Income and finance of First Nations people

Citation

AIHW

Australian Institute of Health and Welfare (2023) Income and finance of First Nations people, AIHW, Australian Government, accessed 27 July 2024.

APA

Australian Institute of Health and Welfare. (2023). Income and finance of First Nations people. Retrieved from https://www.aihw.gov.au/reports/australias-welfare/indigenous-income-and-finance

MLA

Income and finance of First Nations people. Australian Institute of Health and Welfare, 07 September 2023, https://www.aihw.gov.au/reports/australias-welfare/indigenous-income-and-finance

Vancouver

Australian Institute of Health and Welfare. Income and finance of First Nations people [Internet]. Canberra: Australian Institute of Health and Welfare, 2023 [cited 2024 Jul. 27]. Available from: https://www.aihw.gov.au/reports/australias-welfare/indigenous-income-and-finance

Harvard

Australian Institute of Health and Welfare (AIHW) 2023, Income and finance of First Nations people, viewed 27 July 2024, https://www.aihw.gov.au/reports/australias-welfare/indigenous-income-and-finance

Get citations as an Endnote file: Endnote

Higher levels of household income and lower financial constraints have well-established associations with:

- lower risk of disease

- better mental health

- longer lifespans

- lower levels of stress in meeting basic living costs

- greater choices and accessibility of quality food, housing, physical exercise, social participation, health care, and

- better ability for people to maintain a feeling of control or security over their lives (Braveman et al. 2011; Finkelstein et al. 2022; Kiely et al. 2015; Mackenbach 2015, 2020; Marmot 2002; Marmot and Wilkinson 2001; Subramanian et al. 2002).

Income and finances play a crucial role in determining better health and wellbeing of Aboriginal and Torres Strait Islander (First Nations) people. This page presents information on the median weekly equivalised household income of First Nations people and examines changes in that income between 2016 and 2021. It also presents statistics on the personal income and reliance of First Nations people on income support payments and experience of financial stress.

See Employment of First Nations people for more information on employment of First Nations people. Employment is usually the main source of household and personal income.

Median weekly equivalised household income

About household and personal income data

Data on personal and household income for First Nations people come from the Australian Bureau of Statistics (ABS) Census of Population and Housing (the Census) 2016 and 2021 (ABS 2016, 2019, 2021a, 2023).

The Census provides details on household income for specific sub-groups, including for First Nations people, non-Indigenous Australians, and the total population. A household is defined as a First Nations household if it has at least one person who identified as being Aboriginal and/or Torres Strait Islander. A household with no person who identified as being Aboriginal and/or Torres Strait Islander is referred to as an ‘Other household’. The Census computes total household weekly income for First Nations households as the sum of total personal weekly income of each resident aged 15 or over who was present in the household on Census night (ABS 2019, 2023).

The Census also reports on weekly personal income of all individuals aged 15 years and over based on their usual place of residence, and this data can be used to compute the median weekly personal income of all First Nations people. The Census collects weekly personal income in ranges (and not specific amounts), but the ABS derives medians using additional information from the Survey of Income and Housing. The main components of personal income are wages and salaries, pensions, allowances, interest, and dividends.

This page reports on both the household and personal weekly incomes for First Nations people. The household income is reported as equivalised gross weekly household income with adjustments for differences in household size and age profile of household members.

For comparisons across years, incomes are adjusted for inflation (see glossary) using ABS Consumer Price Index data for June 2016 and June 2021 (ABS 2022b). The incomes for both First Nations people and non-Indigenous Australians are presented in 2021 dollars equivalents. The income categories and quintiles used to further illustrate the full income distributions are, however, based on income in each Census period unadjusted for inflation between 2016 and 2021.

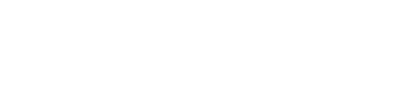

Figure 1 shows inflation-adjusted median weekly equivalised household income of First Nations households in 2016 and 2021.

