Income support for older Australians

Citation

AIHW

Australian Institute of Health and Welfare (2023) Income support for older Australians, AIHW, Australian Government, accessed 27 April 2024.

APA

Australian Institute of Health and Welfare. (2023). Income support for older Australians. Retrieved from https://www.aihw.gov.au/reports/australias-welfare/income-support-older-australians

MLA

Income support for older Australians. Australian Institute of Health and Welfare, 07 September 2023, https://www.aihw.gov.au/reports/australias-welfare/income-support-older-australians

Vancouver

Australian Institute of Health and Welfare. Income support for older Australians [Internet]. Canberra: Australian Institute of Health and Welfare, 2023 [cited 2024 Apr. 27]. Available from: https://www.aihw.gov.au/reports/australias-welfare/income-support-older-australians

Harvard

Australian Institute of Health and Welfare (AIHW) 2023, Income support for older Australians, viewed 27 April 2024, https://www.aihw.gov.au/reports/australias-welfare/income-support-older-australians

Get citations as an Endnote file: Endnote

On this page

Australia’s social security system administered by Services Australia aims to support people who cannot, or cannot fully, support themselves, by providing targeted payments and assistance. Where this is a regular payment that helps with the everyday costs of living it is referred to as an income support payment, with the type of payment often reflecting life circumstances at the time of receipt.

This page examines income support receipt for people aged 65 years and over, and the main payment types they receive. The most common payment for this age group is Age Pension. However, in recent years receipt of other income support payments has increased among those aged 65–69 due to the increasing qualifying age for Age Pension.

Information on government expenditure on these payments is included in Welfare expenditure. See also the glossary for definitions of terms used on this page.

Unless otherwise stated, income support data are sourced from Department of Social Services payment demographic data (September 2013 to March 2023) and from previously unpublished data derived from Services Australia administrative data (June 2001 to June 2013).

Age Pension

Age Pension is paid to people who meet certain requirements, such as age and residency requirements, and is subject to income and asset testing.

Several policy changes have been made to Age Pension over the last 6 years, including a rebalancing of the assets test from 1 January 2017, and incremental increases to the qualifying age for people born on or after 1 July 1952 (DSS 2021). The qualifying age for Age Pension has been increasing by 6 months every 2 years since 2017, depending on the year in which you were born. Since 1 July 2023, Age Pension qualifying age is 67 for people born on or after 1 January 1957 and between 65 and 66.5 for people born before that (see Qualifying age for Age Pension for further details).

Despite increases to the qualifying age for Age Pension, population proportions on this page are presented for those aged 65 and over (unless otherwise specified) for consistency with previous reporting and for comparability across the reporting period (2001 to 2023).

For people who receive Age Pension, the specific amount received depends on their income and assets. As at 20 March 2023, the maximum basic rate for Age Pension, including Maximum Pension Supplement and Energy Supplement, is $1,064.00 per fortnight for a single person, $802.00 for a couple each and $1,604.00 for a couple combined. Age Pension is paid at the same rate as Disability Support Pension and Carer Payment, and the payment rate is reviewed regularly. Payments are reduced incrementally for every dollar of income over $190 per fortnight.

For more information on this payment see Age Pension and Age Pension – payment rates.

Other income support payment types

There is also an increasing number of Australians aged 65 and over receiving other income support payments, such as Unemployment Payments, Disability Support Pension and Carer Payment (224,700 people as at 31 March 2023). These increases are likely to be a result of the above-mentioned increases to the eligibility age for Age Pension and people continuing to receive other income support payments for longer before transitioning to Age Pension.

As at 31 March 2023, there was also a small number of people aged 65 and over receiving other income support payments: parenting payments (225), ABSTUDY (Living Allowance) (5), Austudy (90), and Special Benefit (3,165). These recipients are included in the totals for income support receipt but are not the focus of this page.

See glossary for definitions of the terms used in this box.

How many older Australians receive income support?

As at 31 March 2023, around 2.8 million people aged 65 and over received income support payments, equating to 63% of the population aged 65 and over. Of these, the vast majority (92% or 2.6 million) received Age Pension.

As at 31 March 2023, 228,200 people aged 65 and over received other income support payments, including:

- Disability Support Pension (DSP) – 124,700 people

- Carer Payment – 60,800 people

- JobSeeker Payment – 39,100 people.

For more information on these other income support payments, see Disability Support Pension, Carer Payment, and Unemployment payments.

