Housing assistance

On this page:

The Australian and state and territory governments provide a range of assistance to people having difficulty with finding or sustaining affordable and appropriate housing in the private housing market. Housing assistance refers to both access to social housing (such as public housing) as well as targeted financial assistance for eligible Australians.

Access to affordable and appropriate housing

Housing is a basic human right that is fundamental to the overall health and wellbeing of Australians (United Nations 2014). Living in affordable and appropriate housing provides people with benefits far beyond shelter. Affordable housing can have a substantial impact on people’s health, as well as their access to and satisfaction with their employment opportunities, mental health, and community (Ong et al. 2022; Phibbs and Thompson 2011; Productivity Commission 2015).

Lower income households are particularly at an increased risk of experiencing financial housing stress, influencing a range of outcomes, from educational attainment and workforce and economic participation to health and wellbeing outcomes (Rowley & Ong 2012). Critically, financial housing stress may also contribute to housing instability, which can increase the risk of experiencing homelessness (CSERC 2015; SCRGSP 2021). Access to affordable housing therefore plays a critical role in improving not only the health of Australians, but also their quality of life (Productivity Commission 2018).

Housing assistance can provide households in need with affordable and appropriate housing or with the means to afford appropriate housing. As such, it helps households avoid or alleviate housing stress by affording them with greater resource flexibility, which may allow them to redirect resources to other essential items and services, including food, heating, transport and wellbeing (Anglicare Australia 2019). Housing assistance also improves housing stability, which may improve social cohesion through fostering participation in social and economic life in the community (Bridge et al 2007; Carnemolla and Skinner 2021).

For more information, see Housing affordability and Home ownership and housing tenure (AIHW 2021a).

Drivers for people seeking housing assistance

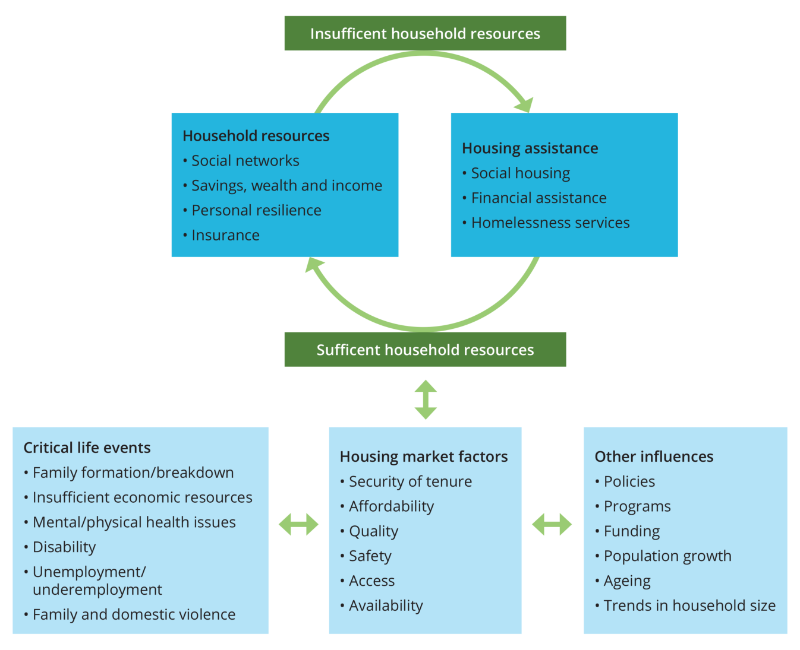

Many factors can lead people to seek assistance with housing. Often it is when there are insufficient household resources to manage the impact of critical life events and/or housing market factors (Figure 1).

Figure 1: Drivers of requests for housing assistance

Critical life events relate to significant life cycle milestones, where a change in circumstance triggers a transition, such as the formation/breakdown of a family, experiencing family and domestic violence, ill health (mental or physical) or changes in working arrangements (Muir et al. 2020). Households that experience several adverse critical life events that affect their social and economic circumstances are more likely to need assistance with accessing or maintaining their housing (Stone et al. 2016).

Housing market factors such as limited access, unaffordability, insecure tenure, poor housing quality and safety that cannot be mitigated by household resources can be a driver for seeking housing assistance. These factors are influenced by critical life events, for example, the formation of a new household with an increase in the number of people who may face limited housing options because of limited suitable stock availability within a specific price range in a preferred area.