In 2021:

- Median weekly equivalised household income for First Nations households was $830. Between 2016 and 2021, median weekly equivalised household income for First Nations households grew by over 18%, compared with a growth of 11% for Other households.

- Among all states and territories, the median weekly equivalised household income in First Nations households was highest in the Australian Capital Territory ($1,379) and lowest in the Northern Territory ($578). Since 2016, the median weekly equivalised household incomes in First Nations households have grown in all states and territories.

- 40% of First Nations households had an equivalised weekly household income of $1,000 or more. This has increased from 29% of First Nations households in 2016.

- The proportion of Other households with an equivalised weekly income of $1,000 or more was 54%, an increase from 44% in 2016.

Figure 1: Weekly equivalised household income by state and territory, and Indigenous status, 2016 and 2021, in 2021 dollars

This visualisation shows the median weekly equivalised household income in 2021 Australian dollars by Indigenous status. For First Nations households, Australia: $830 in 2021 and $701 in 2016. For Other households, Australia: $1,080 in 2021 and $969 in 2016. Additional views are available presenting median weekly household income by state/territory, per cent of households with income $1,000 or more per week, and weekly equivalised household income quintiles.

Source: ABS 2016, 2019, 2021a, 2021d, 2022b, 2023.

Income distribution

In 2021:

- 35% of First Nations people had equivalised weekly household incomes in the bottom 20% of the household income distribution for all Australians aged 15 and over, a reduction from 37% in 2016. (Note: the quintiles have been calculated based on the equivalised weekly household income across all Australian households.)

- 9.5% of First Nations people had weekly equivalised household incomes in the top 20% of the household income distribution for all Australians aged 15 and over. The proportion has not changed much since 2016 (9.1%).

- The proportion of First Nations people in the middle 60% of the weekly equivalised household income distribution was 55%, a slight increase from 54% in 2016.

Personal income

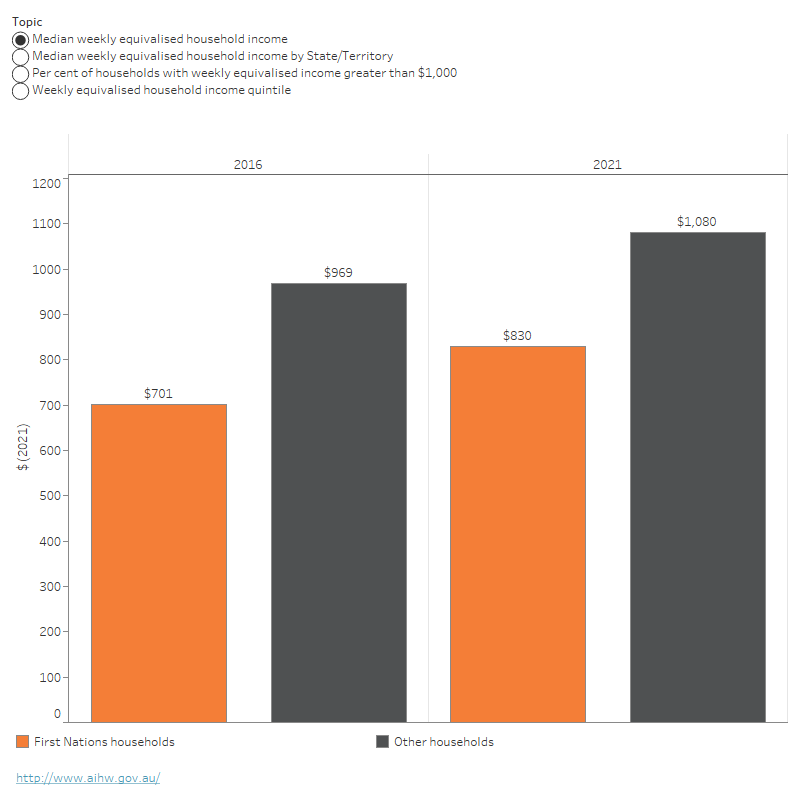

Figure 2 shows inflation-adjusted median weekly personal income for First Nations people aged 15 and over in 2016 and 2021.

