Housing assistance

On this page

There is a range of assistance provided by the Commonwealth and state and territory governments to people who find it difficult to sustain affordable and appropriate housing in the private marketplace. Housing assistance refers to both access to social housing (such as public housing) as well as targeted financial assistance for eligible Australians.

Access to affordable housing

Housing plays a critical role in the health and wellbeing of Australians (SCRGSP 2020). The lack of affordable housing puts households at an increased risk of experiencing housing stress, which can impact on workforce participation, education attainment, social security and health. It can also place people at risk of homelessness (CSERC 2015; SCRGSP 2020; Rowley & Ong 2012).

Housing assistance can help people avoid housing stress which improves household wellbeing (Rowley & Ong 2012). Assistance also enhances security of tenure, which improves social cohesion (Bridge et al. 2007).

For more information, see Housing affordability and Home ownership and housing tenure (AIHW 2019a).

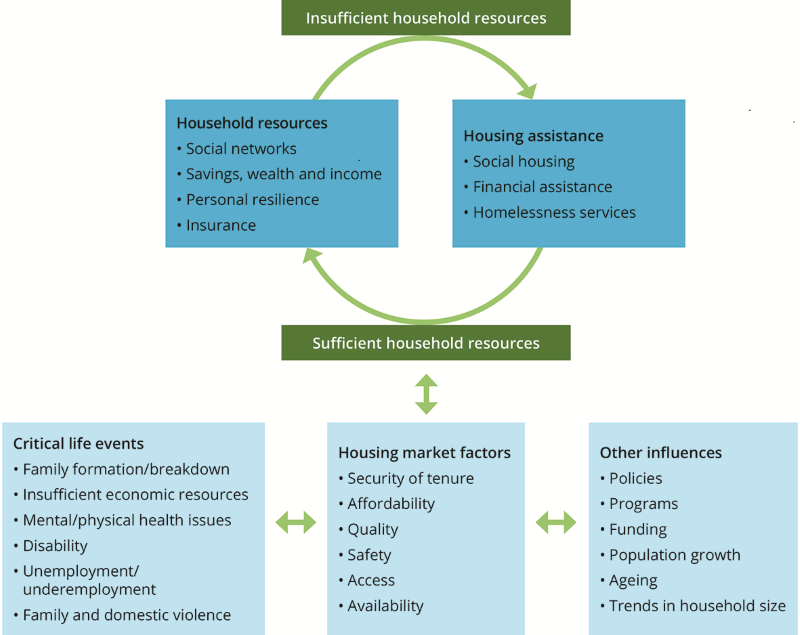

Types of housing assistance

Housing assistance explored throughout this report includes:

- the provision of social housing, owned and managed by government and non-government organisations, including:

- public housing (PH)

- state owned and managed Indigenous housing (SOMIH)

- community housing (CH)

- Indigenous community housing (ICH)

- financial assistance with rental costs for those in the private market, including:

- Commonwealth Rent Assistance (CRA)

- Private Rent Assistance (PRA)

- financial assistance with home purchase, including:

- Home Purchase Assistance (HPA)

- the provision of services to assist in obtaining accommodation or sustaining tenancies, including:

- Specialist Homelessness Services. For information relating to homelessness services, see Specialist homelessness services annual report 2018–19.

Definitions of housing assistance programs

Social housing

- Public housing: Rental housing managed by all state and territory housing authorities. Included are dwellings owned by the housing authority or leased from the private sector or other housing program areas and used to provide public rental housing or leased to public housing tenants. It is accessed by those on low incomes and/or with greatest and/or special needs.

- Community housing: Housing managed by community-based organisations, available to low to moderate income or special needs households. CH models vary across states and territories, and the housing stock may be owned by a variety of groups including government.

- State owned and managed Indigenous housing: Housing that state and territory governments provide and manage. It is accessed by those on low incomes and/or with special need and is available to households that have at least one member who identifies as being of Aboriginal and/or Torres Strait Islander origin.

