Technical notes

| ABS | Australian Bureau of Statistics |

|---|---|

| ADF | Australian Defence Force |

| AIHW | Australian Institute of Health and Welfare |

| Air Force | Royal Australian Air Force |

| Army | Australian Army |

| CI | Confidence interval |

| DOMINO | Data Over Multiple Individual Occurrences |

| DSS | Department of Social Services |

| DVA | Department of Veterans’ Affairs |

| Navy | Royal Australian Navy |

| PMKeyS | Personnel Management Key Solution |

| PIT | Personal income tax |

| SIH | Survey of Income and Housing |

Department of Defence personnel data

Information on ex-serving ADF members was obtained from the Personnel Management Key Solution (PMKeyS). PMKeyS is a Department of Defence staff and payroll management system that contains information on all people with ADF service on or after 1 January 2001 (when the system was introduced). The PMKeyS data underpinning this study were extracted on 5 September 2020. The data supplied for this project included records for those who separated from the ADF between January 2001 and September 2020.

This extract provided a snapshot of a number of demographic and service-related characteristics of ADF personnel as at this date, including rank, service, operational service status. A number of extra characteristics were then derived from this information in the original extract including age, service status, length of service, and time since separation.

Multi-Agency Data Integration Project

The Multi-Agency Data Integration Project (MADIP) is a partnership among Australian Government agencies to develop a secure and enduring approach for combining information on healthcare, education, government payments, personal income tax, and demographics (including the Census) to create a comprehensive picture of Australia over time (ABS 2018). More information about the MADIP can be found at Multi-Agency Data Integration Project (MADIP) | Australian Bureau of Statistics (abs.gov.au). The key MADIP data sets used in this analysis were:

- MADIP Person Linkage Spine (Australian Bureau of Statistics)

- MADIP Core demographic module (Australian Bureau of Statistics)

- 2016 Census of Population and Housing (Australian Bureau of Statistics)

- Personal Income Tax (Australian Taxation Office)

- Social Security information (DOMINO, Department of Social Services).

2016 Census of Population and Housing

Census of Population and Housing data provides a snapshot of Australia. It collected data on the key characteristics of people in Australia on Census night and the dwellings in which they live every five years. In 2016, the Census was conducted on 9 August. The Census provides a comprehensive picture of Australians, at the national or state and territory level, and for a range of smaller geographic units including local government areas. This supports the planning, administration, policy development and evaluation activities of governments and other users (ABS 2015). For this report, the 2016 Census of Population and Housing data set was linked with Defence payroll data to create the linked PMKeyS-Census 2016 data set used in analysis of equivalised total household income of ex-serving ADF population.

Personal Income Tax (PIT) 2013–14 to 2017–18

Personal income tax is imposed by the federal government and collected by the Australian Taxation Office (ATO). The data are submitted to the ATO via a tax return. A tax return must be lodged if (ATO 2022b):

- tax was withheld from any payments

- taxable income was more than the tax-free threshold ($18,200)

- the person is leaving Australia forever or for more than one income year

- the person wishes to claim any tax deductions

- the person is a liable or recipient parent under a child support assessment for the whole income year and your income was $27,063 or more.

PIT data for analysis are provided by the ABS in MADIP as both ranged and continuous income. As continuous income data allows more flexibility for analysis, the continuous dataset was used for this project. This PIT analysis included anyone who submitted a tax return between 2013–14 and 2017–18.

For this report, the PIT data set was linked with Defence payroll data to create the linked PMKeyS-PIT data set used in analysis of personal income and income sources of ex-serving ADF population.

A subset of the PMKeyS-PIT data set was created for each financial year using the corresponding PIT data flag. As 2017–18 is the most recent year of data, it was analysed in-depth by demographic and service-related characteristics. For the remaining financial years, only high-level analysis was performed to capture changes in income and sources of income over time.

PIT data are available from 2010–2011; analysis was limited to data from 2013–14 to 2017–18 as the study period was sufficient to demonstrate changes.