Households that experience a critical life event or are affected by housing market factors, rely on the household resources (such as savings, assets, or social networks) to ensure that they are able to access or sustain appropriate housing (Stone et al. 2015). Households with low incomes often lack the resources to insure against any negative impacts arising from critical life events and/or housing market factors.

Low income household

A household whose equivalised gross income falls in the bottom two-fifths (40%) of households. This measure does not necessarily indicate eligibility for government assistance targeted at low income households, and assistance may also be provided to households that do not meet this definition (ABS 2018).

Household transitions

Households may experience changing needs and events throughout their life course that may result in housing stress. Households typically face the greatest levels of housing instability in response to critical life events and/or changing market factors, such as unemployment or housing affordability issues (Stone et al. 2016).

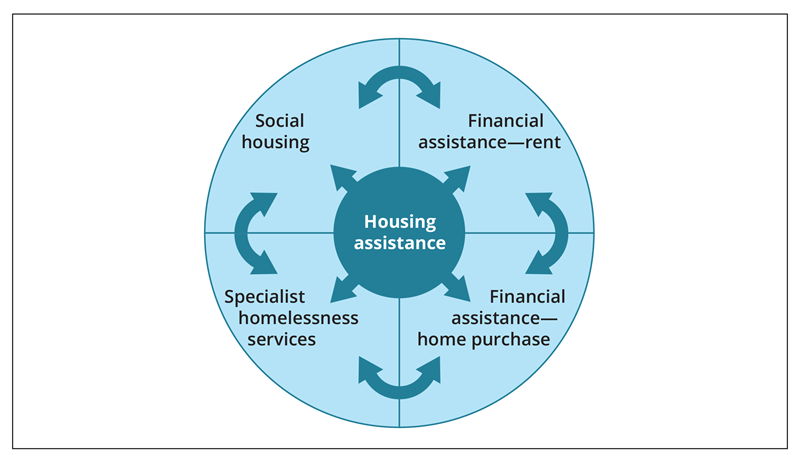

Given the importance of stable housing, a household’s need for assistance to avoid homelessness will vary depending on their circumstances and the events they experience. Some households may need to access services once, while others might spend more time receiving support (AIHW 2019). Households receiving support may transition between receiving access to social housing, and private rental, home purchase or Specialist Homelessness Services (Figure 2).

Figure 2: Housing and specialist homelessness services transitions

Housing assistance policy

Government policies and funding provide support for people based on whether they are homeless, at risk of homelessness or need support to secure/sustain housing. Governments are involved in housing assistance in three main areas: social housing services, financial assistance (private housing) and specialist homelessness services. Policies and programs operate at both national and state/territory levels.

A brief history of housing assistance

In 1943, the Commonwealth Housing Commission was appointed by the Commonwealth government to evaluate the condition of Australia’s housing stock. Due to the combined impact of the Great Depression and the use of labour and building materials in supporting the war effort, appropriate and secure housing was incredibly scarce during this time (Dufty-Jones 2018). In response to Australia’s sizable housing shortage, the government began to shift its attention to providing people with adequate housing, to foster economic development and replace the slums present at the time (Troy 2012; Macintyre 2015).

In 1944, the Commonwealth Housing Commission reported a shortage of some 300,000 dwellings and advised the Commonwealth to provide housing to overcome this housing deficit (Pawson et al. 2020). This advice would later result in the establishment of the first Commonwealth-State Housing Agreement (CSHA) in 1945.

The CSHA was an agreement between the Commonwealth-States/territories to provide funds for the construction of new dwellings. As a result of the CHSA agreement, social housing provision from governments became a more prominent aspect of the housing landscape. Since then, the original 1945 CSHA has been updated numerous times, with the 2003 CHSA being the final revision, before it was officially replaced by the National Affordable Housing Agreement (NAHA) in 2009 (Parliament of Australia 2017). The NAHA was later superseded by the National Housing and Homelessness Agreement in 2018 (DSS 2022).

