Income support for young people

Citation

AIHW

Australian Institute of Health and Welfare (2021) Income support for young people, AIHW, Australian Government, accessed 27 July 2024.

APA

Australian Institute of Health and Welfare. (2021). Income support for young people. Retrieved from https://www.aihw.gov.au/reports/children-youth/income-support

MLA

Income support for young people. Australian Institute of Health and Welfare, 25 June 2021, https://www.aihw.gov.au/reports/children-youth/income-support

Vancouver

Australian Institute of Health and Welfare. Income support for young people [Internet]. Canberra: Australian Institute of Health and Welfare, 2021 [cited 2024 Jul. 27]. Available from: https://www.aihw.gov.au/reports/children-youth/income-support

Harvard

Australian Institute of Health and Welfare (AIHW) 2021, Income support for young people, viewed 27 July 2024, https://www.aihw.gov.au/reports/children-youth/income-support

Get citations as an Endnote file: Endnote

On this page:

Key findings

- In June 2020, almost 1 in 4 (23%) young people aged 16–24 received an income support payment, compared with 14% in June 2019.

- In June 2020, unemployment payments were the most common payment received (50%) by young people aged 16–24 who received an income support payment, followed by student payments (34%).

- Over the period March–May 2020, the proportion of the population aged 16–24 receiving unemployment payments (the JobSeeker Payment and the Youth Allowance [Other]) more than doubled – from 5.6% to 11.5%, reflecting the introduction of social distancing and business restrictions due to the COVID-19 pandemic. By March 2021, this proportion had declined to 8.3%; however, it was still higher than before the pandemic (4.7% in December 2019).

- Over March–May 2020, the proportion of the population aged 16–24 receiving unemployment payments doubled for both males and females (from 6.0% to 11.9% for males and from 5.2% to 11.0% for females). By March 2021, the proportion of young people in receipt of unemployment payments fell to 8.8% for males, and to 7.9% for females.

Many factors influence a young person’s wellbeing, but having an adequate income is essential to measure individual and household wellbeing (ABS 2015). Adequate levels of income for young Australians can help them to better support themselves and their families and to participate in their communities more broadly. For more information on young people’s income see Income: household and individual.

Australia’s social security system aims to support people who cannot, or cannot fully, support themselves. It is an essential part of the more extensive network of services and assistance provided by governments and non-government organisations to improve the economic and social wellbeing of disadvantaged Australians, including young people.

Australian social security payment policy is administered by the Department of Social Services (DSS) and delivered by Services Australia. It provides a range of payments, benefits and allowances to those unable to work (due to disability or caring responsibilities) or unable to find work; as well as payments designed to assist families with the cost of raising children and rental costs.

- In 2018, income from government payments accounted for 8.5% of gross income among those aged 15–24 (see Income: household and individual).

When these payments serve as a recipient’s primary source of income, they are called an ‘income support payment’ – a category of social security payments. This section focuses on income support payments as those receiving these may be more vulnerable than those who do not (see Box 1 for further details on income support payments).

This section presents:

- the latest publicly available information on income support receipt and the characteristics of recipients following the COVID-19 restrictions implemented in Australia in 2020

- trends in income support receipt over the last decade, particularly focusing on any changes before and during the COVID-19 pandemic. Data are sourced from DSS Payment Demographic Data, unless otherwise noted (see Box 1).

Box 1: Income support payments and data sources

Income support payments

Benefits classified as income support payments generally serve as a recipient’s primary source of income; they are regular payments that help with the day-to-day cost of living. These payments are subject to means testing – as income and assets rise, the rate of payment is reduced toward zero. Individuals can receive only 1 income support payment at a time.

Eligibility for income support starts at age 16, with some rare exceptions – as at June 2020, only 1,000 young people aged 15 and under were receiving an income support payment. Therefore, this section focuses on those aged 16–24.

The main income support payments available to young people, and covered in this section, include:

- student payments – Youth Allowance (Student and Apprentice) and ABSTUDY

- unemployment-related payments – Newstart Allowance (ceased on 20 March 2020), JobSeeker Payment (from 20 March 2020) for people aged from 22 years to age pension qualifying age, and Youth Allowance (other) for young people aged 16 to 21 years.

- parenting payments – Parenting Payment Single and Parenting Payment Partnered

- disability-related payments – Disability Support Pension (DSP) and Carer Payment.