Social Security information - Data Over Multiple Individual Occurrences (DOMINO) 2013–14 to 2017–18

DOMINO is a researchable linkable data asset that includes longitudinal information on an individual’s interaction with Centrelink services. It was developed by the Department of Social Services in 2017 and is constructed from Services Australia administrative data. It includes information on Centrelink services, as well as additional characteristics such as location, housing, education, relationships, demographics and medical details.

For this report, the DOMINO data set is linked with Defence payroll data to create the linked PMKeyS-DOMINO data set used in analysis of income support paid by Services Australia of ex-serving ADF population, to supplement sources of income information from PIT analysis.

The version of DOMINO included in MADIP covers the period from 1 January 2006 to 31 December 2019. A subset of the PMKeyS-DOMINO was created for each financial year from 2013–14 to 2017–18 to align with PIT.

Survey of Income and Housing

The Survey of Income and Housing (SIH) is a national survey that collects information to help understand the income, housing and living arrangements of Australian households, and how they change over time. The information gathered from the SIH impacts decisions about income support, pensions, plans for retirement and living costs such as housing and childcare (ABS 2022b). The SIH began in 1994–95 and is generally collected every two years. It is integrated with the Household Expenditure Survey every 6 years. The SIH 2019–20 has a veteran indicator which states ‘Whether ever served in the Australian Defence Force’.

The financial stress and veteran indicators in SIH were used to compare financial stress of households with at least one member who had ever served in the ADF and households where no-one had ever served in the ADF by equivalised disposable household income categories.

References

ABS (Australian Bureau of Statistics) (2015) 2008.0 - Census of Population and Housing: Nature and Content, Australia, 2016, ABS, Australian Government, accessed 16 March 2023.

ABS (Australian Bureau of Statistics) (2018) Multi-Agency Data Integration Project (MADIP), ABS, Australian Government, accessed 6 March 2023.

ABS (Australian Bureau of Statistics) (2022b) Survey of Income and Housing, User Guide, Australia, ABS, Australian Government, accessed 6 March 2023.

ATO (Australian Taxation Office) (2022b) Work out if you need to lodge a tax return, ATO, Australian Government, accessed 6 March 2023.

Data linkage, also known as data integration, is a process that brings together information relating to an individual from more than one source. This report utilised probabilistic linkage between Defence-held Personnel Management Key Solution (PMKeyS) data and the three MADIP data sets 2016 Census of Population and Housing, Personal Income tax (PIT) and Data Over Multiple Individual Occurrences (DOMINO).

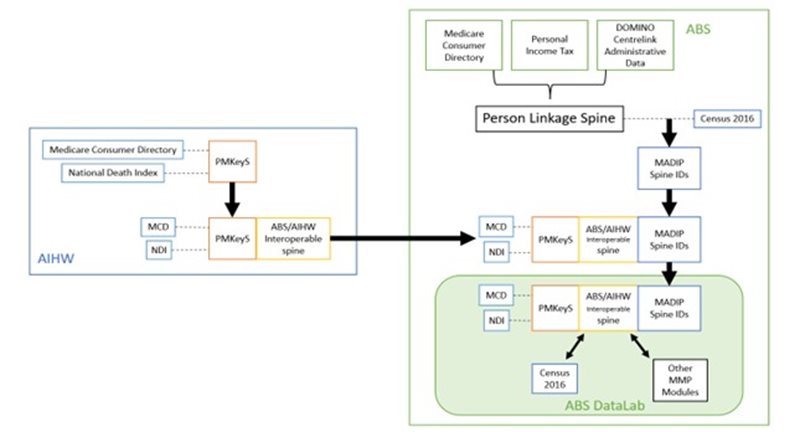

After undergoing data checking and cleaning, the PMKeyS data set was linked using a probabilistic data linkage to the AIHW/ABS interoperable spine. This spine allows data held by both organisations to be linked without the need for sharing any identifiable information. The data was linked to the spine by matching by name, sex and date of birth. The linkage procedure involved creating record pairs–one from each data set–by running a series of passes that allow for variation in full name information and demographic data. There were over 129,000 links found in the PMKeyS-interoperable spine linkage. This linkage was carried out by the Data Linkage Unit at the AIHW. This data set was then transferred to the ABS to be linked to the MADIP spine (Figure 12).