For First Nations people aged 15 and over in 2021:

- median gross personal income was $540 per week. This was an increase from $482 per week in 2016 after adjusting for inflation

- median personal income between 2016 and 2021 grew at a faster rate (12%) than for all Australians aged 15 and over (11%)

- 28% had a gross weekly personal income of $1,000 or more, an increase from 20% in 2016

- First Nations males (32%) were more likely to have a weekly personal income of $1,000 or more compared with First Nations females (23%). The proportion was lower for both First Nations males (24%) and First Nations females (15%) in 2016.

Figure 2: Weekly personal income by sex and Indigenous status, 2016 and 2021

This visualisation shows the median weekly personal income in 2021 Australian dollars by Indigenous status at the individual level and by sex. For First Nations people, Australia: $540 in 2021 and $482 in 2016. For all Australians, Australia: $805 in 2021 and $724 in 2016. Additional views are available presenting median weekly personal income and income category for First Nations males and females.

Source: ABS 2016, 2019, 2021a, 2021d, 2022b, 2023.

Income support payments and COVID-19

Australia’s social security system, administered by Services Australia, aims to financially support people who cannot, or cannot fully, support themselves, by providing targeted payments and assistance. Where this is a regular payment that helps with the everyday costs of living it is referred to as an income support payment, with the type of payment often reflecting life circumstances at the time of receipt. Individuals can receive only one income support payment at a time.

About Government income support payments data

On this page, the information on income support payments for First Nations people is sourced from the DSS Benefit and Payment Recipient Demographics – quarterly data for different periods between June quarter 2016 and June quarter 2022. The latest data was available up until December quarter 2022. However, June quarter data is used to avoid potential seasonality in some of the payments. The population estimates for First Nations people and total populations are based on 2016 and 2021 Census based projections of the estimated resident population by single year of age (ABS 2022a). On this page, ‘recipients of income support payments’ refer to those who had received any of the following groups of payment type/s:

- Age Pension

- student payments that include ABSTUDY (Living Allowance), Austudy, and Youth Allowance (student and apprentice)

- disability-related payments that include Disability Support Pension and Carer Payment

- unemployment payments that include Newstart Allowance (closed 20 March 2020) or Jobseeker Payment (from 20 March 2020), and Youth Allowance (other)

- parenting payments that include Parenting Payment Partnered and Parenting Payment Single

- Special Benefit that is for those who are not eligible for any other income support.

For some years, the recipients of Bereavement Allowance, Sickness Allowance and payments that are closed to new recipients but still paid to existing recipients (including Partner and Widow Allowance to January 2022, Wife Pension (Partner on Age Pension or Partner on Disability Support Pension) to March 2020) were also included in the total number of income support payment recipients.

DSS does not publish numbers of recipients aged under 16 years separately for First Nations people and Other Australians. However, the number of recipients under 16 years were small (a total of 600 on any income support payment for First Nations people and a total of 1,300 on any income support payment for all Australians in the June quarter 2022).

To ensure consistency with previous reporting of First Nations recipients of income support payments, this page reports the total number of all First Nations recipients in all ages (including those aged under 16 years). However, in computing the proportion of income support recipients in the population, by Indigenous status, the numerator still includes recipients of all ages, but the denominator includes only the estimated reference population aged 16 and over. This proportion is very close to the true proportion of First Nations people aged 16 and over who are on income support payments because of the very small numbers of recipients aged under 16 years.

For detailed definitions, descriptions of income support payments and more information, see:

- Unemployment payments

- Parenting payments

- Disability Support Pension

- Carer Payment

- Income support for older Australians

- A guide to Australian Government payments

- glossary.

Data qualification

Indigenous status identification in Services Australia (Centrelink) and population data is voluntary and self-identified. This may influence the quality and completeness of the data and subsequent reporting on the number and proportion of First Nations people receiving income support payments, especially among older First Nations people.

