Income support

Disability Support Pension receipt

645,000 people aged 16–64, or 29% of all income support payment recipients in that age group received the Disability Support Pension (DSP) in March 2023.

DSP recipients in the Australian population

In June 2022, 3.9% of people aged 16–64 received DSP, including 10% of First Nations people.

Duration on DSP

At June 2023, 3 in 4 (76%) DSP recipients aged 16–64 had received it for at least 5 years, and 3 in 5 (60%) for 10 or more years.

On this page:

Introduction

People with disability may receive financial assistance to help with activities of daily life. This section looks at income support payments for people with disability, focusing on those aged 16–64 receiving the DSP. The DSP is the main income support payment available specifically to people with disability.

Disability Support Pension

The Disability Support Pension (DSP) is a means-tested income support payment which assists recipients to meet the everyday costs of living. It can be accessed by people who are aged 16 and over but under Age Pension age (at claim) and who have reduced capacity to work because of their disability.

This includes those who:

- are permanently blind

- have a physical, intellectual or psychiatric condition resulting in functional impairment making the person unable to work for 15 hours or more per week for the next 2 years due to their disability or medical condition

- are unable, as a result of impairment, to undertake a training activity which would equip them for work within the next 2 years.

DSP recipients are encouraged to participate in employment where they have the capacity to, and can gain from the benefits of working, including improved wellbeing.

DSP is administered through Services Australia. For more information see DSP – Qualification & Payability, Disability Support Pension – Participation Requirements, and Disability Support Pension.

While this section focuses on DSP, people with disability may also be eligible for other payments, allowances or supplements, such as Mobility Allowance, government concession cards (which discounts selected goods and services), and more general financial support (such as to assist with study, housing or finding work). For analysis of government payments received by people with disability, see also ‘Government payments’.

Other financial assistance for people with disability

Mobility Allowance

The Mobility Allowance helps with transport costs for people aged 16 and over who have disability, illness or injury, who cannot use public transport without substantial assistance, and who are participating in approved activities (such as studying, training, working, or looking for work).

With the roll-out of the National Disability Insurance Scheme (NDIS), people who receive funded supports from the NDIS are no longer eligible for the Mobility Allowance. At June 2023 around 11,030 people received the Mobility Allowance – compared with 13,500 at June 2020, 33,475 at June 2018, and 60,050 at June 2016 (DSS 2023a).

Supporting carers of people with disability

Financial support for people caring for people with disability is available through the following payments:

- Carer Payment – income support payment for people who, due to caring responsibilities, are unable to support themselves through substantial paid employment

- Carer Allowance – supplementary payment for people who provide daily care and attention at home to a person with disability, a severe medical condition or who is frail and aged

- Carer Supplement – an annual payment for carers in receipt of Carer Allowance and/or Carer Payment

- Child Disability Assistance Payment – an annual payment for those receiving Carer Allowance for a child.

At June 2023, around:

- 305,000 carers received Carer Payment for a total of 302,000 care recipients (including 45,200 children aged under 16, 129,000 people aged 16–64, and 128,000 people aged 65 and over)

- 634,000 carers received Carer Allowance for a total of 697,000 care recipients (including 192,000 children aged under 16, 231,000 people aged 16–64, and 274,000 people aged 65 and over)

- 660,000 carers received Carer Supplement

- 168,000 carers received Child Disability Assistance Payment (DSS 2023b, DSS 2023c).

Data note

Disability Support Pension (DSP) data in this section are largely sourced from unpublished data provided by the Department of Social Services (DSS) based on Services Australia administrative data (DSS 2023a). At the time of data provision, March 2023 data was the most recent available. At the time of writing this report, June 2023 data (DSS 2023b) became publicly available, however these data did not cover all the sub-groups used in this report.

The population benchmarks used in this section are drawn from the Australian Bureau of Statistics (ABS) population estimates (ABS 2019, ABS 2023). At the time of writing, the latest available population estimates for the sub-groups used in this report were for June 2022.

Therefore, this page uses June 2023 data where available, while some information is reported as at March 2023 or June 2022, as appropriate.

DSP data are point-in-time at last Friday of the relevant month.

The size of the DSP population

Around 769,000 people aged 16 and over received the DSP at March 2023. Of these, the vast majority (84%, or 645,000) were aged 16–64 (DSS 2023a).