Figure 12: Linkage process

AIHW staff, using the ABS DataLab environment were subsequently able to link the PMKeyS data to each of the three MADIP data sets using the linkages of both data sets to the MADIP spine. For each of the three MADIP data sets records were then removed for those ADF members who were out of scope.

Strict separation of identifiable information and content data is maintained within the Data Linkage Units at both AIHW and the ABS, so that no one person will ever have access to both. Summary results from the linked data set are presented in aggregate format. Personal identifying information is not released, and no individual can be identified in any reporting.

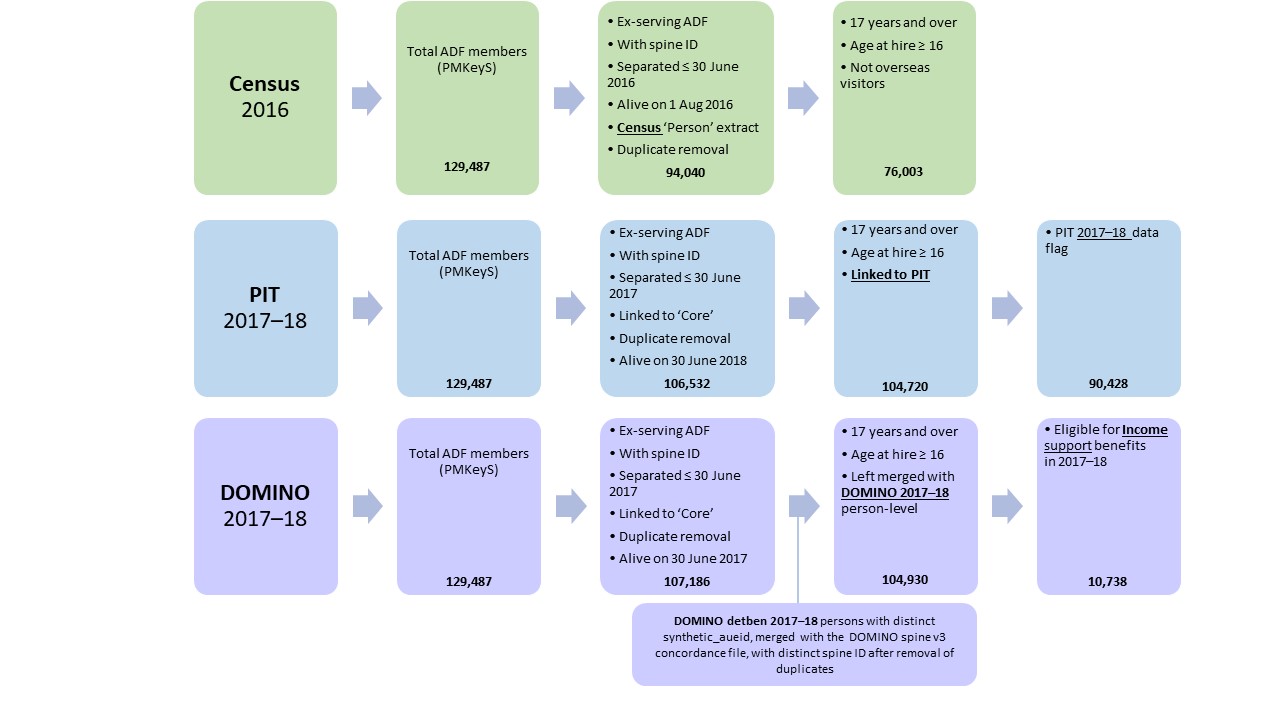

Census 2016

After removing the records of those ADF members who were out of scope, this resulted in an in-scope population of 76,000 links who were aged 17 years and over at Census, older than 16 at hire date, alive, and ex-serving at the time of the 2016 Census, who had served at least one day between 1 January 2001 and 30 June 2016.

