Parenting payments

Citation

AIHW

Australian Institute of Health and Welfare (2023) Parenting payments, AIHW, Australian Government, accessed 26 April 2024.

APA

Australian Institute of Health and Welfare. (2023). Parenting payments. Retrieved from https://www.aihw.gov.au/reports/australias-welfare/parenting-payments

MLA

Parenting payments. Australian Institute of Health and Welfare, 07 September 2023, https://www.aihw.gov.au/reports/australias-welfare/parenting-payments

Vancouver

Australian Institute of Health and Welfare. Parenting payments [Internet]. Canberra: Australian Institute of Health and Welfare, 2023 [cited 2024 Apr. 26]. Available from: https://www.aihw.gov.au/reports/australias-welfare/parenting-payments

Harvard

Australian Institute of Health and Welfare (AIHW) 2023, Parenting payments, viewed 26 April 2024, https://www.aihw.gov.au/reports/australias-welfare/parenting-payments

Get citations as an Endnote file: Endnote

On this page

Australia’s social security system administered by Services Australia aims to support people who cannot, or cannot fully, support themselves, by providing targeted payments and assistance. Where this is a regular payment that helps with the everyday costs of living it is referred to as an income support payment, with the type of payment often reflecting life circumstances at the time of receipt.

This page examines the main income support payments for parents aged 16 and over who are unable to work full time – Parenting Payment Single and Parenting Payment Partnered. These payments are part of a larger network of labour market policies and services, designed to support individuals seeking further employment (see Employment services).

This page also presents information on additional payments to help with the cost of raising children – Family Tax Benefit.

In June 2022, there were 3.3 million families with dependent children in Australia (including 2.1 million couple families and 399,300 one parent families with a child aged less than 10). In June 2022, 7.1% of all families with dependent children were jobless families (each family member aged 15 and over was unemployed, retired or not in the labour force; ABS 2022).

For more information on unemployment and labour force participation, see Employment and unemployment. Information on government expenditure on these payments is included in Welfare expenditure. Also see the glossary for definitions of all terms used on this page.

Unless otherwise stated, income support data are sourced from Department of Social Services payment demographic data (from September 2013 to March 2023) and from previously unpublished data derived from Services Australia administrative data (June 2001 to June 2013).

Parenting payments

Parenting payments are paid in recognition of the impact that caring for children can have on a parent’s capacity to undertake full-time employment. Only one parent or guardian can be the principal carer and receive the payment.

- Parenting Payment Single (PPS): an income support payment for single parents where the youngest child is aged under 8. Single parents must satisfy part‑time mutual obligation requirements of 30 hours per fortnight once their youngest child turns 6 (unless they have a partial capacity to work). Note, the May 2023 budget announced a change to expand the eligibility to include single parents with children aged under 14 from 20 September 2023.

- Parenting Payment Partnered (PPP): an income support payment for partnered parents until their youngest child turns 6.

For people who receive these payments, the specific amount they receive depends on their, and their partner’s, income and assets. As at 20 March 2023, the maximum fortnightly payment for a single person is $949.30 (including Parenting Payment and a pension supplement of $27.20), and the maximum fortnightly payment for a person who is partnered is $631.20. These payments reduce incrementally for every dollar over the income threshold ($202.60–$251.80 for parents with 1–3 children). Payment rates are updated in March and September each year, and a further increase to the PPP rate was announced in the May 2023 budget to be introduced on 20 September 2023.

For further information on the payment rates for each of these payments, see Social Security Guide – current rates.

Recipients aged under 16

A small number of people receiving parenting payments were aged under 16 in March 2023 (70 for PPS). These recipients are included in the numerator in calculating the proportion of people receiving parenting payments aged 16 and over in the population, to ensure consistency in recipient numbers reported on this page.

Family assistance payments

Family assistance payments help families with the cost of raising children. They include:

- Family Tax Benefit (FTB) Part A: a per-child payment for a dependent child aged 0–15, or 16–19 and meeting study requirements.

- FTB Part B: a per-family payment, paid to couples with one main income and care for a dependent child aged under 13. It is also paid to single parents, non-parent carers or grandparent carers who care for a dependent child aged 0–15, or 16–18 and meeting study requirements.

This page does not include all income support payments for people aged 16 and over – for more information on other payment types, see Unemployment payments, Disability Support Pension and Carer Payment. For an overview of income support payments see Income and income support.