The DSP is one of Australia’s most prevalent income support payments for people of working age, the second largest payment type for this age group after unemployment benefits (DSS 2023a). In March 2023, DSP recipients accounted for nearly 3 in 10 (29%) of all income support payment recipients aged 16–64 (DSS 2023a).

About 1 in 25 Australians receive DSP: in June 2022, 3.7% of Australian population aged 16 and over was in receipt of DSP, as were 3.9% of people aged 16–64 (DSS 2023a, ABS 2023).

DSP recipients aged 65 and over

While this report mainly focuses on DSP recipients aged 16–64, about 1 in 6 (16%, or 125,000) DSP recipients are aged 65 and over (at March 2023). The numbers of men and women aged 65 and over receiving DSP are similar (60,700 and 64,000, respectively), and the majority (67%, or 83,700) of those aged 65 and over receiving DSP are aged 65–69 (DSS 2023a, AIHW 2023a).

The number of DSP recipients aged 65 and over has increased over the past 2 decades – from less than 0.1% of the population in this age group (or 2,900) in 2001 to 0.6% (or 16,500) in 2010, 1.3% (or 46,600) in 2016, and 2.7% (or 125,000) in 2022 (ABS 2023, DSS 2023a). This is due to the increase in the qualifying age for the Age Pension, which was gradually raised from 60 to 65 years for women between 1995 and 2013, and then to 67 years for both men and women by 2023. In addition, DSP recipients who qualify for the Age Pension may choose to remain on DSP.

Changes over time in DSP

Changes over time in DSP can be seen in overall numbers and as a proportion of:

- the Australian population

- income support recipients.

Key changes to income support eligibility that affect DSP

Between 2000 and 2023, the social security system has undergone significant reforms likely to influence trends in income support payments and recipients.

Key changes likely to influence DSP trends include:

- Eligibility criteria for DSP have tightened over recent years – for example, starting from 2006, the eligibility for DSP was restricted to people who were unable to work at least 15 hours per week, a decrease from at least 30 hours previously. A new category for the unemployment payment (Newstart Allowance, replaced by JobSeeker Payment in March 2020) was created for people with work capacity of less than 30 hours a week – Newstart Partial Capacity to Work. In 2012, significantly revised impairment tables were introduced.

- Age Pension – the qualifying age for the Age Pension for women gradually increased from 60 in 1995 to 65 in 2013, the same qualifying age as for men. From 1 July 2017, the pension qualifying age for both men and women was gradually raised again, reaching 67 in 2023.

- Closure of income support payments – various payments were closed to new recipients and/or stopped, with eligible recipients transferred to relevant existing payments (including Age Pension and JobSeeker Payment).

DSP and Newstart Allowance/JobSeeker Payment

Around 770,000 people received the DSP in June 2023 and around 808,000 received the JobSeeker Payment (DSS 2023b). Historically, the DSP was one of the fastest-growing government social assistance programs. Policy changes over the last decade, including the 2012 compliance and assessment measures, seem to have slowed this growth. These changes were followed by a fall in the number of new DSP applicants who were granted payment from 63% in 2001–02 to 43% from 2011–12 to 2014–15 (PBO 2018).

In parallel, the proportion of Newstart Allowance (JobSeeker Payment from March 2020) recipients assessed as having partial capacity to work steadily increased from 26% (or 181,000) in June 2014 to 42% (or 289,000) in June 2019. In June 2020, the number of recipients with partial capacity to work continued to increase (reaching 366,000), but their proportion in the total number of recipients dropped to 25%, most likely due to the impact of COVID-19 on the total number of recipients. After 2020, the number of recipients with partial capacity slightly declined but the proportion in the total number of recipients increased to its pre-COVID levels (44%, or 352,000 in June 2023) (DSS 2023b).

Numbers of recipients

Overall, the number of DSP recipients aged 16–64 grew by 3.7% from 2001 to 2022 (June). From about 623,000 in 2001 the number reached a peak of around 802,000 in 2012 (29% increase), then steadily declined to 646,000 in 2022 (19% decrease between 2012 and 2022).