PIT 2013–14 to 2017–18

After removing the records of those ADF members who were out of scope, the in-scope population for each financial year were aged 17 years and over, 16 years and over at hire date, alive during the financial year, and ex-serving at the beginning of financial year, who had served at least one day between 1 January 2001 and the last day before the financial year (for example, 30 June 2017 for the 2017–18 financial year).

The in-scope population for 2017–18 is 90,400. Information on population scope for other financial years can be found in Data.

DOMINO 2013–14 to 2017–18

After removing the records of those ADF members who were out of scope, the in-scope population for each financial year were aged 17 years and over, 16 years and over at hire date, alive and ex-serving at the beginning of the financial year, who had served at least one day between 1 January 2001 and the last day before the financial year (for example, 30 June 2017 for the 2017–18 financial year).

The in-scope population for 2017–18 is 105,000. Information on population scope for other financial years can be found in Data.

Figure 13: Processing and linkage counts for the analysed MADIP data sets

Age

The minimum age of both ex-serving ADF and Australian populations was capped at 17 years. For the Census and SIH data set age restriction was for survey respondents and was recorded at the time of the surveys. For PIT and DOMINO age was taken at the start of the calendar year, instead of financial year, due to limitations in the timepoint to which data are available. For example, for PIT 2017–18 age was recorded as of 1 January 2017.

Hire age

Hire age was calculated using the calculated age (see above) and the hire date variable from PMKeyS. Ex-serving ADF members were included if their hire age was 16 years or over to remove any linkage errors.

Service status

For Census, PIT and DOMINO service status was determined using the PMKeyS variable to indicate service status (that is, serving, reserve, ex-serving) of veterans at the data extraction date, September 2020.

Service status at a point in time was determined using the PMKeyS service status and separation date variables.

SIH has a veteran indicator which states ‘Whether ever served in the Australian Defence Force’ but does not indicate if they are currently serving.

Separation date

The ex-serving ADF population has been restricted to those who separated prior to a specific date to ensure the study population had separated from the ADF at the start of the study period.

PMKeyS in MADIP provides the year of separation and whether members separated in the first (January to June) or second (July to December) half of the financial year.

For 2016 Census, the ex-serving ADF population has been restricted to those who separated prior to 1 July 2016 to ensure the study population had separated from the ADF at the time of the 2016 Census.

For PIT and DOMINO, the ex-serving ADF population has been restricted to those who separated prior to 1 July closet to the study period. For example, for PIT 2017–18, ex-serving ADF population includes those who separated prior to 1 July 2017.

Separation date was used to calculate length of service and time since separation.

Date of death

The ex-serving ADF population has been restricted to those who were alive at any point (for example, for DOMINO) or during (for example, for PIT) the study period. Month and year of death from PMKeyS and MADIP Modular Products 2011–2019 (Core Module) was used to determine whether a person was alive or had passed.

Australian population

Australian comparator cohort was constructed for each data source and study period, which includes the following criteria.

For 2016 Census:

- ages of 17 years and over at 2016 Census

- not overseas visitors.

For PIT:

- alive during the financial year

- ages of 17 years and over at the start of the calendar year (Refer section ‘Scope of populations – Age’ for further information on age)

- submitted an income tax return for the financial year.

For DOMINO:

- alive at any point during the financial year

- ages of 17 years and over at the start of the calendar year (Refer section ‘Scope of populations – Age’ for further information on age).

For SIH, the comparator was households where:

- usual residents who regarded the dwelling as their own or main home

- private dwellings such as, houses, flats, home units, caravans, garages, tents and other structures such as long-stay caravan parks that were used as places of residence during the time of interview

- ages of 17 years and over at the time of the survey

- no household members had ever served in the ADF.

There are some challenges and limitations with the analysis of linked administrative data that should be noted, namely:

- bias from linkage errors where records cannot be linked

- limitations in the period to which data are available

- limitations with the study population

- data sources are of varying quality and/or completeness.

Also, values based on small numbers have been suppressed to maintain data confidentiality, and/or avoid publishing statistics of low reliability.