- Indigenous community housing: Housing that Indigenous communities own and/or manage. These organisations may either directly manage the dwellings they own or sublease tenancy management services to the relevant state/territory housing authority or another organisation. This type of housing is made available to households with at least one Indigenous member (AIHW 2019b).

Financial assistance with rental costs

- Commonwealth Rent Assistance: This is a payment provided by the Australian government to eligible families and individuals who pay or are liable to pay private rent or community housing rent. Commonwealth Rent Assistance is paid at 75 cents for every dollar above a minimum rental threshold until a maximum rate (or ceiling) is reached. The minimum threshold and maximum rates vary according to the household or family situation, including the number of children (DSS 2019).

- Private Rent Assistance: This is financial assistance administered by each state and territory government. It provides a range of financial assistance to low-income households experiencing difficulty in securing or maintaining private rental accommodation. Private Rent Assistance is usually provided as a one-off form of support—such as bond loans and rental grants—but can also include ongoing rental subsidies and payment of relocation expenses (AIHW 2019c).

Financial assistance with home purchase

- Home Purchase Assistance: This is a form of government financial assistance administered by each state and territory. It provides a range of financial assistance to eligible households to improve their access to, and maintain, home ownership. Home Purchase Assistance may vary from state to state and some products are not offered by all states and territories (AIHW 2019c).

Home ownership schemes

The First Home Loan Deposit Scheme is an Australian Government initiative to support eligible first home buyers to purchase a home sooner. Under the Scheme, part of an eligible first home buyer’s home loan from a participating lender will be guaranteed by National Housing Finance and Investment Corporation (NHFIC); up to 15 per cent of the value of the property purchased. This is aimed at enabling first home buyers to purchase a home with a deposit of as little as 5 per cent (lender's criteria apply) (NHFIC 2020).

First Home Super Saver Scheme, introduced by the Australian Government in the 2017–18 Federal Budget, supports first homebuyers who meet the eligibility criteria to save money for a house deposit using their superannuation fund. They can voluntarily contribute up to $15,000 in any one financial year, and $30,000 in total under the scheme. They receive the tax benefit of saving through their superannuation contribution arrangements (ATO 2019).

The Indigenous Home Ownership Program helps to facilitate Indigenous Australians into home ownership through providing access to affordable home loan finance. The program aims to address barriers such as loan affordability, low savings, impaired credit histories and limited experience with long-term loan commitments (IBA 2019).

The National Disability Insurance Scheme funds Specialist Disability Accommodation for eligible participants with extreme functional impairment or very high support needs when deemed necessary and reasonable. These homes must be built to specific design standards and may be purpose built apartments or free standing dwellings (NDIS 2019).

The First Home Owner Grant scheme, introduced nationally on 1 July 2000, is funded by the state and territory governments and administered under their legislation. A one-off grant is payable to first homeowners who apply and satisfy eligibility criteria. (Australian Government 2020). Additional schemes may also be in place in states/territories, such as first home buyer exemptions from some transfer duties.

These types of assistance are not the focus of this report.

Housing assistance policy framework

Government policies and funding provide support for people whether they are homeless, at risk of homelessness or need support to secure/sustain housing. The government is involved in housing assistance in three main areas: social housing services, financial assistance (private housing) and specialist homelessness services. Policies and programs operate at both national and state/territory levels.

Brief history of housing assistance

Post-World War II, there was a shortage of affordable and suitable housing due to the Great Depression and the use of labour and building materials for supporting the war effort (Dufty-Jones 2018). This resulted in the government focusing its attention on providing adequate housing as well as replacing slums (Troy 2012; Macintyre 2015).

In 1943, the Commonwealth Housing Commission was appointed by the Commonwealth government to evaluate the condition of Australia’s housing stock. The Commission estimated that there was a shortage of 300,000 dwellings and advised the Commonwealth to provide housing to overcome the deficit in housing. This resulted in the first Commonwealth-State Housing Agreement (CSHA) in 1945.