This trend varied by sex, with a much more pronounced growth in the number of female DSP recipients between 2001 and 2012 compared with males. Between 2001 and 2022:

- the number of female DSP recipients

- increased by 60% from 232,000 in 2001 to 373,000 in 2012

- decreased by 20% from 373,000 in 2012 to 297,000 in 2022

- the number of male DSP recipients

- increased by 9.8% from 391,000 in 2001 to 429,000 in 2012

- decreased by 19% from 429,000 in 2012 to 349,000 in 2022

The trend also varied by age (faster pre-2012 growth in the 16–24 age group). For example:

- the number of DSP recipients aged 16–24

- increased by 41% from 39,600 in 2001 to 55,900 in 2014

- decreased by 11% from 55,900 in 2014 to 49,700 in 2022

- the number of DSP recipients aged 25–49

- increased by 24% from 247,000 in 2001 to 307,000 in 2012

- decreased by 19% from 307,000 in 2012 to 249,000 in 2022

- the number of DSP recipients aged 50–64

- increased by 31% from 336,000 in 2001 to 440,000 in 2012

- decreased by 21% from 440,000 in 2012 to 347,000 in 2022.

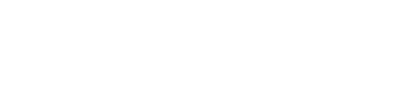

Proportion of the Australian population

While the number of the DSP recipients increased between 2001 and 2022 (June), the proportion of DSP recipients in the Australian population aged 16–64 remained relatively stable over this period, fluctuating between 4.9% (or 623,000) in 2001 and 5.4% (or 802,000) in 2012 and then decreasing to 3.9% (or 646,000) in 2022 (DSS 2023a).

This trend differs for males and females:

- The proportion of males aged 16–64 receiving DSP steadily declined from 6.2% (or 391,000) in 2001 to 4.2% (349,000) in 2022.

- The proportion of females aged 16–64 receiving DSP

- increased from 3.7% (or 232,000) in 2001 to 5.0% (or 373,000) in 2012

- decreased to 3.6% (or 297,000) in 2022 (Figure SUPPORT.1).

These declines are likely largely a result of changes in eligibility for DSP over this period. Further, the large increases in the number of female DSP recipients coincided with increases in the qualifying age for the Age Pension, and closure of some payments.

Figure SUPPORT.1: Proportion of population aged 16–64 receiving DSP, by year and sex, 2001–2022

The chart shows the difference in the proportion of males receiving DSP compared with the proportion of females has decreased from 2001 to 2022.

Notes:

- Percentages have been calculated using the estimated Australian population in that year, derived from ABS population data as the denominator.

- DSP data as at 24 June 2022.

- Data may differ from official statistics on income support payments and recipients, due to differences in methodology and/or data source.

Source data tables: Data tables – Income support. View data tables

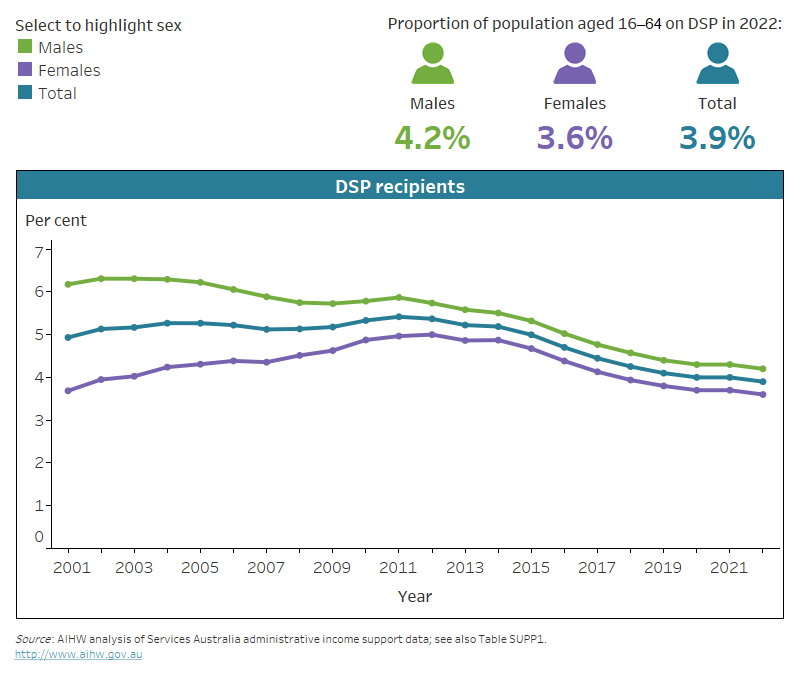

Proportion of the income support population

Between 2001 and 2019 there was an overall increase in the proportion of income support recipients aged 16–64 receiving DSP – from 23% (or 623,000) in 2001 to a peak of 32% (or 802,000) in 2012, declining to 30% (or 668,000) in 2019. In 2020, the proportion of DSP recipients dropped to 21% (or 660,000), mainly because of an increase in the number of recipients of other income support payments caused by the impacts of COVID-19. After 2020, the proportion of DSP recipients in the income support population aged 16–64 gradually increased, almost reaching the pre-COVID level in 2023 (29% or 645,000 in March 2023) (DSS 2023a).