Limitations related to linkage

The linkage processes only provide data for those ex-serving ADF members who had a record for the respective data source. An individual not having a record could be a result of:

- For Census

- them being overseas at the time of the 2016 Census, and/or

- them not having completed a Census record.

- For PIT

- them having income under the tax-free threshold ($18,200), and/or

- no tax has been withheld from their income (ATO 2022b).

- For all linkage

- linkage error due to coercion to a later spine, insufficient information for linkage, or the record not being available.

Limitations related to the period of available data

The most recent data available for PIT in MADIP is 2017–18, whereas the version we used for DOMINO has data up until 31 December 2019. As data from different sources are analysed to complement one another, the same data period for different data sources was chosen where possible, that is, up to 2017–18 for both PIT and DOMINO. Therefore, for DOMINO, it was not the most recent data that have been analysed.

Limitations of the study population

Census, PIT and DOMINO

For 2016 Census, PIT and DOMINO, the study population is limited to ADF members who served at least one day since 1 January 2001 and separated prior to the study period. The ex-serving study population does not include members who separated before 1 January 2001 and also between 1 July 2016 and 9 August 2016 (Census night) for the Census analysis.

For the 2017–18 study population, the reference date for age is 1 January 2017, for geographic locations it is 2016 and for service-related characteristics it is as of 30 June 2017. The reference dates for the demographic characteristics are not at the beginning of the financial year, 1 July 2017, due to limitations in the timepoint to which data are available.

SIH

The SIH collects information by personal interview from usual residents of private dwellings in urban and rural areas or Australia (excluding Very Remote areas), covering around 97% of the Australian population (ABS 2022c).

As the SIH data set collects self-reported data, it is not possible to know how participants interpreted what constitutes ADF service, such as whether it is limited to overseas deployment or excludes reserve service. It is also not possible to distinguish between current serving and ex-serving personnel.

Limitations related to quality and completeness of data sources

PMKeyS

Due to a change in the way reasons for separating the ADF was recorded during 2002, analysis for reasons for separation and for models of ex-serving ADF members (that is, without comparison with Australian population) include only ADF members who separated from the ADF between 1 January 2003 and 30 June 2017.

MADIP

Age – for analyses of PIT and DOMINO

For PIT and DOMINO age was taken at the start of the calendar year, instead of financial year, due to limitations in the timepoint to which data are available. For example, for PIT 2017–18 age was recorded as of 1 January 2017.

Total income or loss – for analysis of PIT

Total income or loss for a financial year corresponds to the value on the bottom of page 3 on the ATO's tax return for individuals for the financial year (ATO 2022c).

Total income or loss are income before tax and deductions. It includes income from the following categories:

- Salary or wages

- Allowances, earnings, tips, director’s fees etcetera

- Employer lump sum payments

- Employment termination payment

- Australian Government allowances and payments like Newstart, Youth Allowance and Austudy payment

- Australian Government pensions and allowances

- Australian annuities and superannuation income streams

- Australian superannuation lump sum payments

- Attributed personal services income

- Gross interest

- Dividends

- Employee share schemes

- Supplement income or loss (for example, business income).

PIT data in MADIP include from the above only the following categories:

- Salary or wages (category 1)

- Government pensions and allowances (categories 5 and 6)

- Annuity and superannuation (category 7)

- Business income (from category 13).

Therefore, total income or loss is different from the sum of the four income sources analysed in this report.

Income from DVA funded pensions and benefits

Income from DVA funded pensions and benefits are:

- not included in the analysis of income support section as it might be incomplete in MADIP

- People who receive DVA payments and do not apply for income support paid through Services Australia will not be captured in MADIP.

- DVA payments data available in MADIP do not include ‘Veteran payment’, which is one of the DVA income support payments.

- not recorded in PIT data in MADIP as they are not taxable.

- The ‘Australian Government allowances and payments like Newstart, Youth Allowance and Austudy payment’ and ‘Australian Government pensions and allowances’ categories in PIT data in MADIP only include taxable income.