Young people may also receive Special Benefit (for those in financial hardship who are ineligible for other income support). As well, before March 2020, young people could receive Sickness Allowance (for individuals temporarily incapacitated) or Bereavement Allowance (for recently widowed persons). Since 20 March 2020, assistance for young people who are recently widowed or temporarily incapacitated is provided through JobSeeker Payment or Youth Allowance (other). These payments, combined with those listed earlier, are referred to as ‘income support payments’ throughout this section.

Further details about the different government payments available to young Australians, as well as to other Australians, can be found at the Services Australia website and Department of Social Services website.

Data sources and methodology

Data in this report are sourced from official published data from the DSS (DSS Payment Demographic Data) that are constructed from Services Australia administrative data, unless otherwise specified. Data are based on counts of recipients on the last Friday of December in the year being reported on (for example, the 25th of December in 2020), unless otherwise specified.

How many young people receive income support?

Young people in Australia may receive income support payments for a range of reasons, with the payment type often reflecting their life circumstances at the time. The payment can indicate, for example, those who require support while pursuing higher education (student payments) or while looking for work (unemployment-related payments), or those who are unable to work due to disability or caring responsibilities (disability-related payments). In this section, income support payments refer to the payments listed in Box 1.

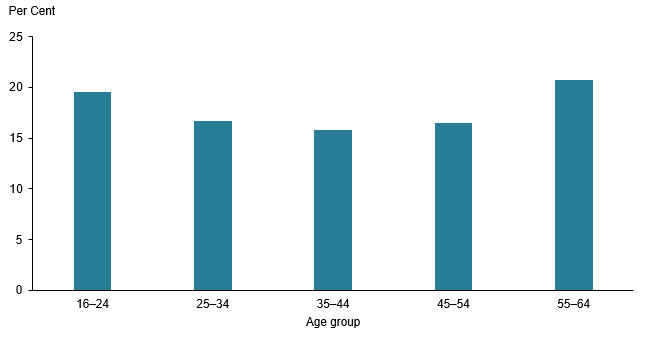

As at 25 December 2020, 567,700 young people aged 16–24 received an income support payment, equating to 20% of the population aged 16–24. Young people were slightly more likely to be receiving income support payments than those aged 25–54 (see Figure 1). As a proportion of the population, income support receipt was:

- 17% for Australians aged 25–34

- 16% for Australians aged 35–44

- 17% for Australians aged 45–54

- 21% for Australians aged 55–64.

As a proportion of all income support recipients, young people account for a roughly equal proportion of the income support population – 20% compared with 18–22% for the 10-year age groups between ages 25–64.

Figure 1: Proportion of people aged 16–64 receiving income support, by age group, December 2020

Chart: AIHW.

Source: AIHW analysis of DSS Payment Demographic data on data.gov.au.

What types of income support do young people receive?

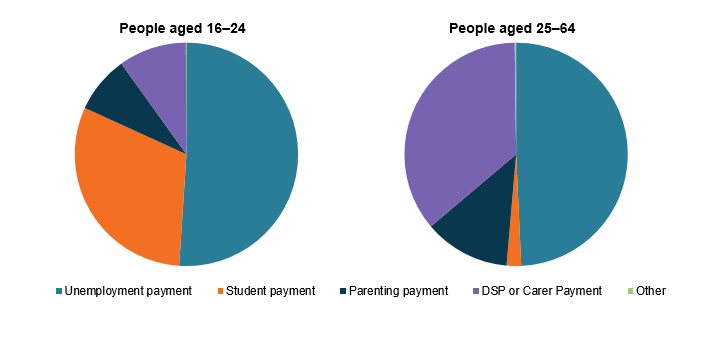

Of the 567,700 young people aged 16–24 receiving an income support payment as at December 2020:

- 51% received unemployment payments

- 31% received student payments

- 10% received disability-related payments

- 8.3% received parenting payments (Figure 2).

In comparing receipt of income support among young people aged 16–24 and those aged 25–64:

- about the same proportion of each age group received unemployment payments (51% and 49%, respectively) (Figure 2)

- the proportion of those receiving student payments was far greater for those aged 16–24 than for those aged 25–64 (31% and 2%, respectively)

- the proportion of those receiving both disability-related and parenting payments was lower for those aged 16–24 than for those aged 25–64 (10% versus 36%, and 8% versus 12%, respectively).