The female income support recipients aged 16–64 are less likely to receive DSP than males (Figure SUPPORT.2), however, consistent with the increase in numbers of female DSP recipients between 2001 and 2012, the proportion of DSP recipients in the total income support population aged 16–64 has increased at a faster rate for females than males:

- The proportion of female income support recipients on DSP almost doubled between 2001 and 2012, rising from 14% (or 232,000) in 2001 to 26% (or 373,000) in 2012. It dropped to 18% (or 305,000) in 2020 before increasing to 23% (or 296,000) in 2023.

- The proportion of male income support recipients on DSP increased between 2001 and 2008, from 34% (or 391,000) in 2001 to 45% (or 405,000) in 2008. By 2019, this declined to 39% (358,000), dropping to 25% (or 355,000) in 2020 and then increasing to 36% (348,000) in March 2023 (Figure SUPPORT.2).

The rapid growth in female income support recipients receiving DSP from 2001 to 2014 was largely driven by the mature age population (aged 50–64), with the proportion of females on income support receiving DSP more than doubling in this age group from 22% (or 117,000) in 2001 to 48% (or 218,000) in 2014, before falling to 40% (or 170,000) in March 2023. This compares with a smaller increase for males aged 50–64, from 62% (or 220,000) in 2001 to 71% (or 220,000) in 2008, followed by a sizeable decrease to 51% (or 174,000) in 2023.

These differing rates of change have resulted in the gender gap for the 50–64 age group converging over the last 22 years. In 2001, the proportion of male income support recipients aged 50–64 receiving DSP was almost 3 times that for females, but by 2023, it fell to 1.3 times as high (Figure SUPPORT.2).

These trends are largely influenced by the consolidation of payments provided to those of mature age. This has particularly affected females and it coincided with decreasing proportions receiving the Age Pension and payments closed to new entrants.

Figure SUPPORT.2: Proportion of income support population aged 16–64 receiving DSP, by sex and age group, 2001–2023

The chart shows the proportions of people receiving DSP out of the income support population have dropped from 30% in 2019 to 21% in 2020.

Notes:

- Data for 2023 are as at 31 March 2023.

- Data may differ from official statistics on income support payments and recipients, due to differences in methodology and/or data source.

Source data tables: Data tables – Income support. View data tables

Changes to income support payments due to COVID-19

In 2020, the Australian government introduced several temporary changes to JobSeeker Payment and Youth Allowance (Other) in response to COVID-19. These included:

- expanded eligibility for JobSeeker Payment and Youth Allowance (other) to assist people who have lost their job, whose income has reduced as a result of COVID-19, or who needed to care for someone affected by COVID-19

- waiving the assets test and some waiting periods, and making the partner income test more generous (Parliamentary Library 2020).

Most of these changes applied from March to September 2020.

Between March 2020 and June 2020, the number of people receiving JobSeeker Payment increased by 82%, from 793,000 to 1.4 million. In the same period, the number of people receiving Youth Allowance (other) increased by 85% from 93,400 to 173,000. By June 2022, the numbers of recipients of these 2 payments had fallen to 832,000 for JobSeeker Payment and 77,200 for Youth Allowance (other) (DSS 2023b).

The large increase in 2020 in the total income support payment population due to COVID-19 affects the proportion of the income support population who receive DSP.

Note: JobSeeker Payment replaced Newstart Allowance, from March 2020, as the main income support payment for recipients aged between 22 and Age Pension qualification age who have capacity to work. Youth Allowance (other) is an income support payment for people aged 16–21 who are looking for work or temporarily unable to work.

Characteristics of DSP recipients

This section examines the demographic characteristics and income support attributes of DSP recipients aged 16–64.