The CSHA was an agreement between the Commonwealth-States/territories with the purpose of providing funds for the construction of new dwellings. This resulted in housing provision by governments becoming a more prominent part of the housing landscape. The 1945 CSHA has been updated numerous times and the 2003 CSHA was eventually replaced by the National Affordable Housing Agreement (NAHA) in 2003 (Parliament of Australia 2001), and since then superseded by the National Housing and Homelessness Agreement in 2018 (CFFR 2019).

Historically, social housing was built to stimulate the economy, to provide secure accommodation and to help people participate in the workforce (Roger 2016) and was made available to working families on low to moderately low incomes (Groenhart et al. 2014; AHURI 2017). From 1956 to 1973, the focus was to encourage home ownership and to support low-income households in the public rental market.

By the 1999 CSHA, the emphasis was to help families and individuals who could not be adequately housed in the private market. A key feature of this Agreement was that housing assistance should be based on need as opposed to the earlier notion of security of tenure (Parliamentary of Australia 2001).

With the introduction of NAHA in 2003, social housing increasingly focused on assisting households with greater disadvantage and higher and more complex needs than before—those in greatest need, especially those experiencing homelessness (CFFR 2019).

National Housing and Homelessness Agreement (NHHA)

The National Housing and Homelessness Agreement began in July 2018. It aims to improve access to affordable, safe and sustainable housing across the housing spectrum. The agreement covers social housing and support for people experiencing homelessness or those at risk of homelessness (CFFR 2019). Funding provided under the NHHA is commensurate with funding under former agreements.

Housing assistance funding

In 2018–19, the Australian Government funding for services under the NHHA was $1.7 billion (SCRGSP 2020). This funding is included in total state and territory government net recurrent expenditure to support the delivery of housing and homelessness services.

State and territory government capital (non-recurrent) expenditure for social housing was $1.5 billion in 2018–19. Net recurrent expenditure on social housing was $4.0 billion in 2018–19, a decrease in real terms from $4.1 billion in 2017–18. In 2018–19, this expenditure included $3.0 billion for public housing and $205.8 million for state owned and managed Indigenous housing (SCRGSP 2020).

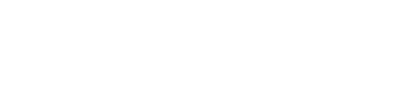

Drivers for people seeking housing assistance

Many factors can lead people to seek assistance with housing. Often it is when there are insufficient household resources to manage the impact of critical life events and/or housing market factors (Figure 1).

Figure 1: Drivers of requests for housing assistance

Critical life events relate to significant life cycle milestones that lead to transitions, for example, the formation/breakdown of a family, experiencing family and domestic violence, ill health (mental or physical) or changes in working arrangements. These transitions may lead households to seek housing assistance. Research shows that households that experience a number of adverse critical life events, affecting their social and economic circumstances, are more likely to need assistance in accessing or maintaining their housing (Stone et al 2016).

Housing market factors such as limited access, unaffordability, insecure tenure, poor housing quality and safety that cannot be mitigated by household resources can be a driver for seeking housing assistance. These factors are influenced by critical life events, for example, the formation of a new household with an increase in people may face limited housing options as a result of limited suitable stock availability within a specific price range in a preferred area.

Households that experience a critical life event or are affected by housing market factors, rely on the household resources (such as savings, assets, or social networks) to ensure that they are able to access or sustain appropriate housing (Stone et al 2015). Households with low incomes often lack the resources to insure against any negative impacts arising from critical life events and/or housing market factors leading them to require housing assistance.

Household transitions

Households may experience changing needs and events throughout the life course. This can render them in need of diverse types of assistance and impact upon a household’s demand for assistance over time. Households need the greatest support at certain life stages such as when they experience unemployment or housing affordability issues (Stone et al. 2016).

Some households may need to access services once, while others might spend more time in the system, accessing different services (AIHW 2019d). Those obtaining support may transition between receiving access to social housing, and private rental, home purchase or Specialist Homelessness Services (Figure 2).