Figure 2: Income support payment types received by people aged 16–24 and 25–64, as a proportion of income support recipients, December 2020

Note: Other includes Special Benefit, Widow Allowance and Partner Allowance.

Chart: AIHW.

Source: AIHW analysis of DSS Payment Demographic data on data.gov.au.

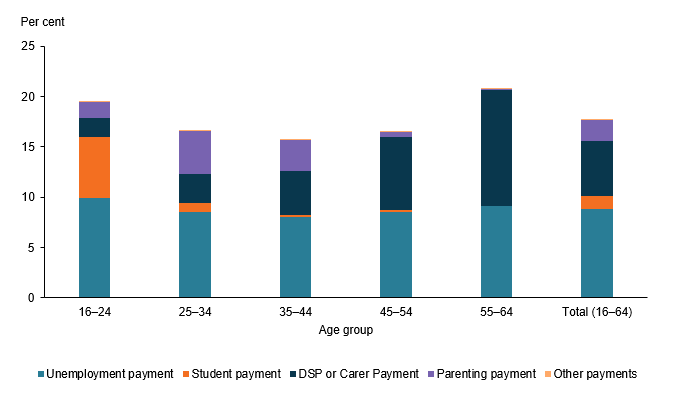

When looking at the proportion of the total population receiving income support payments by age group, unemployment payment receipt was slightly higher for people aged 16–24 (at 10%) than other age groups of working age, which ranged from 8.0% (35–44 years) to 9.1% (55–64 years) (Figure 3). In contrast, receipt of DSP or Carer Payment was lowest for young people aged 16–24 at 1.9%, compared with 7.3% to 12% for those aged 45–64.

Figure 3: Proportion of people aged 16–64 receiving income support payments, by age group and payment type, December 2020

Note: Other includes Special Benefit, Widow Allowance and Partner Allowance.

Chart: AIHW.

Source: AIHW analysis of DSS Payment Demographic data on data.gov.au.

Unemployment payments

Unemployment payments are available for young people who either do not have a job or are earning under the income threshold.

According to the ABS Labour Force Survey, as at 30 June 2020, there were:

- 329,000 unemployed young people aged 15–24 (unemployment rate of 16%)

- an additional 397,000 underemployed young people – that is, who were seeking more hours of work (underemployment rate of 20%) (ABS 2021a).

For more information on youth unemployment and underemployment, see Engagement in education or employment.

To receive an unemployment payment, most applicants are required to be looking for work or be engaged in activities that will help them find work in the future (such as volunteering or training) (see Box 2 for further details). From March to September 2020, these requirements were suspended for all recipients to help those affected by the COVID-19 pandemic.

As at the end of June 2019, before these requirements were suspended, 39% of all unemployment payment recipients were exempt from these requirements due to an impairment that reduced their work capacity to fewer than 30 hours per week. In June 2020, 85% of all unemployment payment recipients had worked zero hours in the last fortnight, a slight increase from 81% in June 2019.

Box 2: Unemployment payments

The main unemployment payments available to those aged 16–24 are Newstart Allowance (until March 2020), the JobSeeker Payment (from March 2020) and the Youth Allowance (other).

Newstart Allowance

Before March 2020, Newstart Allowance was the main income support payment for unemployed people of workforce age (those aged 22 and over, but under the Age Pension qualifying age) while they look for work or participate in approved activities that may increase their chances of finding a job.

JobSeeker Payment

As of March 2020, the JobSeeker Payment replaced the Newstart Allowance as the main income support payment for those aged 22 and over who are unemployed and looking for work, or temporarily unable to work.

Youth Allowance (other)

Youth Allowance (other) provides financial help to those aged 16–21 who are looking for work, temporarily unable to work, or undertaking approved activities. Qualification is subject to a parental income test unless the young person is considered independent.

Not all recipients of unemployment payments are unemployed. Recipients can earn an income and still receive a payment, or they may not be actively looking for work while undertaking other approved activities to increase their employability.

- As at 30 June 2018, it was estimated that almost 1 in 3 (30%) unemployment payment recipients of all ages were unemployed (Parliamentary Library 2019).

Further, not all unemployed people receive an unemployment payment. Unemployed people may not meet all eligibility requirements (such as asset tests or partner income tests) or may, instead, be receiving a different income support payment.