- Our analysis of 2017–18 PIT and DOMINO data also shows a lower percentage of people receiving ‘Government pensions and allowances’ in PIT than those receiving income support paid by Services Australia in DOMINO (see data tables available from Data).

The AIHW and DVA are exploring options to include income from DVA funded pensions and benefits from DVA in future analysis.

SIH

SIH has a veteran indicator which states ‘Whether ever served in the Australian Defence Force’ but does not indicate if they are currently serving.

References

ABS (Australian Bureau of Statistics) (2022c) Income, ABS, Australian Government, accessed 6 March 2023.

ATO (Australian Taxation Office) (2022b) Work out if you need to lodge a tax return, ATO, Australian Government, accessed 6 March 2023.

ATO (2022c) Total income or loss 2022, ATO, Australian Government, accessed 3 May 2023.

Mean

The mean or average value is a measure of central tendency. The mean is the sum of values set divided by the number of values (Kirkwood and Sterne 2003). For example, the mean age would be the sum of all the ages divided by the number of people.

Means are included only in data tables available from Data.

Median

Median is defined as the number which has the rank (n+1)/2 of n numbers. If n is an odd number, then the rank of the median will be a whole number, and the median will be the “middle number” in the data set. But if n is even, then the rank will be a half-rank, and will be the average of the “two middle numbers” in the data set (Underhill and Bradfield 2013).

Proportion difference

Proportion differences, also referred to as absolute differences are presented in data tables that accompany this report. They are a measure the magnitude of the gap between populations without respect to how big or small the individual proportions are. Proportion differences are subject to volatility when used with small numbers, and so should be used with caution when comparing ex-serving ADF member results to the Australian population.

The proportion difference is calculated by subtracting the proportion of a comparator population from the proportion of a study population.

Figure 14: Formula for calculating proportion differences

Proportion differences are included only in data tables available from Data.

Proportion ratio

Proportion ratios measure the degree of inequality between populations, that is, comparing the proportion in one population to the same proportion in another population. Proportion ratios are sensitive to size of the populations, and are subject to volatility when used with small numbers, and so should be used with caution when comparing ex-serving ADF member to the Australian population.

The proportion ratio is calculated by dividing the proportion in a study population by the proportion in a comparator population.

Figure 15: Formula for calculating proportion ratios

When a proportion ratio is greater than 1, it suggests an increased likelihood of the outcome in the study group. When a proportion ratio is less than 1, it suggests a reduced likelihood of the outcome in the study group. If a proportion ratio is 1 or close to one, it suggests no difference or little difference in likelihood of the outcome.

Proportion ratios are included only in data tables available from Data.

Quintiles

Quintiles are a useful way to measure income inequality (ABS 2022a). Quintiles are five equally sized divisions of a distribution (Kirkwood and Sterne 2003). For example, for the quintiles for the PIT 2017–18 variable total income or loss of the Australian population 20% of the population would fall into each quintile.

Binomial logistic regression modelling

Binomial logistic regression modelling is conducted to understand the association between various service characteristics of ex-service ADF members and a binomial outcome, such as whether or not ex-serving ADF members received business income.

Estimates from the regression model are presented as odds ratios for the group of interest compared with a reference group for each service and demographic characteristic in the data tables attached to this report.

Odds expresses the chance that an outcome may occur. The odds of outcome is equal to the probability that the outcome does occur (p) divided by the probability that the outcome does not occur (1 - p):

Figure 16: Formula for calculating odds

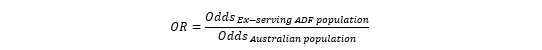

An odds ratio (OR) indicates how many times higher the odds of outcome is in one group of people with a particular characteristic than in another group without that characteristic.

Figure 17: Formula for calculating odds ratios

The size of the reported odds ratio indicates the strength of the association or relationship a service or demographic characteristic has to income circumstance (for example, having a high household income, receiving income from annuity or superannuation, or receiving income support paid by Services Australia), relative to the reference group. The odds ratios inform the direction of association with odds ratios greater than 1 showing the outcome was more common than the reference outcome, while odds ratios less than 1 show it is less likely.