See glossary for definitions of the terms used in this box.

How many people receive parenting payments?

As at 31 March 2023, 289,300 people (1.4% of the population aged 16 and over) received one of the following parenting payments:

- 226,500 received Parenting Payment Single (PPS)

- 62,800 received Parenting Payment Partnered (PPP).

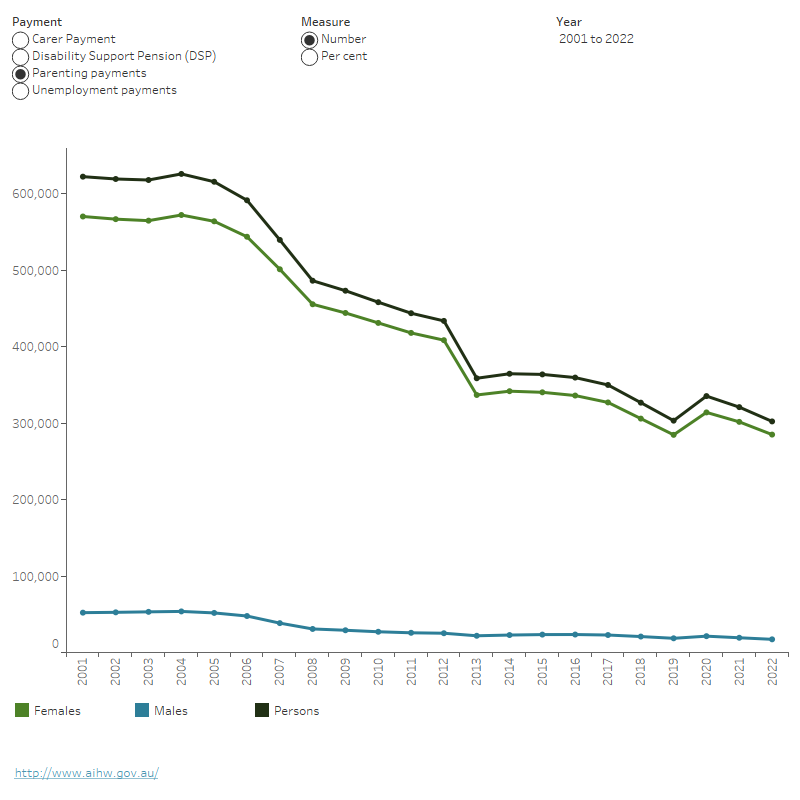

Trends

The number and proportion of the population receiving parenting payments has generally declined since 2001 – from 622,500 in June 2001 to 302,300 in June 2022 (or from 4.1% to 1.4% of the population aged 16 and over; Figure 1). This decline reflects in part labour market conditions as well as changes to parenting payment policies in 2006 and 2013, where new recipients had part-time participation requirements and could only continue to receive the payment until their youngest child turned 6 (for partnered recipients) or 8 (for single recipients). See Box 3.1 in ‘Chapter 3 Income support over the past 20 years’ in Australia’s Welfare 2019: data insights, for further details. Note, further policy changes to PPS were announced in May 2023 budget on increasing the age eligibility of youngest child (to 14 years) for single parents.

Despite declines in the number of people receiving parenting payments prior to March 2020, receipt did increase in the early months of the COVID-19 pandemic, by 12% from March to June 2020 (an additional 37,200 recipients, or from 1.5% to 1.6% of the population aged 16 and over). However, receipt of parenting payments returned to pre-pandemic levels by September 2021 (1.5% of the population aged 16 and over) and remained relatively stable to March 2023.

For more information on the impact of COVID-19 on these payments, see ‘Chapter 3 Employment and income support following the COVID-19 pandemic’ in Australia’s welfare 2023: data insights and ‘Chapter 4 The impacts of COVID-19 on employment and income support in Australia’ in Australia’s Welfare 2021: data insights.

Figure 1: Trends in people aged 16 and over receiving parenting payments and other payments, June 2001 to June 2022

The line chart shows the number and proportion of males, females and persons aged 16 years and over receiving parenting payments from June 2001 to June 2022. The number and proportion of people receiving parenting payments steadily declined from June 2001 to June 2019 (from 622,500 to 303,300 or from 4.1% to 1.5% of the population aged 16 years and over). It increased to 335,500 in June 2020 (or to 1.6% of the population aged 16 years and over), and then steadily declined until June 2022 (to 302,300 or 1.4% of the population aged 16 years and over). As at June 2022, a higher proportion of females (2.7%) than males (0.2%) aged 16 years and over received parenting payments.