- It was estimated that over 1 in 4 (28%) unemployed people of all ages received an unemployment payment in 2018 (Parliamentary Library 2019).

As at 25 December 2020, 290,000 people aged 16–24 received an unemployment payment, equating to 10% of the population aged 16–24. Of all income support recipients aged 16–24, 1 in 2 received an unemployment payment.

Young people aged 16–24 accounted for 1 in 5 (20%) of all unemployment payment recipients of workforce age (16–64). Receipt of this payment was slightly higher for people aged 16–24 than other age groups of working age, which ranged from 8.0% (35–44 years) to 9.1% (55–64 years) (Figure 3).

Student payments

In May 2020, around 63% or 2 million young people aged 15–24 were studying (including school students), with 1 million of them studying for a Certificate III or above. Of these 2 million young people studying, 51% were female (1,090,000 compared with 983,000 males) (ABS 2020).

For more information on young people’s education, see Non-school qualification.

A range of payments are available to support young people studying or undertaking an apprenticeship (see Box 3 for further details). Student payments are generally viewed as having a positive effect on being engaged in the labour market; therefore, higher numbers of student payment recipients are seen as a positive outcome.

Box 3: Student payments

The main payments for those aged 16–24 who are studying or undertaking an apprenticeship are Youth Allowance (Student) (YAS), Youth Allowance (Australian Apprentices) (YAA) and ABSTUDY. Another student payment, Austudy, is excluded here as the qualifying age for the start of payment is 25. Student payments are subject to other eligibility criteria, including personal, parental and partner income tests.

ABSTUDY

ABSTUDY is a living allowance and range of supplementary benefits for Aboriginal and Torres Strait Islander students and apprentices.

Youth Allowance (YAS) and Youth Allowance (YAA)

The Youth Allowance payments are available for full-time students and Australian apprentices aged 16–24. Secondary students aged 16–17 must be independent or living away from home to receive these payments. Students aged 16–17 living at home may also qualify if they have completed year 12 or equivalent and are studying full time.

As at 25 December 2020, 174,700 people aged 16–24 received a student payment – 167,900 YAS and YAA combined, and 6,800 ABSTUDY, equating to:

- 6.0% of the Australian population aged 16–24 (Figure 3), compared with 0.9% of the Australian population aged 25–34.

Further, 1 in 3 (31%) income support recipients aged 16–24 received 1 of these student payments.

Young people aged 16–24 accounted for 78% of all student payment recipients aged 16–64 (including Austudy), reflecting that young people are more likely to be studying or undertaking apprenticeships than those in older age groups.

Disability Support Pension

In 2018, there were an estimated 291,000 – or almost 1 in 10 (9.3%) young people in Australia – with disability.

- Nearly 2 in 5 (37%) of these young people – about 107,000 or 3.4% of the Australian population aged 15–24 – have severe or profound disability. This means sometimes or always needing help with daily self-care, mobility or communication activities (ABS 2019). For further information on people of all ages with disability in Australia, see People with disability in Australia, 2020.

Young people with disability may receive financial assistance to meet their everyday costs of living. In 2018, an estimated 44% of young people with severe or profound disability received a government pension or allowance as their main source of income (ABS 2019). The DSP is the primary income support payment for people aged 16 and over with disability who have a reduced capacity to work because of their impairment (see Box 4 for further details). Note that children with disability under the age of 16 may qualify their carer for Carer Payment.

Box 4: Disability-related payments

Disability Support Pension

The DSP is a means-tested income support payment for people who are aged 16 and over but under the Age Pension age (at claim) and who have reduced capacity to work because of their disability. This includes those who:

- are permanently blind

- have a physical, intellectual or psychiatric condition resulting in functional impairment that makes the person unable to work for 15 hours or more per week for the next 2 years due to their disability or medical condition

- are unable, as a result of impairment, to undertake a training activity that would equip them for work within the next 2 years.

Carer Payment

The Carer Payment is for those who, due to caring responsibilities, are unable to support themselves through substantial paid employment. In December 2020, 8,100 young people aged 16–24 received the Carer Payment due to their caring responsibilities.

As at 25 December 2020, 47,650 young people aged 16–24 received the DSP, equating to 1.6% of the population aged 16–24. Of all income support recipients aged 16–24, 8.4% received the DSP.