Trends

The number of Australians aged 65 and over receiving income support has been steadily increasing over the past 8 years, from 2.5 million in June 2014 to 2.8 million in June 2022. However, when taking into account population growth for the 65 and over population over this period, income support receipt has declined – from 72% to 63% of the population aged 65 and over between 2014 and 2022. This is due to the population aged 65 and over growing more than twice as quickly as the number of people in this age group receiving income support (29% population increase compared with a 12% increase in the number of people receiving income support over this period).

Patterns in income support receipt for Australians aged 65 and over are largely driven by those receiving Age Pension, which accounted for 92% of all income support receipt for this age group as at 31 March 2023. The number of people receiving Age Pension increased by 6% over the last 8 years – from 2.4 million to 2.6 million between June 2014 and June 2022, despite a slight dip in 2017. This decrease reflected changes to the Age Pension assets test from January 2017.

Consistent with income support receipt overall, the proportion of the population aged 65 and over receiving Age Pension has gradually declined – from 70% in 2014 to 58% by June 2022 (Figure 1). Some of this decline reflects increases to the qualifying age for Age Pension from 65 in 2017 to 67 by 2023 (depending on year of birth) see Age Pension box above. For Australians aged 70 and over, who meet the age eligibility requirements, the decline in the proportion of the population receiving Age Pension over this period was not as steep (from 76% to 69%).

Between June 2014 and June 2022, the number and proportion of people aged 65 and over receiving other income support payments have been steadily increasing:

- DSP increased from 36,200 to 119,300 (1.1% to 2.7% of the population aged 65 and over)

- Carer Payment increased from 34,400 to 59,700 (1.0% to 1.3%)

- Newstart Allowance/JobSeeker Payment increased from 0 recipients to 41,800 (0% to 0.9%).

Changing distribution of payment types

The growth in receipt of the above-mentioned income support payments has led to a relative decrease in the share of income support recipients aged 65 and over receiving Age Pension – from 97% of recipients in June 2014 to 92% in March 2023. This is likely due to increases to the eligibility age for Age Pension as mentioned above (on 1 July in 2017, 2019 and 2021), leading to recipients commencing or remaining on other income support payments. Following each incremental increase in the qualifying age for Age Pension there have been steep declines in the number of people aged 65–69 receiving Age Pension over the subsequent three quarters. This included declines of 2.7–4.6% from September 2017, 2.0–4.6% from September 2019, and 2.6–6.1% from September 2021, compared with small increases or decreases of less than 1.0% in most other quarters since 2017.

Coinciding with these declines in Age Pension were increases in the receipt of other income support payments, including DSP, Carer Payment and Newstart Allowance/JobSeeker Payment. For example, the number of people aged 65–69 receiving Newstart Allowance increased by 51% in September 2019 and 38% in December 2019 (11,100 more recipients from June to December 2019), compared with declines of 4.7% to increases of 2.5% in most other quarters. The number of people aged 65–69 receiving DSP increased by 18% (6,300 more recipients) and 9.8% (5,100 more recipients) in the September 2017 and September 2019 quarters, compared with 0.4–3.7% increases in most other quarters.

These patterns of people aged 65–69 increasingly receiving income support payments other than Age Pension, has led to the age profile of people receiving Age Pension becoming older – 85% were aged 70 and over as at March 2023, compared with 77% in December 2017.