Ninety-five per cent (95%) confidence intervals (CI) are also presented to indicate the statistical precision and significance. The result is interpreted as having a statistically significant association (that is, not due to chance) if the confidence interval does not cross the value of 1.

For binomial logistic models that compare the odds of ex-serving ADF members to the Australian population, there is an overlap as the ex-serving ADF members are part of the Australian population. A comparison group consisting of the Australian population less the ex-serving ADF members would be unsuitable as the ex-serving ADF members in this report are limited to those who separated after 1 January 2001. Therefore, the comparison group would still consist of ex-serving ADF members who separated before 2001 and thereby not representative of a “non-ex-serving group”. Using the Australian population as a comparison group results in overlaps of 0.44% for Census, 0.48% for DOMINO and 0.64% for PIT. Each of the overlaps are below 10%, above which a correction factor would be required (Hayes and Berry 2006).

Estimation method

Data from the SIH are based on self-reported veteran status. As only as sample of people in Australia were surveyed, results need to be converted into estimates for the whole population. This was done through a process called weighting:

- Each household is given a number (known as a weight) to reflect how many households they represent in the whole population.

- A household’s weight is based on their probability of being selected in the sample.

- The initial weights are then calibrated to align with independent estimates of the population of interest, referred to as ‘benchmarks’. The weighted estimates are not intended to represent the veteran population, and therefore may over- or under-represent certain types of veterans. Veterans made up a small portion of the overall SIH sample, which may cause some issues with the reliability and validity of results in this report (ABS 2022b).

Relative standard error

A Relative Standard Error (RSE) is the standard error expressed as a percentage of the estimate. It is a useful measure of accuracy, as it gives an indication of the percentage errors likely to have occurred due to sampling. For this analysis, RSEs were calculate by dividing the standard error of the estimate by the estimate and multiplying by 100 (ABS 2023).

Margin of Error

A Margin of Error (MOE) describes the distance from the population value that the sample estimate is likely to be within and is specified at a given level of confidence. For this analysis 95% confidence intervals were used, and the 95% MOE was calculated as 1.96 multiplied by the standard error of the proportion (ABS 2022b).

References

ABS (Australian Bureau of Statistics) (2022a) Summary Indicators of Income and Wealth Distribution, Survey of Income and Housing, User Guide, Australia, ABS, Australian Government, accessed 16 March 2023.

ABS (2022b) Survey of Income and Housing, User Guide, Australia, ABS, Australian Government, accessed 6 March 2023.

ABS (2023) Errors in Statistical Data, ABS, Australian Government, accessed 1 March 2023.

Hayes LJ and Berry G (2006) ‘Comparing the part with the whole: should overlap be ignored in public health measures?’, Journal of Public Health, 28(3):278-282, doi:10.1093/pubmed/fdl038.

Kirkwood BR and Sterne JA (2003) ‘Essential medical statistics’, 2nd edn, Blackwell Science, Massachusetts.

Underhill L and Bradfield D (2013) ‘Introstat’ Creative Commons, San Francisco.

ABS (Australian Bureau of Statistics) (2022a) Summary Indicators of Income and Wealth Distribution, Survey of Income and Housing, User Guide, Australia, ABS, Australian Government, accessed 16 March 2023.

ABS (2022b) Survey of Income and Housing, User Guide, Australia, ABS, Australian Government, accessed 6 March 2023.

ABS (2023) Errors in Statistical Data, ABS, Australian Government, accessed 1 March 2023.

Hayes LJ and Berry G (2006) ‘Comparing the part with the whole: should overlap be ignored in public health measures?’, Journal of Public Health, 28(3):278-282, doi:10.1093/pubmed/fdl038.

Kirkwood BR and Sterne JA (2003) ‘Essential medical statistics’, 2nd edn, Blackwell Science, Massachusetts.

Underhill L and Bradfield D (2013) ‘Introstat’ Creative Commons, San Francisco.