Housing profile of older people

Trends in home ownership and the private rental market

Home ownership

In Australia, home ownership has provided older people with security of housing tenure and long-term social and economic benefits (AIHW 2018). It has often been relied upon as an asset on retirement, reducing the risk of poverty and housing stress in older ages (PA 2016). Australians have high rates of home ownership, yet the rates have been decreasing in more recent years (ABS 2019). The home ownership rate of 30–34 year olds was 64% in 1971, decreasing 14 percentage points to 50% in 2016, according to Census data. For Australians aged 25–29, the home ownership rate was 50% in 1971, decreasing 13 percentage points to 37% in 2016. While more pronounced for younger people, there has also been a decrease in rates of home ownership for older Australians (AIHW 2019).

Home ownership rates for older Australians, both with and without a mortgage (where the household reference person was aged 55 and older), have decreased from 84% in 1995–96 to 81% in 2017–18 (ABS 2019). This largely reflects a drop in rates of home ownership of older people without a mortgage, decreasing from 77% in 1995–96 to 58% in 2017–18. An increase in home ownership with a mortgage offset much of this change, more than tripling from 7% in 1995–96 to 23% in 2017–18. The increase in older households paying off a mortgage may be a reflection of several factors: the large rise in property prices in the last few decades, households paying off their mortgage at older ages than in the past, and the benefits of having access to redraw facilities (ABS 2017b).

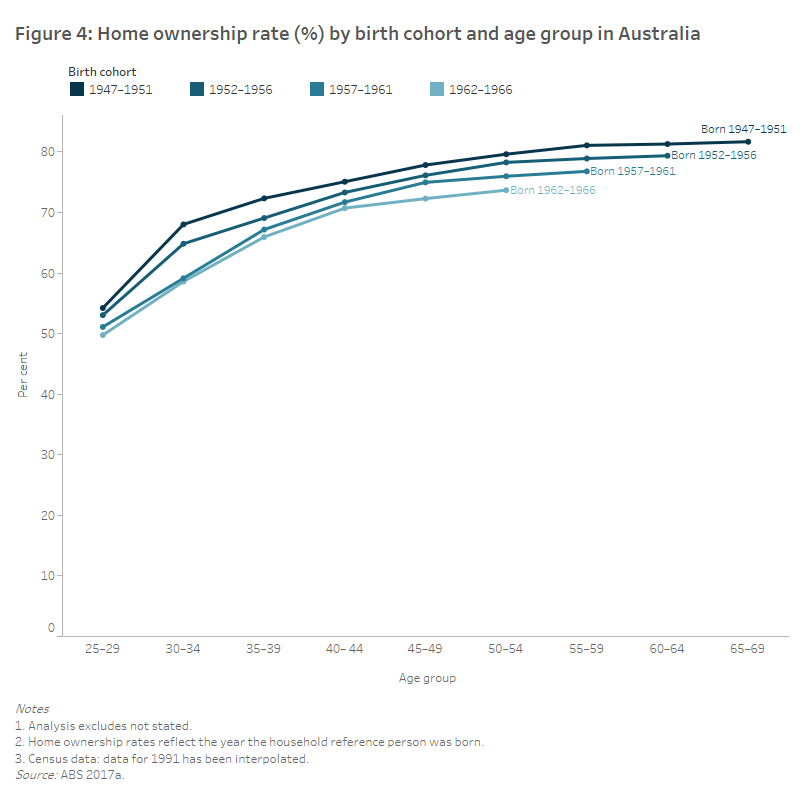

Australian Census data on home ownership by birth cohorts further illustrate changes in home ownership rates (with and without a mortgage) of older Australians (Figure 4). For each successive birth cohort after those born between 1947–1951, home ownership rates have fallen. Home ownership rates of those in the 1947–51 birth cohort was 54% when they were 25–29 years of age, increasing to 80% when they were 50–54, or 25 years later. By contrast, the home ownership rate of the birth cohort 1962–1966 was lower at 25–29 years of age (50%), and increased to a leaser extent to 74% when they were 50–54 years (ABS 2017a).

Private rental market

Many older private renters are vulnerable and economically disadvantaged; a group who may rent out of necessity rather than choice (PC 2015). Renting privately may be problematic, particularly for older Australians in retirement. Renting in older ages can be associated with the risk of poverty and adverse impacts on health and wellbeing, and older people renting can be disproportionately affected by insecure tenures (PC 2015). Households experiencing less security of housing tenure are likely to be at an increased risk of homelessness (AIHW 2019). Furthermore, older households who rent can be more likely to move than those owning their homes outright. Research has shown that many older Australians strongly prefer to age in place, staying in their family home (PC 2015).

Australia has seen a decline in home ownership for older people, offset by an increase in the proportion of older Australians in the private rental market; increasing from 6% of all those 55 and over in 1995–96 to 12% in 2017–18 (ABS 2019). More older people in the rental market rent from a private landlord (70% of older renters) than from state or territory housing authorities (20%). When considering rental tenure by various age groupings, the proportion renting from state or territory housing authorities increases with age. Of older people renting in 2017–18, 16% of those aged 55–64 were renting from a state or territory housing authority, compared with 21% of those aged 65–74 and 29% of those aged 75 and over (ABS 2019).

Low–income renters

Older households with low-income in the private rental market may be at greater risk of housing affordability stress. One measure of housing stress is the 30/40 rule, which focuses on low-income households and their housing costs. According to this rule, households in financial housing stress are lower-income households (lowest 40% of income distribution) that spend more than 30% of gross household income on housing costs (ABS 2019).

For low-income older households in the private rental market, the proportion of gross income spent on housing costs varied between older age groups (based on the reference person of the household) and family living arrangements. In 2017–18, housing costs as a proportion of gross income:

- was highest for lone person households aged 65 and over (44%); similar for lone person households aged 55–64 (43%)

- was higher for couple only households aged 65 and over (36%), than couple only households aged 55–64 (32%) (ABS 2019).

The impact of housing stress on older low-income renters may be different from younger low-income renters as they may have retired from the paid workforce, lack the capacity for future earnings and have low levels of wealth to draw upon. They also may have limited capacity to secure suitable housing that meets their changing needs (AHURI 2018). Further, older households with low-income may find it difficult to compete with higher-income households in the private rental market and may therefore seek assistance with housing costs or seek to rent a social housing property.

References

ABS (Australian Bureau of Statistics) 2017a. AIHW analysis of Census of Population and Housing, 1971 to 2016, customised report. Canberra: ABS.

ABS 2017b. Housing Occupancy and Costs, Australia, 2015–16. ABS cat. no. 4130.0. Canberra: ABS.

ABS 2019. Housing Occupancy and Costs, Australia, 2017–18. ABS cat. no. 4130.0. Canberra: ABS.

AHURI (Australian Housing and Urban Research Institute) 2018. Supporting older lower income tenants in the private rental sectorViewed 13 August 2019.

AIHW (Australian Institute of Health and Welfare) 2018. Housing Assistance in Australia 2018. Cat. no. HOU 296. Canberra: AIHW.

AIHW 2019. Housing Assistance in Australia 2019. Cat. no. HOU 315. Canberra: AIHW.

Parliament of Australia 2016. The Senate Economic References Committee. April 2016 'A husband is not a retirement plan'Achieving economic security for women in retirement.

Productivity Commission 2015. Housing decisions of older Australians, Commission Research Paper. Canberra: Productivity Commission.