Figure 2: Housing and specialist homelessness services transitions

- AHURI (Australian Housing and Urban Research Institute) 2017. Public housing renewal and social mix. Policy brief 1 Sep 2017. Viewed 11 February 2020.

- AIHW (Australian Institute of Health and Welfare) 2019a. Australia’s Welfare snapshots. Viewed 19 February 2020.

- AIHW 2019b. Housing Assistance glossary. Viewed 18 February 2020.

- AIHW 2019c. Housing Assistance in Australia 2019. Cat. no. HOU 315. Canberra: AIHW.

- AIHW 2019d. People in short-term or emergency accommodation: a profile of Specialist Homelessness Services clients. Cat. no. HOU 300. Canberra: AIHW.

- AIHW 2019e. Specialist Homelessness Services Annual Report 2018–19. Cat no. HOU 318. Canberra: AIHW.

- ATO (Australian Tax Office) 2019. First home super saver scheme. Viewed 19 February 2020.

- Australian Government 2020. First Home Owner Grant. Viewed 19 February 2020.

- Bridge C, Flatau P, Whekan S, Wood G, & Yates J 2007. How does housing assistance affect employment, health and social cohesion? Australian Housing and Urban Research Institute (AHURI) Research & Policy Bulletin issue 87. Melbourne: AHURI.

- CSERC (Commonwealth Senate Economic Reference Committee) 2015. Out of reach? The Australian housing affordability challenge. Canberra: CSERC.

- CFFR (Council on Federal Financial Relations) 2019. National Housing and Homelessness Agreement. Viewed 12 February 2020.

- DSS (Department of Social Services) 2019. Housing support–Commonwealth Rent Assistance. Canberra: DSS. Viewed 12 February 2020.

- Dufty-Jones R 2018. A historical geography of housing crisis in Australia. Australian Geographer Volume 49 Issue 1, pages 5-23.

- Groenhart L, Burke T & Ralston L 2014. Thirty years of public housing supply and consumption 1981–2011. AHURI Final Report No. 231. Melbourne: AHURI.

- IBA (Indigenous Business Australia) 2019. Indigenous Business Australia Annual report 2018–19. Canberra: IBA.

- Macintyre S 2015. Australia’s Boldest Experiment: War and Reconstruction in the 1940s. Sydney: New South Publishing.

- NDIS (National Disability Insurance Scheme) 2019. Specialist Disability Accommodation. Viewed 10 March 2020.

- NHFIC (National Housing Finance and Investment Corporation) 2020. First Home Loan Deposit Scheme. Viewed 8 April 2020.

- Parliament of Australia 2001.The Commonwealth-State Housing Agreement. E-Brief online issued 29 November 2001. Canberra: Parliament of Australia. Viewed 18 February 2020.

- Roger D 2016. Design, policy and stigma: Lessons from Australia's golden age of public housing. Blueprint for Living, ABC Radio National 22 June 2016. Viewed 11 February 2020.

- Rowley S & Ong R 2012. Housing Affordability, housing stress and household wellbeing in Australia. AHURI Final Report no. 192. Melbourne: AHURI.

- SCRGSP (Steering Committee for the Review of Government Service Provision) 2020. Report on Government Services 2020 – Housing. Canberra: Productivity Commission.

- Stone W, Sharam A, Wiesel I, Ralston L, Markkanen S, & James A 2015. AHURI. Accessing and sustaining private rental tenancies: critical life events, housing shocks and insurances. AHURI Final Report No.259. Melbourne: AHURI.

- Stone S, Parkinson S Sharam A & Ralston L. 2016. Housing assistance need and provision in Australia: a household-based policy analysis. Australian Housing and Urban Research Institute (AHURI). AHURI Final Report No. 262. Melbourne: AHURI.

- Troy, P 2012. Accommodating Australians: Commonwealth Government Involvement in Housing. Annandale, NSW: Federation Press.