Historically, social housing was built to stimulate the economy, provide people with secure accommodation, and help people participate in the workforce (Pawson et al. 2020). As such, access to social housing was made available to predominantly working families on very low, low, and moderate incomes (Groenhart et al. 2014; Yates 2013). However, from 1956 to 1973, the Government’s housing strategy shifted towards encouraging home ownership and supporting low-income households in the public rental market. In 1973, income eligibility limits were introduced to social housing households, signifying the beginning of the shift towards the current policy where social housing are allocations partly based on need (Yates 2013).

By the 1999 CSHA, a greater emphasis was placed on helping families and individuals that could not be appropriately housed in the private market. Accordingly, a key feature of the 1999 CHSA was providing housing assistance according to need, rather than security of tenure (Parliament of Australia 2001).

With the introduction of the NAHA in 2009, social housing increasingly focused on assisting households with greater disadvantage, and higher and more complex needs— or in other words, people who are in greatest need, especially people experiencing homelessness (CFFR 2019).

National Housing and Homelessness Agreement (NHHA)

The objective of the National Housing and Homelessness Agreement (NHHA) is to contribute to improving access to affordable, safe, and sustainable housing across the housing spectrum. The NHHA describes government roles and responsibilities for social housing, and support for people experiencing homelessness and those at risk of homelessness (CFFR 2020).

The NHHA came into effect on 1 July 2018, reforming previous funding agreements with states and territories (the National Affordable Housing Agreement (NAHA) supported by the National Partnership Agreement on Homelessness (NPAH)). The NHHA provides around $7.8 billion in Commonwealth funding to states and territories for housing and homelessness services within the period of the agreement.

Housing assistance funding

In 2020–21, the Australian Government funding under the NHHA was around $1.7 billion. A further $5.3 billion was spent on Commonwealth Rent Assistance, which was an increase compared to the relatively stable funding of around $4.7 billion in recent years and was mostly due to policy responses during the COVID-19 pandemic. Net recurrent expenditure by state and territory government on social housing was almost $4.5 billion in 2020–21, an increase in real terms from $4.3 billion in 2019–20. State and territory government capital (non-recurrent) expenditure on social housing was $2.1 billion in 2020–21 (SCRGSP 2022).

Types of housing assistance

Housing assistance explored throughout this report includes:

- the provision of social housing, owned and managed by government and non-government organisations, including:

- public housing (PH)

- state owned and managed Indigenous housing (SOMIH)

- community housing (CH)

- Indigenous community housing (ICH)

- financial assistance with rental costs for those in the private market, including:

- Commonwealth Rent Assistance (CRA)

- Private Rent Assistance (PRA)

- financial assistance with home purchase, including:

- Home Purchase Assistance (HPA)

The report does not cover the provision of services that assist people with obtaining accommodation or sustaining tenancies such as services provided by Specialist Homelessness Services. For information relating to these specific homelessness services, see Specialist homelessness services annual report (AIHW 2021b).

Definitions of housing assistance programs

Social housing

- Public housing: Rental housing managed by all state and territory housing authorities. This includes dwellings that are owned by the housing authority or leased from the private sector or other housing program areas and used to provide public rental housing or leased to public housing tenants. Public housing can be accessed by non-Indigenous Australians, Indigenous Australians, and permanent residents on low incomes and/or with greatest and/or special needs

- Community housing: Housing managed by community-based organisations, available to low to moderate income or special needs households. Community housing models vary across states and territories, and the housing stock may be owned by a variety of groups including government. Community housing can be accessed by non-Indigenous Australians, Indigenous Australians, and permanent residents.

- State owned and managed Indigenous housing: Housing that state and territory governments provide and manage. It is accessed by those on low incomes and/or with special needs and is available to households that have at least one member who identifies as being of Aboriginal and/or Torres Strait Islander origin.

- Indigenous community housing: Housing that Indigenous communities own and/or manage. These organisations may either directly manage the dwellings they own or sublease tenancy management services to the relevant state/territory housing authority or another organisation. This type of housing is made available to households with at least one Indigenous member (NIAA 2022).

Financial assistance with rental costs

- Commonwealth Rent Assistance: This is a payment provided by the Australian government to eligible families and individuals who pay or are liable to pay private rent or community housing rent. Commonwealth Rent Assistance is paid at 75 cents for every dollar above a minimum rental threshold until a maximum rate (or ceiling) is reached. The minimum threshold and maximum rates vary according to the household or family situation, including the number of children (DSS 2019). Indigenous Australians who are eligible can access this program.