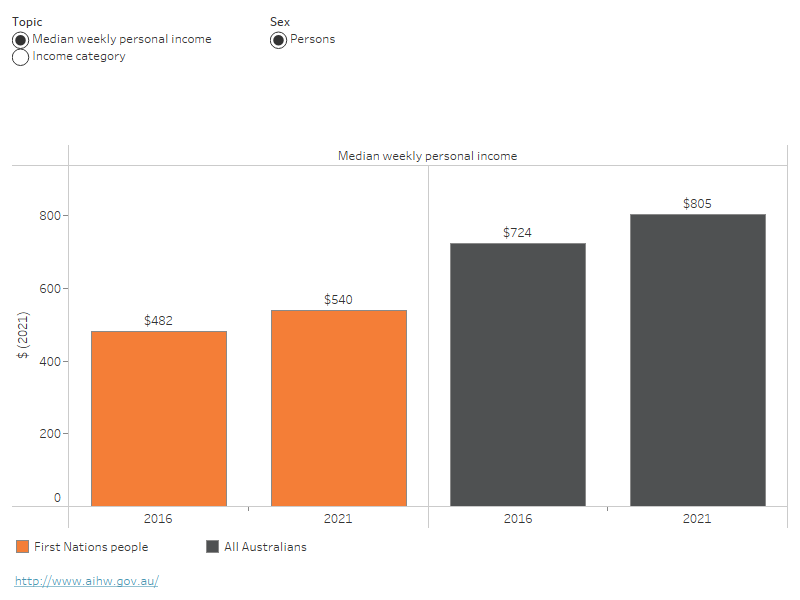

Figure 3: Number and proportion of income support payment recipients by payment type and Indigenous status, June 2016 to June 2022 quarters

This visualisation shows the proportion of reference population (i.e., those in the eligible age range for each payment) receiving income support payments by payment type and Indigenous status in June 2022. For First Nations people, Age Pension: 51%, Total: 48%, JobSeeker Payment: 23%, Youth Allowance (other): 14%, Disability Support Pension: 11%, Youth Allowance (student and apprentice): 1.5%, Parenting Payment Single: 7.7%, Carer Payment: 3.6%, Parenting Payment Partnered: 1.4%, ABSTUDY (Living Allowance): 1.8%. For other Australians, Age Pension: 58%, Total: 24%, JobSeeker Payment: 5.1%, Youth Allowance (other): 2.1%, Disability Support Pension: 4.4%, Youth Allowance (student and apprentice): 6.4%, Parenting Payment Single: 1.2%, Carer Payment: 1.8%, Parenting Payment Partnered: 0.4%. Additional views are available presenting the proportions of reference population receiving income support payments, the number and proportion of First Nations people in total recipients for the June 2016–June 2022 quarters.

Sources: ABS 2019, 2021a, 2022a; AIHW 2021a; DSS 2016, 2017, 2018, 2019, 2020a, 2020b, 2020c, 2021a, 2021b, 2021c, 2021d, 2022.

Figure 3 presents several related aspects of income support payments for First Nations people between the June 2016 and June 2022 quarters.

As at 24 June 2022, a total of 285,600 First Nations people received income support payments, equating to an estimated 48% of the total population of First Nations people aged 16 years and over. Out of 285,600 First Nations people who received income support payments:

- 35% (100,900) were recipients of Jobseeker Payment

- 20% (57,200) were recipients of Disability Support Pension

- 15% (41,600) were recipients of Parenting Payment Single

- 8.9% (25,500) were recipients of Age Pension

- 7.4% (21,200) were recipients of Youth Allowance (other)

- 6.8% (19,400) were recipients of Carer Payment

- the remaining (6.9%) were recipients of ABSTUDY (Living Allowance), Austudy, Parenting Payment Partnered, Youth Allowance (student and apprentice) and Special Benefit.