Young people accounted for 7% of all DSP recipients aged 16–64, with the number of these recipients rising steeply with increasing age – 2 in 3 (65%) were aged 45–64, equating to 6.9% of the population aged 45–64 in receipt of the DSP (Figure 3).

Parenting payments

Parenting payments are available to parents who are unable to work full time due to their caring role. These payments are the main income support payment available to low-income parents with sole or primary responsibility for a young child (see Box 5).

Box 5: Parenting payments

Parenting payments provide a safety net for parents who might otherwise be at risk of hardship. Parenting payments recognise the impact that caring for a young child can have on a parent’s capacity to undertake full-time employment. Only 1 parent or guardian can be the principal carer and receive the payment.

Parenting Payment Single

Parenting Payment Single is for single parents where the youngest child is aged under 8. Single parents must satisfy part‑time mutual obligation requirements of 30 hours per fortnight once their youngest child turns 6 (unless exempt).

Parenting Payment Partnered

Parenting Payment Partnered is for partnered parents where the youngest child is aged under 6.

As at 25 December 2020, 47,000 people aged 16–24 received a parenting payment, equating to 1.6% of the population aged 16–24, and 8.3% of income support recipients aged 16–24. Of these, 3 in 4 (34,600) received a Parenting Payment Single.

Young people aged 16–24 accounted for 14% of all parenting payment recipients of workforce age – those aged 25–44 were more than twice as likely to receive a parenting payment than those aged 16–24, reflecting the influence of key life stages (3.7% compared with 1.6%, respectively) (Figure 3).

While Parenting Payment Single and Parenting Payment Partnered are the main income support payments for parents in Australia, families may also receive additional financial support toward the cost of raising children through the Family Tax Benefit (see the DSS website for further details). For young people aged 16–24, 2% (or 63,300) received Family Tax Benefit A and the same proportion (2%, or 60,100) received Family Tax Benefit B.

For information about transitions within the income support system, see Box 6.

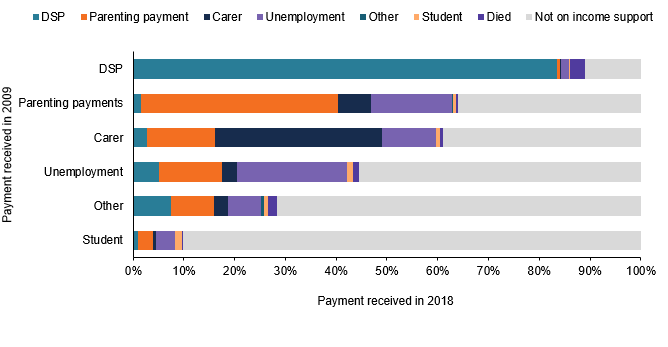

Box 6: Transitions within the income support system

The long-term transitions of young people in/out of the income support system, or between payments, can indicate the broader pathways of young people and provide a more nuanced picture of their interactions with the income support system.

Methodology

To investigate these transitions, individuals aged 18–24 who received income support payments as at June 2009 were tracked through the data to investigate what income support payment (if any) they were receiving 9 years later, in June 2018.

The data used in this analysis are sourced from the Research and Evaluation Database (RED) – a researchable longitudinal database constructed from Services Australia administrative income support data. Data from the RED may differ from official statistics on income support payments and recipients, as well as from counts published elsewhere in this report, due to differences in methodology.

This analysis does not capture all the changes over this period – rather, it captures only the payment an individual was receiving at the 2 measurement points. As well, the analysis examines a cohort who, 12 years ago, were aged 18–24 as of the date this report is published. The analysis may or may not be analogous to the experience of young people today.

Results

Overall, in 2018, over 1 in 3 (38%) income support recipients aged 18–24 in 2009 were receiving an income support payment:

- More than 4 in 10 (43%) of the 2009 unemployment payment recipients were receiving an income support payment. This included 22% on an unemployment payment, 12% on Parenting Payment Single and another 9% on other payments.

- More than 6 in 10 (64%) of the 2009 parenting payment recipients were receiving income support. This includes 39% on a parenting payment, 16% on an unemployment payment and 9% on other payments.

- Almost 9 in 10 (86%) 2009 DSP recipients were receiving income support, with 83% receiving DSP (Figure 4).

Figure 4: Most common movements of the 2009 cohort aged 18–24 between payment categories at 2018

Chart: AIHW.