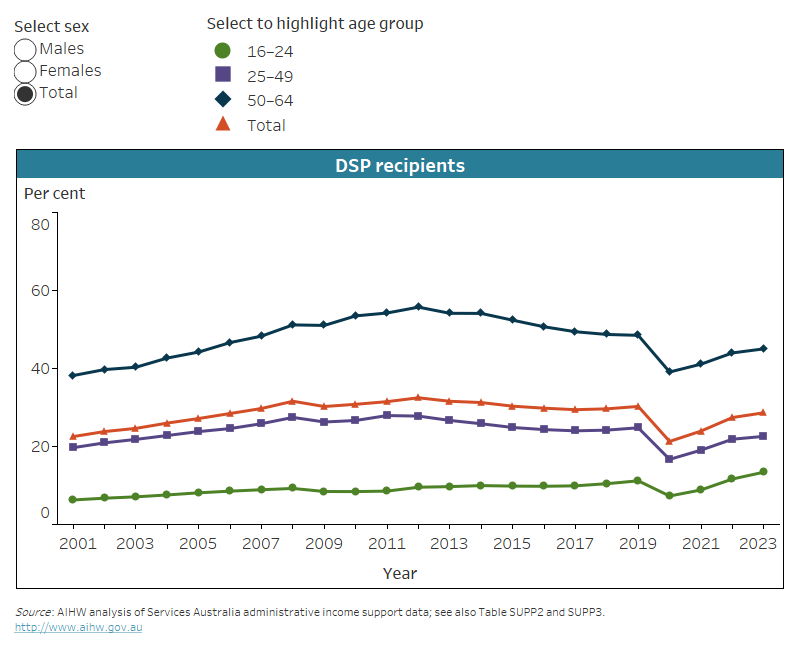

Demographic characteristics

Males are more likely to receive DSP than females, and so are people in the older age groups in comparison with those who are younger. In June 2022, 4.3% of all males in Australia aged 16–64 were receiving DSP (or 355,000 people), compared with 3.7% (or 305,000) of females. In terms of age groups, 7.8% (or 356,000) of people aged 50–64 received DSP, compared with 2.9% (or 256,000) of those aged 25–49 and 1.6% (or 47,800) of those aged 16–24 (DSS 2023a).

Looking at the age breakdown of the DSP recipients aged 16–64, more than half are aged 50–64 (at March 2023):

- 53% (or 344,000) are aged 50–64

- 39% (or 249,000) are aged 25–49

- 8.0% (or 51,600) are aged 16–24 (Figure SUPPORT.3, DSS 2023a).

Female DSP recipients are more likely to be in the older age group than males (at March 2023):

- around 3 in 5 (57% or 170,000) female DSP recipients are aged 50–64, compared with 50% (or 174,000) of males

- 36% (or 107,000) of female DSP recipients are aged 25–49, compared with 41% (or 142,000) of males

- 6.5% (or 19,200) of female DSP recipients are aged 16–24, compared with 9.3% (or 32,300) of males (Figure SUPPORT.3).

Eight in 10 (82% or 532,000) DSP recipients aged 16–64 were single (at March 2023):

- 84% (or 292,000) of males

- 81% (or 239,000) of females (Figure SUPPORT.3).

One in 12 (8.7% or 56,000) DSP recipients aged 16–64 in March 2023 were Aboriginal and Torres Strait Islander (First Nations) people (Figure SUPPORT.3). The proportion of First Nations people in the total number of DSP recipients aged 16–64 is about the same for males (8.6% or 30,100) and females (8.8% or 25,900).

The proportion of DSP recipients who are First Nations people (8.7% in March 2023) is higher than the proportion of the First Nations people in the Australian population aged 16–64 (3.3% as at 30 June 2022). First Nations people are more likely to receive DSP than non-Indigenous Australians: in June 2022, 10% (or 54,100) of First Nations people aged 16–64 received DSP, compared with 3.7% (or 592,000) of non-Indigenous Australians.

For more information about income and finance of First Nations Australians, see Income and finance of First Nations people (AIHW 2023b).

Figure SUPPORT.3: Characteristics of DSP recipients aged 16–64, by sex, 31 March 2023

The chart shows female DSP recipients are more likely (57%) to be aged 50–64 than males (50%).

Notes:

- Remoteness data excludes 1,185 females and 1,535 males with missing remoteness information.

- Data may differ from official statistics on income support payments and recipients, due to differences in methodology and/or data source.