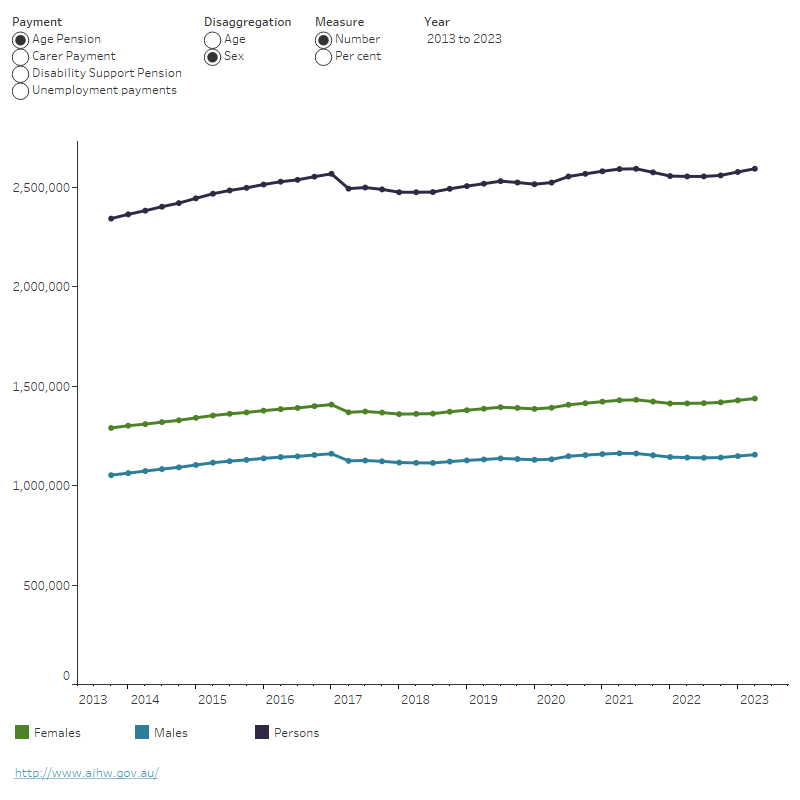

Figure 1: Trends in people receiving Age Pension and other payments (for those aged 65 years and over), September 2013 – March 2023

The line chart shows the number and proportion of males, females and persons aged 65 years and over receiving Age Pension and other payments from September 2013 to March 2023. This information can be presented for specific payments, and by age groups over 65. The line chart shows a slight increase in the number of people aged 65 and over receiving Age Pension from 2013 to 2023, despite a dip in 2017. However, the proportion of the population aged 65 years and over receiving Age Pension has been steadily declining since 2017 (from 66.3% in March 2017 to 58.1% in March 2023). For people aged 65-69, there has been a steep decline in the number and proportion receiving Age Pension since 2017. The number and proportion of people aged 65-69 receiving other income support payments (DSP, Carer Payment and Newstart Allowance/Jobseeker Payment) has increased steeply since 2017.

Notes

- Data are as at the last Friday of each corresponding month.

- Data before 2013 may differ from official sources due to differences in methodology.

- Before September 2020, unemployment payments included Newstart Allowance (before March 2020), JobSeeker Payment (from March 2020) and Youth Allowance (other). From September 2020, Sickness and Bereavement Allowance are also included in the JobSeeker counts.

- Per cent refers to the proportion of the population aged 65 and over receiving different payment types, using Australian Bureau of Statistics (ABS) Estimated Resident Population data for September 2013 to September 2022.

Source: AIHW analysis of unpublished data provided by the Department of Social Services (September 2013 – March 2023).

Age, sex and other characteristics of people receiving Age Pension

Given the vast majority (92%) of people aged 65 and over receiving income support are receiving Age Pension, the rest of this page focuses on the characteristics of those receiving Age Pension.