Source: AIHW analysis of Services Australia administrative data.

Have there been changes over time?

As at 26 June 2020, 656,300 young people aged 16–24 received an income support payment, with the number of recipients considerably higher than in previous years (628,500 in 2011, dropping to 417,700 in 2019).

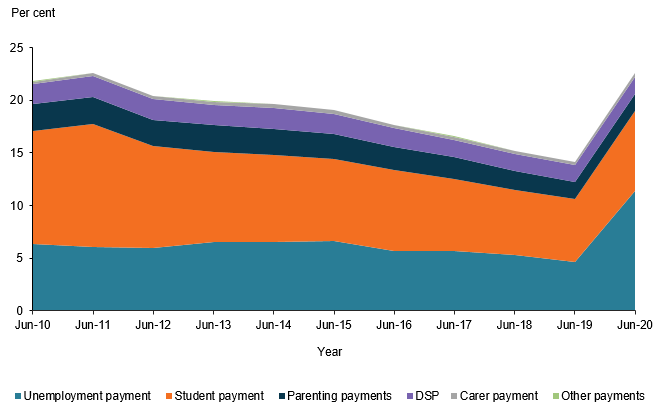

Before March 2020, the proportion of young people in receipt of income support payments had been steadily falling over the previous decade:

- from 22% in 2010

- to around 19–20% between 2012 and 2015

- to 14% in 2019.

These declines reflect labour market conditions as well as reforms to the social security system over this period. The overall pattern observed for young people follows the same trend as for those aged 25–64.

Since March 2020, however, a number of government programs have been put in place to reduce the economic impact of the restrictions on non-essential industries due to the COVID-19 pandemic. As at June 2020, 23% of young people received an income support payment – an increase of 9 percentage points from June 2019.

This section presents trends in receipt of income support over the last decade, with the following sub-section focusing on how this changed during the COVID-19 pandemic.

Types of payment

Between 2010 and 2019, unemployment payment receipt for young people aged 16–24 was relatively steady, fluctuating between 4.7–6.6%.

- As at June 2020, however, the number and proportion of unemployment payment recipients more than doubled compared with that in 2019, with numbers increasing by 192,500, and the proportion from 4.7% to 11.4% (Figure 5). For further information on this increase, see Government payments during COVID-19.

While the number of recipients of student payments aged 16–24 decreased overall from 298,900 in June 2010 to 220,700 in June 2020, there was a 25% increase (or an additional 44,300 recipients) between 2019 and 2020. This increase may have been influenced by the 2020 COVID-19 pandemic and young people’s continuing to study and delaying their entry into the labour market due to unfavourable job market conditions.

- In a similar fashion, the proportion of those aged 16–24 receiving student payments also fell from 11% in 2010 to 6.0% in 2019, increasing slightly to 7.6% in 2020.

The proportion of the population aged 16–24 receiving the DSP remained relatively stable between 2010 and 2020 though with some fluctuations: the proportions rose gradually between 2010 and 2014 (from 1.8% to 2.0%), then fell steadily to 1.6% in 2020. This decline may have been influenced by changes in eligibility criteria for the DSP (see People with disability in Australia, 2020 for more information on changes in eligibility criteria).

Parenting payments for single parents aged 16–24 decreased from 52,400 in 2010 to 35,800 in 2020 (a decline from 1.9% to 1.2% of the population aged 16–24). For partnered parents aged 16–24, there was also a decrease – from 19,500 in 2010 to 11,900 in 2020 (or from 0.7% to 0.4%). These declines may in part reflect labour market conditions, reforms to the social security system over this period, as well as parents’ deciding to have children later in life than in previous decades.

Figure 5: Proportion of people aged 16–24 receiving income support payments, by payment category, June 2010 to June 2020

Chart: AIHW.

Source: AIHW analysis of DSS Payment Demographic data on data.gov.au and other Services Australia administrative data.

Government payments during COVID-19

In April 2020, the Australian Government introduced short-term policy measures to protect those whose income was adversely affected by the coronavirus pandemic (COVID-19). These included:

- a coronavirus supplement for recipients of unemployment, parenting and student payments

- the suspension of mutual obligations and other eligibility requirements

- the introduction of the JobKeeper Payment for businesses.