Source data tables: Data tables – Income support. View data tables

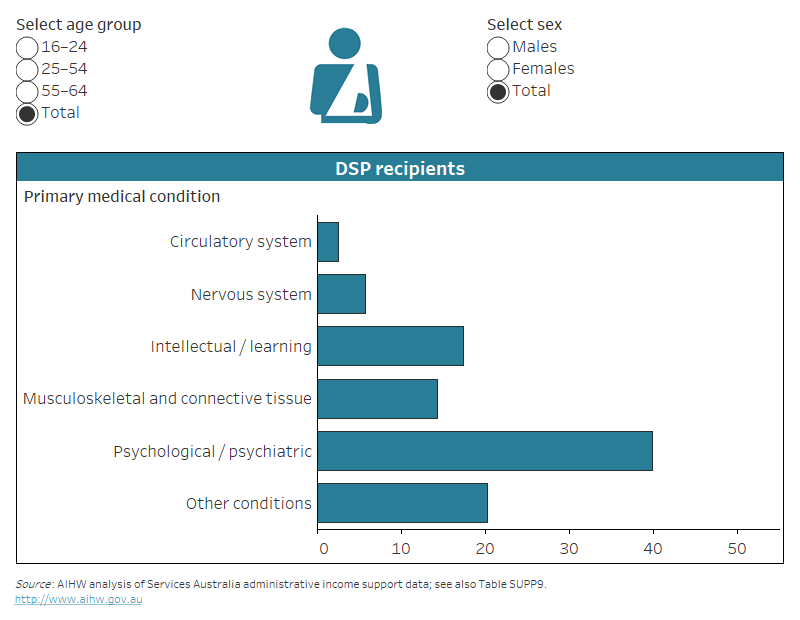

Primary medical condition

The most common primary medical conditions of DSP recipients aged 16–64 at June 2023 were:

- psychological or psychiatric conditions (40% or 257,000)

- intellectual or learning conditions (17% or 112,000)

- musculoskeletal and connective tissue conditions (14% or 92,300) (Figure SUPPORT.4).

What is meant by primary medical condition?

Data on the medical conditions of DSP recipients are recorded by primary medical condition. Twenty-one primary medical condition classification groups each cover a number of individual medical conditions. The medical condition with the highest impairment rating determines under which primary medical condition a recipient is recorded.

Figure SUPPORT.4: Primary medical conditions of DSP recipients aged 16–64, by age group and sex, June 2023

The chart shows people aged 16–24 receiving DSP are more likely to have an intellectual or learning disability (41%) than those aged 55–64 (6.4%).

Notes:

- Data on the medical conditions of DSP recipients is recorded by Primary Medical Condition. There are 21 Primary Medical Condition classification groups that each cover a number of individual medical conditions. The medical condition with the highest impairment rating determines which primary medical condition a recipient is recorded under.

- Data may differ from official statistics on income support payments and recipients, due to differences in methodology and/or data source.

Source data tables: Data tables – Income support. View data tables

The most common primary medical conditions vary by age, with those in the younger age groups more likely to have psychological or psychiatric condition, or intellectual or learning condition recorded as their primary medical condition (Figure SUPPORT.4). For DSP recipients:

- aged 16–24

- 2 in 5 (42% or 21,800) have a psychological or psychiatric condition recorded as their primary medical condition

- 2 in 5 (40% or 21,000) have an intellectual or learning primary condition

- 1 in 21 (4.7% or 2,400) have a condition of the nervous system as their primary condition

- aged 25–54

- 2 in 5 (44% or 151,000) have a psychological or psychiatric primary condition

- 1 in 5 (22% or 74,600) have an intellectual or learning primary condition

- 1 in 11 (8.7% or 29,700) have a musculoskeletal or connective tissue primary condition

- aged 55–64

- 1 in 3 (34% or 84,100) have a psychological or psychiatric primary condition

- 1 in 4 (25% or 62,200) have a musculoskeletal or connective tissue primary condition

- 1 in 16 (6.4% or 16,100) have an intellectual or learning primary condition (Figure SUPPORT.4).

The most common primary medical conditions also show some variations by sex:

- Male DSP recipients aged 16–64 are more likely than females to have an intellectual or learning condition as their primary medical condition (19% or 65,700, compared with 16% or 45,900).