In June 2022, about 5.6% of all income support payment recipients in Australia were First Nations people in the Services Australia administrative records. This compares with the estimated 2.8% share of First Nations people aged 16 years and over in the total Australian population aged 16 years and over.

The equivalent proportion of First Nations recipients of income support payments in all income support payment recipients in Australia by specific payment types were:

- 27% in Youth Allowance (other)

- 18% in Parenting Payment Single

- 12% in JobSeeker Payment

- 11% in Parenting Payment Partnered

- 7.5% in Disability Support Pension

- 6.4% in Carer Payment

- 1.3% in Youth Allowance (student and apprentice)

- 1.0% in Age Pension.

First Nations people are over-represented in being recipients of certain payment types, such as Youth Allowance (other), Parenting Payment Single and Jobseeker Payment (where the percentages reported above are considerably higher than the proportion of First Nations people in the relevant total population age-groups).

Since the COVID-19 pandemic began in Australia in early 2020, the Australian Government has made considerable changes to policies and eligibility for income support payments. In late March 2020 short-term policy changes were made to the JobSeeker Payment (such as waiving the assets tests, waiting periods, and mutual obligation requirements) in response to the COVID-19 pandemic. The changes that resulted in relaxing the eligibility criteria for specific income support payments, such as JobSeeker Payment, as well as the general decline in economic activity in the context of lockdowns and other business-related restrictions, led to an increase in the number of income support payment recipients among both First Nations people and non-Indigenous Australians (see Box 4.1 in 'Chapter 4 The impacts of COVID-19 on employment and income support in Australia' in Australia’s welfare 2021: data insights for further details).

This is reflected in the increasing number of First Nations recipients of income support payments in the periods indicated below:

- 10,700 (or 4.3% more) First Nations recipients were added between the December 2019 and March 2020 quarters.

- An additional 36,000 First Nations people received income support payments between March and June 2020. This was a 14% increase.

- In June 2020 the number of First Nations recipients of income support payments as a proportion of the total population of First Nations people aged 16 and over increased to 53%, compared to 47% in March 2020.

- There was a further increase of 4,100 First Nations people on income support between June and December 2020 (a 1.4% increase).

- The total number of First Nations people on income support peaked at 299,600 in December 2020; however, expressed as the proportion of the total population of First Nations people aged 16 and over who were income support recipients, the peak of 53% persisted from the June 2020 to December 2020 quarters.

- As the short-term changes to the JobSeeker Payment and Coronavirus Supplement ended on the 31 March 2021, the number of First Nations recipients of income support payments fell by 3.2% between December 2020 and March 2021.

Figure 3 compares the number and proportion of First Nations recipients of income support payments in June 2021 and June 2022. Both datasets should be relatively unaffected by the short-term responses to COVID-19 which ended in March 2021, though the June 2021 data may be affected more than the data for June 2022.

The data show that between June 2021 and June 2022:

- The total number of First Nations recipients of income support payments increased by 1.4%.

- The proportion of First Nations recipients in the population of First Nations people aged 16 years and over decreased from 49% to 48%. This is consistent with the patterns for Other Australians recipients for whom the proportion also fell, from 25% to 24%.

- The proportion of First Nations recipients among all income support payment recipients in the Australian population increased from 5.3% to 5.6%.

- The number of First Nations people receiving specific income support payments increased by 6.1% for Disability Support Pension, 5.7% for Carer Payment, 5.1% for Parenting Payment Single, 3.2% for Age Pension and 1.1% for JobSeeker Payment.

- The number of First Nations recipients declined for several payment types: by 13% for Youth Allowance (student and apprentice), 9.9% for Parenting Payment Partnered and 9.7% for Youth Allowance (other).

Financial stress

The higher the level of financial stress on a household, the lower its ability to cope when faced with unexpected shocks that lead to a fall in income or rise in expenditure. Financial stress is a complex area and may differ from household to household. However, some common aspects of financial stress can be captured by measures of housing stress, security of necessities, and the ability to raise funds in an emergency. Households with lower financial stress are expected to have lower housing stress, higher security of necessities, and are better able to raise funds in an emergency.