- Private Rent Assistance: This is financial assistance administered by each state and territory government. It provides a range of financial assistance to low-income households experiencing difficulty with securing or maintaining private rental accommodation. Private Rent Assistance is usually provided as a one-off form of support—such as bond loans and rental grants—but may also include ongoing rental subsidies and payment of relocation expenses. Indigenous Australians who are eligible can access this program.

Financial assistance with home purchase

- Home Purchase Assistance: This is a form of government financial assistance administered by each state and territory. It provides a range of financial assistance to eligible households to improve their access to, and maintain, home ownership. Home Purchase Assistance may vary by state and territory, as some products are only offered within certain states and territories.

Government assistance for home ownership

There are a range of government programs to support people into home ownership. These are briefly described below, however, are not the focus of this report.

Several schemes are managed by the National Housing Finance and Investment Corporation (NHFIC) on behalf of the Australian Government (NHFIC 2022).

- First Home Loan Deposit Scheme supports people to buy their first home sooner, with a deposit of as little as 5%.

- New Home Guarantee supports people to build or buy a new home, with higher property price caps available in selected areas.

- Family Home Guarantee aims to support eligible single parents with at least one dependent child in purchasing a family home, with a deposit of as little as 2%.

The First Home Super Saver Scheme (FHSSS) was introduced by the Australian Government in the 2017–18 Federal Budget. The FHSSS supports first homebuyers who meet the eligibility criteria to save money for a house deposit using their superannuation fund. Those who are eligible can voluntarily contribute up to $15,000 in any one financial year, and $30,000 in total under the scheme. They receive the tax benefit of saving through their superannuation contribution arrangements (ATO 2022).

The Indigenous Home Ownership Program supports Indigenous Australians into home ownership through providing access to affordable home loan finance. The program aims to address barriers such as loan affordability, low savings, and impaired credit histories (IBA 2021).

The National Disability Insurance Scheme funds Specialist Disability Accommodation (SDA) for a number of NDIS participants with extreme functional impairment or very high support needs, when deemed necessary and reasonable. SDA funding is used to stimulate investment in the building of new dwellings for NDIS participants (NDIS 2020).

The First Home Owner Grant scheme, introduced nationally on 1 July 2000, is funded by the state and territory governments and administered under their legislation. A one-off grant is payable to first homeowners who apply and satisfy eligibility criteria (Australian Government 2020). Additional schemes may also be in place in states/territories, such as first home buyer exemptions from some transfer duties.

Some of these forms of assistance can be used in conjunction with one another and/or state and territory first homeowner grants and stamp duty concessions.

ABS (Australian Bureau of Statistics) 2018 ‘Census of Population and Housing: Estimating homelessness, 2016’, ABS Cat. No. 2049.0., ABS, Australian Government.

AIHW (2019) ‘People in short-term or emergency accommodation: a profile of Specialist Homelessness Services clients’, Cat. no. HOU 300. AIHW, Australian Government, accessed 24 March 2022.

AIHW (2021a) ‘Australia’s Welfare snapshots‘, Australia’s Welfare, AIHW, Australian Government, accessed 8 March 2022.

AIHW (2021b) ‘Specialist homelessness services annual report’, Cat no. HOU 327., AIHW, Australian Government, accessed 24 March 2022.

Anglicare Australia (2019) “Rental affordability snapshot: national report”, Anglicare website, accessed 24 March 2022.

ATO (Australian Tax Office) (2022) ‘First home super saver scheme‘, ATO website, accessed 8 March 2022.

Australian Government (2020) ‘First Home Owner Grant‘, First Home website, accessed 10 March 2021.

Bridge C, Flatau P, Whekan S, Wood G and Yates J (2007) ‘How does housing assistance affect employment, health and social cohesion?‘, Australian Housing and Urban Research Institute (AHURI) Research & Policy Bulletin issue 87, AHURI, Melbourne.

Carnemolla and Skinner (2021) ‘Outcomes Associated with Providing Secure, Stable, and Permanent Housing for People Who Have Been Homeless: An International Scoping Review’, Journal of Planning Literature, 36(4):508-525.

