured, compared with 46–50% in 2017–2019. This decline reflects labour market conditions at the start of the pandemic and coincided with falls in employment (see Employment and unemployment for further details). By 2021, this had recovered to 51%.

The proportion of participants reported as not in the labour force 3 months after participating remained relatively stable from 2017–2021 (17–20%), suggesting that the pandemic did not have a large impact overall on participants who were not in the labour force (DEWR 2022; see ‘Chapter 3 Employment and income support following the COVID-19 pandemic’ in Australia’s welfare 2023: data insights for further details).

Trends in Disability Employment Services

Between June 2011 and June 2022, the number of DES participants more than doubled from 145,400 to 296,500, with the rate of increase varying over this period (Figure 1):

- Between June 2011 and June 2018, participant numbers increased by 33%, or by an average of 572 participants per month.

- Between June 2018 and June 2021, participant numbers rose more quickly, a 63% increase overall or by an average of 3,400 per month over this period.

- From June 2021 until January 2022, participant numbers remained relatively stable (around 313,000) before gradually declining to 273,600 in March 2023.

Outcomes of Disability Employment Services

While the number of people accessing DES continued to steadily increase throughout the early months of the COVID -19 pandemic, the number of participants who had maintained employment following their engagement with DES declined slightly in mid-2020. From May 2020 to August 2020, for example, the number of people who had been working at or above their minimum required hours for 13 weeks (that is, people with 13-week outcomes) were between 14% and 18% lower than the same months in the previous year (a reversal of the pattern seen in previous years). Similar to the decline in jobactive employment outcomes, this decline reflects labour market conditions at the start of the pandemic and coincided with falls in employment.

As at March 2023, the numbers of people with 4-, 13-, 26- and 52-week outcomes were all higher than before the pandemic in February 2020 (DSS 2023).

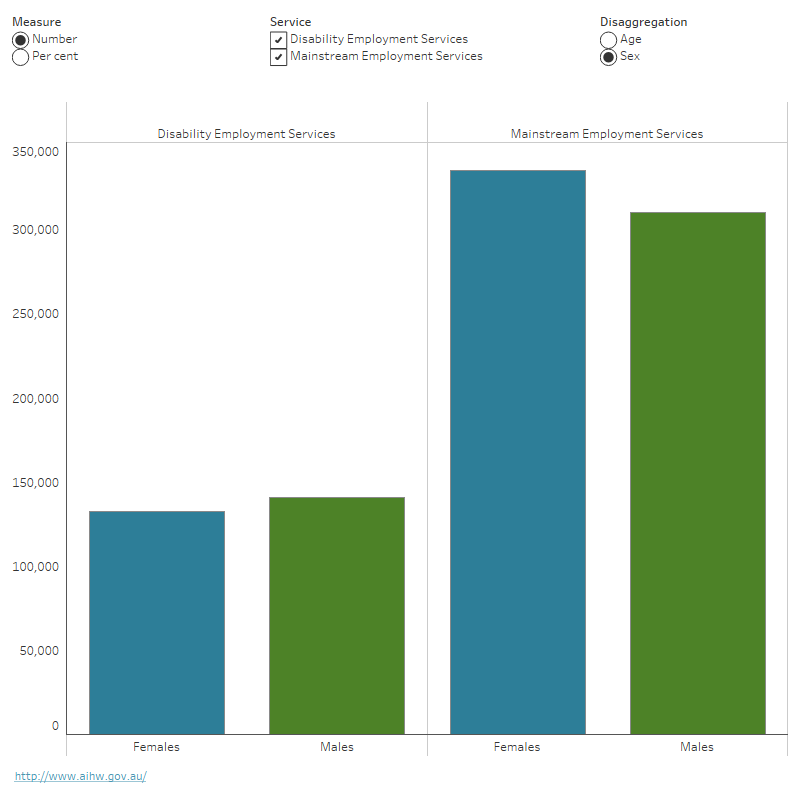

Age and sex

As at 31 March 2023, males accounted for 48% of mainstream employment service participants, and 51% of DES participants.

As at 31 March 2023, the age profile of participants in these employment services programs differed substantially, with DES participants tending to be older:

- 18% of mainstream employment service participants were under 25, 43% were aged 25–44, and 39% were aged 45 and over

- 11% of DES participants were under 25, 32% were aged 25–44 and 57% were 45 and over (Figure 2).

Additionally, of all DES participants, the majority reported either a physical (43%) or psychiatric (41%) condition as their primary disability.

Some of the cohorts examined above may have been targeted by separate employment services and therefore be under-represented in these data.

Figure 2: Number of mainstream employment services and disability employment services participants by age group and sex, as at 31 March 2023

The vertical bar chart shows the number of mainstream employment service and disability employment service participants, for the key characteristics in the tooltip (age group and sex), as at March 2023. The vertical bar chart shows that participation in mainstream employment services was most common among those aged 25–34 and 35–44 (142,300 and 137,300, respectively) and least common among those aged under 25 (115,300). A higher number of females than males participated in mainstream employment services (335,200 and 310,310, respectively). Participation in disability employment services was most common among those aged 45–54 and over 55 (61,200 and 95,400, respectively) and least common among those aged under 25 (30,400). A higher number of males than females participated in disability employment services (140,800 and 132,900, respectively).

Note. Per cent refers to participation in employment services by age group and sex as a proportion of all participants.

Source: Department of Social Services Disability Employment Services – monthly profile;

Where do I go for more information?

For more information about employment services, see:

- Department of Employment and Workplace Relations Workforce Australia

- NIAA Community Development Program

- Department of Social Services Disability Employment Services.

ABS (Australian Bureau of Statistics) (2023) Labour force, Australia, May 2023, ABS, Australian Government, accessed 22 February 2023.

DEWR (Department of Employment and Workplace Relations) (2022) Employment services outcomes reports, Post Program Monitoring survey results – January 2021 to December 2021 – jobactive provider‑servicing, DEWR, Australia Government, accessed 11 May 2023.

DEWR (2023) Workforce Australia and ParentsNext Caseload Time Series – October 2022 to May 2023, [data set] DEWR, Australian Government, accessed 8 May 2023.

DSS (Department of Social Services) (2023) DSS Disability Employment Services – monthly profile, [data set] DSS, Australian Government, accessed 11 May 2023.

NIAA (National Indigenous Australians Agency) (2022) Community Development Program quarterly compliance data, NIAA, Australian Government, accessed 22 May 2023.