An individual’s inability to raise emergency funds and having cash-flow problems are typically used to gauge financial stress and income vulnerability (Breunig and Cobb-Clark 2006; Saunders et al. 2007). Thus, people who are unable to raise emergency funds or are experiencing cash-flow problems can be considered as financially stressed or vulnerable (Breunig et al. 2017; Whiteford 2013).

Expenditure on housing (such as rent payments or mortgage repayments) constitute a major component of a household’s total living costs. Households that spent a high proportion of gross income on housing are more likely to be in financial stress. Housing affordability and financial stress are typically measured by assessing the proportion of a household’s gross income that is spent on housing costs – like rent payments or mortgage repayments (AIHW 2021b; ABS 2021b, 2021c; Thomas and Hall 2016). While rental or mortgage stress may not necessarily indicate that a household is in overall financial stress (ABS 2021b, 2021c), these capture crucial aspects of their financial status.

About financial stress data

Data on First Nations people’s ability to raise emergency funds and experience of cash-flow issues come from the 2018–19 National Aboriginal and Torres Strait Islander Health Survey (NATSIHS) (AIHW 2021a).

To measure housing stress, the Census provides data on the rent affordability indicator (RAID) for rented households and mortgage affordability indicator (MAID) for mortgaged households (see glossary). The data on RAID and MAID for First Nations people reported in this page were supplied through ABS customised reports of Census 2016 and 2021 (ABS 2019, 2023) and supplemented by data derived from the Census TableBuilder.

The ABS computes the rent affordability indicator by dividing rent payments by an imputed household income. A household is often considered under rental stress if it spends more than 30% of household income on rental payments. Similarly, mortgage stress for mortgaged households is measured through the mortgage affordability indicator, calculated by dividing mortgage repayments by an imputed household income. A household is often considered under mortgage stress if mortgaged repayments are more than 30% of household income.

The data presented on this page exclude households that were unable to determine the proportion of household income as rent payments or mortgaged repayments. The tabulations on this page are in reference to either First Nations households or First Nations people aged 15 years and over.

AIHW (2021a) shows that the proportion of financially stressed First Nations people aged 15 and over had increased between 2014–15 and 2018–19. In 2018–19:

- over half (53%) of First Nations people aged 15 and over lived in households that could not raise $2,000 within a week for an emergency, an increase from 48% in 2014–15

- 39% of First Nations people aged 15 and over had reported that their household had days without money for basic living expenses in the last 12 months, compared with 28% in 2014–15 (AIHW 2021a).