CSERC (Commonwealth Senate Economic Reference Committee) (2015) ‘Out of reach? The Australian housing affordability challenge’, CSERC, Australian Government.

DSS (Department of Social Services) (2019) ‘Housing support–Commonwealth Rent Assistance’, DSS website, accessed 24 March 2022.

DSS (2022) ‘National Housing and Homelessness Agreement’, DSS website, accessed 24 March 2022.

Dufty-Jones R (2018) ‘A historical geography of housing crisis in Australia‘, Australian Geographer, 49(1):5-23.

Groenhart L, Burke T and Ralston L (2014) ‘Thirty years of public housing supply and consumption 1981–2011‘, AHURI Final Report No. 231, AHURI, Melbourne.

IBA (Indigenous Business Australia) (2021) ‘Indigenous Business Australia Annual report 2019–20’, Indigenous Business Australia, Australian Government.

Macintyre S (2015) ‘Australia’s Boldest Experiment: War and Reconstruction in the 1940s‘, New South Publishing, Sydney.

Muir K, Powell A, Flanagan K, Stone W, Tually S, Faulkner D, Hartley C and Pawson H (2020) ’A pathway to where?’ Inquiry into understanding and reimagining social housing pathways', AHURI Final Report No. 332, AHURI, Melbourne.

NDIS (National Disability Insurance Scheme) 2021 ‘Specialist Disability Accommodation‘, NDIS website, accessed 24 March 2022.

NHFIC (National Housing Finance and Investment Corporation) (2022) ‘https://www.nhfic.gov.au/what-we-do/support-to-buy-a-home/‘, NHFIC website, accessed 24 March 2022.

NIAA (National Indigenous Australians Agency) (2022) ‘Indigenous Community Housing Organisations’, NIAA website, accessed 24 March 2022.

Ong R, Singh R, Baker E, Bentley R and Hewton J (2022) ‘Precarious housing and wellbeing: a multidimensional investigation’, AHURI Final Report No. 373, AHURI, Melbourne.

Pawson H, Milligan V and Yates J (2020) ‘Housing Policy in Australia: A Case for System Reform’, Palgrave Macmillan, Singapore.

Parliament of Australia (2017) ‘Social housing and homelessness: Budget Review 2017-18 Index’, report prepared by M Thomas, Parliament of Australia, Australian Government, accessed 24 February 2022.

Parliament of Australia (2001) ‘The Commonwealth-State Housing Agreement’, report prepared by G Mcintosh and J Phillips, Parliamentary Library, Australian Government, accessed 25 February 2022.

Productivity Commission (2015) ‘Housing Assistance and Employment in Australia’, Productivity Commission, Australian Government.

Productivity Commission (2018) ‘Introducing Competition and Informed User Choice into Human Services: Reforms to Human Services - Inquiry report’, Productivity Commission, Australian Government.

SCRGSP (Steering Committee for the Review of Government Service Provision) (2021) ‘Report on Government Services 2021 – Housing’, Productivity Commission, Australian Government.

SCRGSP (Steering Committee for the Review of Government Service Provision) (2022) ‘Report on Government Services 2022 – Housing’, Productivity Commission, Australian Government.

Rowley S and Ong R (2012) ‘Housing Affordability, housing stress and household wellbeing in Australia‘, AHURI Final Report no. 192, AHURI, Melbourne.

Stone W, Parkinson S, Sharam A and Ralston L (2016) ‘Housing assistance need and provision in Australia: a household-based policy analysis’, AHURI Final Report No. 262., AHURI, Melbourne.

Stone W, Sharam A, Wiesel I, Ralston L, Markkanen S, & James A (2015) ‘Accessing and sustaining private rental tenancies: critical life events, housing shocks and insurances’, AHURI Final Report No.259, AHURI, Melbourne.

Troy P (2012) ‘Accommodating Australians: Commonwealth Government Involvement in Housing’, Federation Press, Annandale.

United Nations (2014) ‘Fact Sheet No. 21, The Human Right to Adequate Housing’, Committee on Economic, Social and Cultural Rights, United Nations, accessed 24 March 2022.

Yates J (2013) ‘Evaluating social and affordable housing reform in Australia: lessons to be learned from history’, International Journal of Housing Policy, 13(2): 111-133.