Notes

- Data are as at June 30 in each year.

- Data before 2013 may differ from official sources due to differences in methodology.

- Before September 2020, unemployment payments included Newstart Allowance (before March 2020), JobSeeker Payment (from March 2020) and Youth Allowance (other). From September 2020, Sickness and Bereavement Allowance are also included in the JobSeeker counts.

- A small number of people receiving income support payments are aged under 16 (70 for Parenting Payment Single, 5 for unemployment payments (Youth Allowance (other)), and 5 for Carer Payment in March 2023). These people are included in the numerator in calculating the proportion of the population aged 16 and over receiving these payments.

- Per cent refers to the proportion of the population aged 16 and over receiving different payment types, using Australian Bureau of Statistics (ABS) Estimated Resident Population data for June 2001 to June 2022.

Source: AIHW analysis of Department of Social Services Benefit and Payment Recipient Demographics – quarterly data on data.gov.au (June 2014– June 2022), and of unpublished data constructed from Services Australia administrative data (June 2001–June 2013).

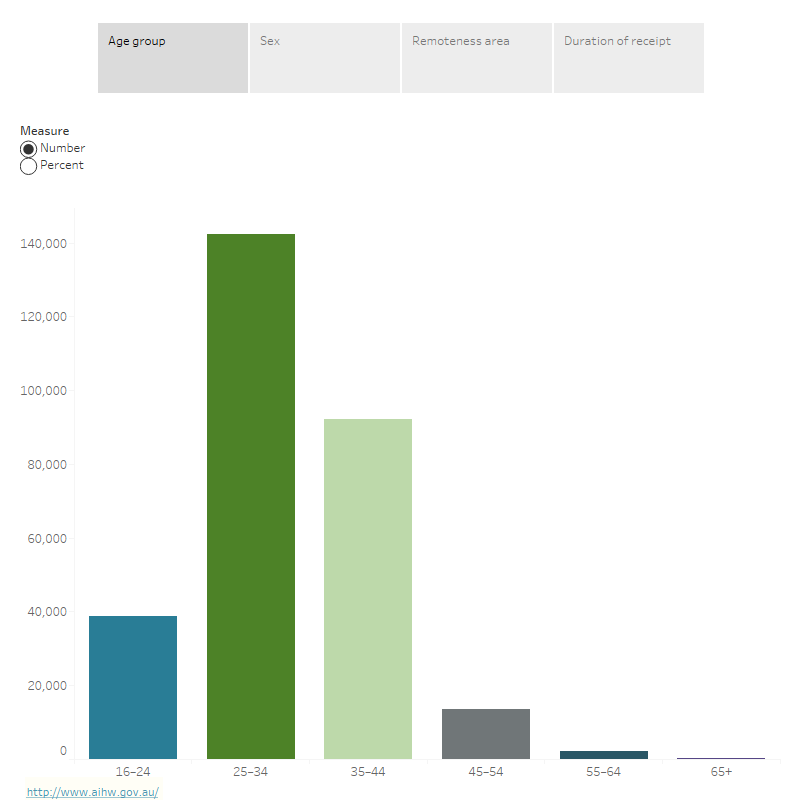

Age and sex

As at 31 March 2023, almost 1 in 2 (49%) people receiving parenting payments were aged 25–34 and just under 1 in 3 (32%) were aged 35–44. This equates to 3.8% of people aged 25–34 and 2.6% of people aged 35–44 receiving parenting payments (Figure 2).

Females accounted for nearly all people receiving parenting payments – 96% for PPS and 90% for PPP.

First Nations people

As at 31 March 2023, 48,400 Aboriginal and Torres Strait Islander (First Nations) people (see glossary) received a parenting payment, representing 7.4% of First Nations people aged 15 and over. This compares with 1.2% of Other Australians (see glossary) aged 15 and over receiving parenting payments (see Income and finance of First Nations people for more information).

Note that Indigenous status identification in most data collections is voluntary. This may influence the quality and completeness of the data and subsequent reporting on the number and proportion of First Nations people receiving income support payments, especially among older First Nations people.