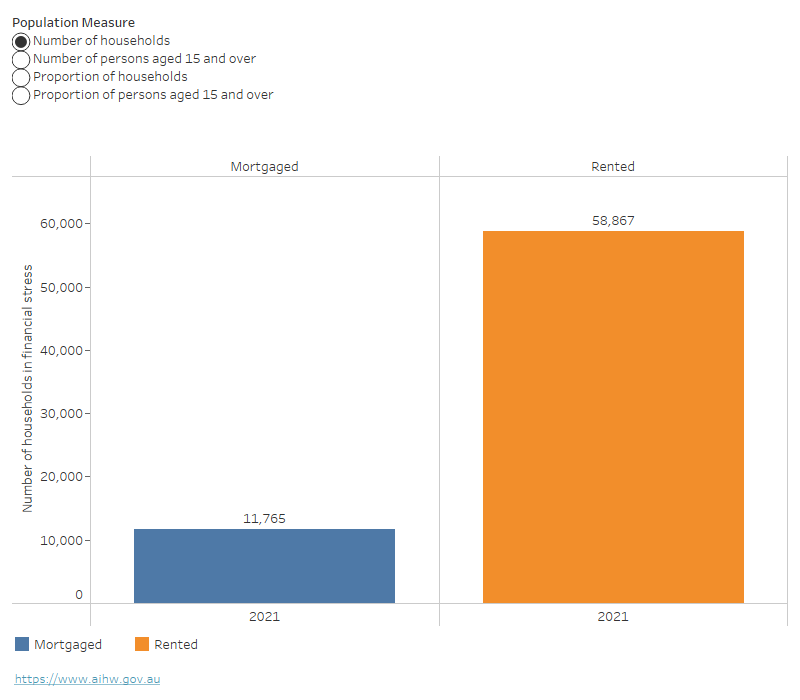

Figure 4 shows that in 2021:

- 35% (58,900) of rented and 14% (11,800) of mortgaged First Nations households reported to have more than 30% of household income as rent payments (for rented households) or mortgage repayments (for mortgaged households)

- 27% (65,400) of First Nations people aged 15 years and over had rent payments more than 30% of their household income. This was a decrease from 30% (54,900) in 2016

- 12% (13,400) of First Nations people aged 15 years and over had mortgage repayments of more than 30% of their household income, a reduction from 18% (14,100) in 2016.

Figure 4: Number and proportion of First Nations households and people aged 15 and over in financial stress by tenure type, 2016 and 2021

This visualisation shows the proportion of First Nations persons aged 15 years and over in households that paid more than 30% of their household income as rent payment (if rented) or mortgage repayments (if mortgaged) in 2021 and 2016. For First Nations people aged 15 years and over in rented households: 27% in 2021 and 30% in 2016. For First Nations people aged 15 years and over in mortgaged households: 12% in 2021 and 18% in 2016.

Notes

- Financial stress is measured through household’s mortgage repayments exceeding 30% of household income (mortgage stress) and rent payments exceeding 30% of household income (rental stress).

- Data on number and proportion of households with mortgage and rental stress in Census TableBuilder is available for 2021 only.

- Data for the number and proportion of persons aged 15 years and over in the households with rental or mortgage stress are available for 2016 and 2021 through ABS 2023 Customised report.

Sources: ABS 2016, 2019, 2021a, 2023.

Where do I go for more information?

For further information on the income and finance of First Nations people, see:

- ABS Estimates of Aboriginal and Torres Strait Islander Australians, June 2021

- ABS Census of Population and Housing: Characteristics of Aboriginal and Torres Strait Islander Australians, 2016

- ABS Census of Population and Housing: Characteristics of Aboriginal and Torres Strait Islander Australians, 2021

- Services Australia A guide to Australian Government payments

- ABS National Aboriginal and Torres Strait Islander Health Survey 2018–19

- Productivity Commission Overcoming Indigenous disadvantage: key indicators 2020.

See also First Nations people.

ABS (Australian Bureau of Statistics) (2016) AIHW analysis of Census of Population and Housing, 2016 TableBuilder, accessed 14 February 2023.

ABS (2019) Census of Population and Housing 2016 and 2011 Customised Report, ABS, Australian Government, accessed 23 May 2023.

ABS (2021a) AIHW analysis of Census of Population and Housing, 2021TableBuilder, accessed 14 February 2023.

ABS (2021b) Rent affordability indicator (RAID), ABS, Australian Government, accessed 14 February 2023.

ABS (2021c) Mortgage affordability indicator (MAID), ABS, Australian Government, accessed 14 February 2023.

ABS (2021d) Aboriginal and Torres Strait Islander people: Census, ABS, Australian Government, accessed 14 February 2023.

ABS (2022a) National, state and territory population June 2022, ABS, Australian Government, accessed 14 February 2023.

ABS (2022b) Consumer Price Index, Australia, TABLES 1 and 2. CPI: All Groups, Index Numbers and Percentage Changes, ABS, Australian Government, accessed 14 February 2023.

ABS (2023) Census of Population and Housing 2021 and 2016 Customised Report, ABS, Australian Government, accessed 23 May 2023.