- Male DSP recipients aged 16–64 are more likely to have a psychological or psychiatric primary medical condition than females (41% or 114,000, and 39% or 114,000, respectively). This is especially the case for the 16–24 age group, where 45% (or 14,600) of male recipients have this type of primary condition, compared with 37% (or 7,200) of females. However, in the 55–64 age group males are less likely (32% or 40,200) to have this type of primary condition than females (35% or 43,900) (Figure SUPPORT.4).

Payment rate and earning an income while receiving DSP

The amount of income support payment (also known as payment rate) received by an individual depends on their circumstances, living conditions, income, and assets. Income support recipients are required to report earnings from all sources. Those who have income (such as from work, investments, or superannuation) and/or substantial assets over the threshold amounts may have their benefit payments reduced, resulting in a part‑rate payment.

At March 2023:

- 1 in 8 (12% or 77,600) DSP recipients aged 16–64 received a part-rate payment. This was similar for males (11% or 39,900) and females (11% or 37,700).

- 1 in 12 (8.0% or 51,400) declared earnings. This was similar for males (8.2% or 28,500) and females (7.7% or 51,400) (DSS 2023a).

Duration on DSP and income support

Most DSP recipients stay on the DSP for several years. At March 2023, of DSP recipients aged 16–64:

- more than 3 in 4 (76% or 490,000) had been on DSP for at least 5 years

- 3 in 5 (60% or 387,000) for 10 or more years (DSS 2023a).

People receiving DSP also tend to stay longer on income support in general, in contrast with recipients of other payments for people below the Age Pension age. At June 2023:

- Almost 9 in 10 (86% or 659,500) DSP recipients had been receiving income support for at least 5 years. In comparison, fewer than 2 in 5 (38% or 303,800) JobSeeker recipients had been receiving income support for 5 years or more.

- Around 1 in 10 (11% or 88,400) DSP recipients had been on income support between one and 5 years, compared with 1 in 3 (35% or 284,800) JobSeeker Payment recipients.

- Just 2.9% (or 22,600) of DSP recipients had been receiving income support payments for less than one year, compared with 1 in 4 (27% or 219,400) JobSeeker Payment recipients (DSS 2023b).

Movement of DSP recipients through the income support system

Understanding the movement of Disability Support Pension (DSP) recipients between different payment types and on and off income support provides insights into their income support pathways, exits and entries.

To examine the movement of DSP recipients through the income support system, the AIHW previously undertook analysis of all recipients at June 2009, tracking them through the data to investigate what income support payment (if any) they were receiving 9 years before (in 2000) or 9 years after (in 2018). The results of this analysis are presented in the ‘Income support’ section of the previous version of this report.

Where can I find out more?

- Data tables for this report.

- ABS Disability, Ageing and Carers, Australia: Summary of Findings, 2018.

- This report: ’Income’ of people with disability.

- Income support (including DSP) in Australia’s Welfare 2023.

- Australian Government income support payments – Services Australia, and Department of Social Services.

- DSS payment demographic data.

ABS (Australian Bureau of Statistics) (2019) Estimates and Projections, Aboriginal and Torres Strait Islander Australians, ABS, accessed 24 October 2023.

ABS (2023) National, state and territory population, ABS, accessed 4 October 2023.

AIHW (Australian Institute of Health and Welfare) (2023a) Australia's welfare 2023: Topic summary – Income support for older Australians, AIHW, accessed 13 November 2023.

AIHW (2023b) Australia's welfare 2023: Topic summary – Income and finance of First Nations people, AIHW, accessed 30 October 2023.

DSS (Department of Social Services) (2016) Annual report 2015–16, DSS, Australian Government, accessed 10 November 2023.

DSS (2023a) AIHW customised data request, DSS.

DSS (2023b) DSS Benefit and Payment Recipient Demographics – quarterly data, various, DSS, data.gov.au, Australian Government, accessed 23 October 2023.

DSS (2023c) Annual report 2022–23, DSS, Australian Government, accessed 10 November 2023.

PBO (Parliamentary Budget Office) (2018) Disability Support Pension: historical and projected trends, Report no. 01/2018, PBO, accessed 23 October 2023.

Parliamentary Library (2020) The impact of COVID-19 on JobSeeker Payment recipient numbers by electorate, Statistical Snapshot, Research Paper Series 2020–21, Department of Parliamentary Services, Parliament of Australia, accessed 3 November 2023.