Remoteness area

As at 31 March 2023, people aged 16 and over living in Very remote areas were 4 times as likely to be receiving parenting payments as people living in Major cities (4.9% and 1.2%, respectively; Figure 2).

Figure 2: Number and proportion of people aged 16 years and over receiving parenting payments, by selected characteristics, as at 31 March 2023

The vertical bar chart shows the number and proportion of people aged 16 years and over receiving parenting payments, for the key characteristics in the tool tip (age group, duration of receipt, remoteness area, and sex), as at 31 March 2023. Receipt of parenting payments was highest among the 25–34 and 35–44 age groups (142,300 or 3.8% of the 25–34 age group and 92,200 or 2.6% of the 35–44 age group, respectively). Receipt of parenting payments was higher among females than males (273,300 or 2.6% of females aged 16 and over, and 16,000 or 0.2% of males, respectively). The majority of parenting payment recipients had been receiving income support for 5 or more years (124,700 or 43%). People living in Very Remote areas were 4 times as likely to receive parenting payments as people living in Major Cities (4.9% and 1.2%, respectively).

Notes

- Proportions are as at 31 March 2023, using ABS population data (September 2022 for age group and sex and June 2021 for remoteness area). Duration of receipt is reported as a proportion of all parenting payment recipients.

- A small number of people receiving parenting payments are aged under 16 (70 for Parenting Payment Single in March 2023). These people are included in the numerator in calculating the proportion of the population aged 16 and over receiving parenting payments.

Source: AIHW analysis of Department of Social Services Benefit and Payment Recipient Demographics – quarterly data on data.gov.au (March 2023).

Earning an income while receiving income support

Means-tested arrangements are designed to ensure that income support targets the people most in need, by assessing an individual’s income and assets to determine eligibility for a full or part-rate payment (see glossary). People receiving income support are required to report income from all sources, including work, investments and/or substantial assets.

As at 31 March 2023, for people receiving parenting payments:

- over 1 in 4 (29%) received a part-rate payment, which is slightly higher than recent years (24–28% since 2019)

- almost 1 in 3 (30%) declared earnings from employment in the preceding fortnight – 34% and 15% for people receiving PPS and PPP, respectively. Of these, the vast majority (93%) earned at least $250 in the last fortnight.

The proportion of people receiving parenting payments who declared earnings declined from 25% in September 2019 to 21% in June 2020, before gradually increasing to 30% in March 2023. This increase in the proportion with earnings since June 2020 may reflect the growth in employment over this period, as well as changes made to the income threshold (see glossary) for PPP from April 2021.

Duration of income support receipt

As at 31 March 2023, 14% of people receiving parenting payments had received income support for less than 1 year, 11% for 1–2 years, 32% for 2–5 years and 43% for 5 or more years. These proportions were similar to those observed between 2017 and 2019.

People receiving PPS tended to receive income support payments for longer than people receiving PPP – 46% of people receiving PPS had received income support for 5 or more years compared with 32% of people receiving PPP. This partially reflects differences in eligibility for these payments (see box for further details).

How many people receive Family Tax Benefit?

As at 31 March 2023, there were 1.3 million Family Tax Benefit (FTB) Part A recipients and 1.0 million FTB Part B recipients receiving FTB through fortnightly instalments. The majority of recipients (76%) receive both FTB Part A and FTB Part B. As well, almost half (42%) received an income support payment (based on previously unpublished December 2022 data from Department of Social Services).

Between June 2015 and June 2022, the number of FTB recipients has been generally declining:

- 10% decline for FTB Part A (from 1.54 to 1.38 million)

- 20% decline for FTB Part B (from 1.34 to 1.07 million).

Taking into account the total number of families with dependants in Australia (ABS 2022), this represents a decline from 43% of families in June 2015 receiving FTB Part B to 32% in June 2022.

For more information on the impact of COVID-19 on parenting and family payments, see ‘Chapter 4 The impacts of COVID-19 on employment and income support in Australia’ in Australia’s welfare 2021: data insights.

Where do I go for more information?

For more information on parenting payments, see:

- Services Australia A guide to Australian Government payments

- Department of Social Services payment demographic data.

ABS (Australian Bureau of Statistics) (2022) Labour Force Status of Families, June 2022, ABS website, accessed 27 March 2023.

DSS (Department of Social Services) (2023) DSS Benefit and Payment Recipient Demographics – quarterly data, DSS, Australian Government, accessed 19 June 2023.