AIHW (Australian Institute of Health and Welfare) (2021a) Indigenous income and finance, AIHW, Australian Government, accessed 14 February 2023.

AIHW (2021b) Housing affordability, AIHW, Australian Government, accessed 14 February 2023.

Braveman P, Egerter S and Williams DR (2011) The social determinants of health: coming of age, Annual Review of Public Health 32:381–98, accessed 14 February 2023.

Breunig R and Cobb-Clark D (2006) Understanding the factors associated with financial stress in Australian households, Australian Social Policy, 2005, 13–64. Canberra: Australian National University, accessed 14 February 2023.

Breunig R, Hasan S and Hunter B (2017) Financial stress and Indigenous Australians, Bonn, Germany, IZA Institute of Labor Economics, accessed 14 February 2023.

DSS (Department of Social Services) (2016) DSS demographics - June 2016, DSS, Australian Government, accessed 14 February 2023.

DSS (2017) DSS demographics - June 2017, DSS, Australian Government, accessed 12 May 2023.

DSS (2018) DSS demographics - June 2018, DSS, Australian Government, accessed 14 February 2023.

DSS (2019) DSS demographics - June 2019, DSS, Australian Government, accessed 14 February 2023.

DSS (2020a) DSS demographics - December 2019, DSS, Australian Government, accessed 14 February 2023.

DSS (2020b) DSS demographics - March 2020, DSS, Australian Government, accessed 12 May 2023.

DSS (2020c) DSS demographics – June 2020, DSS, Australian Government, accessed 14 February 2023.

DSS (2021a) DSS demographics - September 2020, DSS, Australian Government, accessed 12 May 2023.

DSS (2021b) DSS demographics - December 2020, DSS, Australian Government, accessed 14 February 2023.

DSS (2021c) DSS demographics - March 2021, DSS, Australian Government, accessed 12 May 2023.

DSS (2021d) DSS demographics - June 2021, DSS, Australian Government, accessed 14 February 2023.

DSS (2022) DSS demographics - June 2022, DSS, Australian Government, accessed 14 February 2023.

Finkelstein DM, Harding JF, Paulsell D, English B, Hijjawi GR and Ng'andu J (2022) Economic Well-Being And Health: The Role Of Income Support Programs In Promoting Health And Advancing Health Equity, Health Aff (Millwood). 2022 Dec;41(12):1700-1706. doi: 10.1377/hlthaff.2022.00846. PMID: 36469819, accessed 14 February 2023.

Kiely KM, Leach LS, Olesen SC and Butterworth P (2015) How financial hardship is associated with the onset of mental health problems over time, Soc Psychiatry Psychiatr Epidemiol; 50: 909–18, accessed 14 February 2023.

Mackenbach JP (2015) Socioeconomic inequalities in health in high-income countries: the facts and the options. In: Detels R, Gulliford M, Karim QA and Tan CC (eds). Oxford textbook of global public health, Oxford University Press.

Mackenbach JP (2020) Re-thinking health inequalities, Eur J Public Health 2020; 30: 615.

Marmot M and Wilkinson RG (2001) Psychosocial and material pathways in the relation between income and health: a response to Lynch et al, BMJ; 322: 1233–36, accessed 14 February 2023.

Marmot M (2002) The influence of income on health: views of an epidemiologist, Health Aff (Millwood), 21(2):31–46, accessed 14 February 2023.

Saunders P, Naidoo Y and Griffiths M (2007) Towards new indicators of Disadvantage: Deprivation and social exclusion in Australia, Social Policy Research Centre, accessed 14 February 2023.

Subramanian SV, Belli P and Kawachi I (2002) The macroeconomic determinants of health, Annu Rev Public Health; 23: 287–302, accessed 14 February 2023.

Thomas M and Hall A (2016) Housing affordability in Australia- external site opens in new window, Parliament of Australia, accessed 14 February 2023.

Whiteford P (2013) Australia: inequality and prosperity and their impacts in a radical welfare state, Australian National University, accessed 14 February 2023.