Age and sex

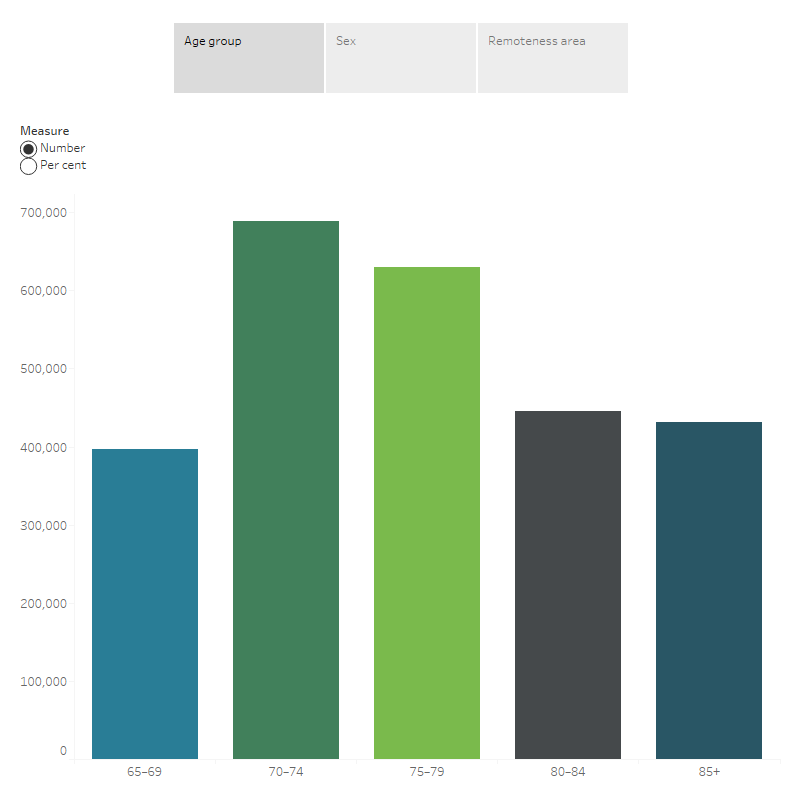

As at 31 March 2023, the proportion of the population aged 65 and over who received Age Pension increased with age – from 30% of those aged 65–69, to 60% of those aged 70–74, and 78% of those aged 85 and over (Figure 2).

As at 31 March 2023, women were more likely to receive Age Pension than men – 1.4 million (61% of women aged 65 and over) compared with 1.2 million men (55% of men aged 65 and over) (Figure 2).

First Nations people

As at 31 March 2023, 27,100 Aboriginal and Torres Strait Islander (First Nations) people (see glossary) received Age Pension, representing 51% of the First Nations people aged 65 and over. See Income and finance of First Nations people for more information.

Note that Indigenous status identification in most data collections is voluntary. This may influence the quality and completeness of the data and subsequent reporting on the number and proportion of First Nations people receiving Age Pension.

Remoteness area

As at 31 March 2023, people living in Inner regional and Outer regional areas were more likely to be receiving Age Pension (63% and 61%, respectively, of the population aged 65 years and over living in these areas) than those living in Major cities (56%), Remote areas (57%) or Very remote areas (52%) (Figure 2).

Figure 2: Number and proportion of people aged 65 years and over receiving Age Pension, by selected characteristics, as at 31 March 2023

The vertical bar chart shows the number and proportion of people aged 65 and over who received Age Pension, for the key characteristics in the tool tip (age group, remoteness area, and sex), as at 31 March 2023. The vertical bar chart shows that the proportion of people receiving Age Pension increases with age (from 30% to 78% for age groups 65–69 to 85 and over). A higher proportion of women than men aged 65 and over received Age Pension (61% and 55%, respectively). People living in Inner or Outer Regional areas were more likely to be receiving Age Pension (63% and 61%, respectively, of the population aged 65 and over living in these areas) than those living in Remote or Very Remote areas (57% and 52%, respectively).

Note: Proportions are as at 31 March 2023, using ABS population data (September 2022 for age group and sex and June 2021 for remoteness area).

Source: AIHW analysis of Department of Social Services Benefit and Payment Recipient Demographics – quarterly data on data.gov.au (March 2023).

Earning an income while receiving income support

Means-tested arrangements are designed to ensure that income support targets the people most in need, by assessing an individual’s income and assets to determine eligibility for a full or part-rate payment. People receiving income support are required to report income from all sources (including work, investments and/or substantial assets).

As at 31 March 2023, for people receiving Age Pension:

- 31% received a part-rate payment

- 3.2% declared earnings from employment in the preceding fortnight, of which over 4 in 5 (86%) earned at least $250 in the last fortnight.

The proportion of people receiving a part-rate Age Pension has declined – from 41% of people receiving Age Pension in March 2015, to 38% in March 2017, to 36% in March 2020. The rate of decline was steeper over the early months of the COVID-19 pandemic (from 36% to 33% between March and June 2020) and stabilised around 30–33% between June 2020 and March 2023.

This overall decline in part-rate Age Pension payments between 2015 and 2022 is partly attributable to changes to the assets test in January 2017. This included an increase to the assets ‘test free area’ (that is, the amount of assets an individual can have without their pension being affected). It also changed the rate at which assets over the free area reduce the rate of pension – thereby changing the proportion of part-rate pensioners.

Earnings from employment for those receiving Age Pension declined very slightly over the same period. Prior to December 2020, the proportion of people receiving Age Pension who reporting earnings was consistently around 4–4.5%, it then gradually declined reaching a record low of 2.9% in September 2021 and remained relatively stable to March 2023 (3.2%).

Where do I go for more information?

For more information on Age pension, see:

- Services Australia A guide to Australian Government payments

- Department of Social Services payment recipient demographic data.

DSS (2023) DSS benefit and payment recipient demographic data, DSS, Australian Government, accessed 19 June 2023.