Just before these short-term measures were introduced, on 20 March 2020 the JobSeeker Payment replaced Newstart Allowance, consolidating it with several other payments (such as Sickness Allowance and Bereavement Allowance) (see boxes 1 and 2 for further information).

Access to government payments and income support became increasingly important for young people in 2020, due to their greater vulnerability to job loss in the wake of COVID-19 restrictions. Of the 592,000 Australians who lost employment in April 2020, more than 1 in 3 (38% or 222,900) were aged 15–24 (ABS 2021a).

Young people were particularly affected by loss of work during this time as they were more likely to work in industries hardest hit by social distancing measures (retail, hospitality and recreation) and more likely to be on casual contracts. As well, those employed on a casual basis were more likely to have been with their current employer less than 12 months, making them ineligible for the JobKeeper Payment (Parliamentary Library 2020).

Income support

As at March 2020, before COVID-19 restrictions, 405,800 (or 14%) young people aged 16–24 received an income support payment. By June 2020, this had increased by 250,500 to 656,300 (or 23%) but then dropped slightly by December 2020 to 567,700 (or 20%).

The overall rise in income support receipt among 16–24-year-olds was largely driven by an increase in unemployment payments. Data on unemployment payment recipients is available monthly over the period of the COVID-19 pandemic (as opposed to quarterly data for other payments).

Over the period March–May 2020, the proportion of the population aged 16–24 receiving unemployment payments more than doubled – from 5.6% to 11.5%. This equates to an increase of 171,700 recipients over this period (from 162,000 to 333,600), reflecting the introduction of social distancing and restrictions on businesses.

Between May and September 2020, the number and proportion of recipients remained relatively stable (around 11%), declining steadily thereafter – 10% in October 2020 to 8.3% by March 2021 (Figure 6). This downward trend reflects:

- the easing of restrictions imposed by the COVID pandemic

- an associated decline in the receipt of unemployment payments by young people between May and March 2021 (from 333,600 to 242,900 – a decrease of 27%).

Figure 6: Proportion of people aged 16–24 receiving unemployment payments, March 2020 to March 2021

Chart: AIHW.

Source: AIHW analysis of JobSeeker Payment and Youth Allowance recipients – monthly profile on data.gov.au.

Age

Before COVID-19 restrictions, 5.6% of young people aged 16–24 received unemployment payments; this proportion was higher than for those aged 25–44, but lower than for those aged 55–64 (as at March 2020).

By April 2020, however, 9.0% of those aged 16–24 were receiving unemployment payments, which was higher than for other age groups (7.3–8.1%) (Figure 7).

This gap in the age-specific proportions between young people and other age groups continued to widen between May and June 2020 and then started to narrow, so that, by March 2021, the proportion of young people receiving unemployment payments was more similar to that for the other age groups (8.3% compared with 7.0–8.5% for other age groups). This proportion of young people on unemployment payments, however, was still 1.5 times as high as the pre‑pandemic level.

Those aged 16–24 accounted for the second highest increase in unemployment payment receipt, with a 106% increase (or 171,700) between March and May 2020 (compared with a 126% increase for those aged 25–34 and a 54–83% increase for other age groups).

Between May 2020 and March 2021, young people aged 16–24, as well as those aged 25–34, recorded a decrease of 27% in unemployment payment receipt. Other age groups also saw a reduction in unemployment payment receipt over this time, but at a lower rate (a decline of 11–21%).

Figure 7: Proportion of people receiving unemployment payments, by age group, March 2020 to March 2021

Chart: AIHW.

Source: AIHW analysis of JobSeeker Payment and Youth Allowance recipients, monthly profile on data.gov.au.

Sex

The rise in unemployment payment receipt differed between young males and young females. The total increase overall for both males and females for unemployment payments was 50% between March 2020 and March 2021. Payment for females increased by 52%, compared with 48% for males for this period.

Between March and April 2020, the number of females aged 16–24 receiving unemployment payments increased by 72%, compared with an equivalent 53% increase for males (a recipient increase of 52,100 and 47,400, respectively).

- Between April and May 2020, however, the increase in recipients aged 16–24 was greater for males than for females (31% compared with 24%)

- Between May 2020 and March 2021, the number of recipients fell for both young males and females (declines of 26% and 28%, respectively).

Figure 8 illustrates how the COVID-19 pandemic influenced unemployment payments by sex for the population aged 16–24.

- Over the March–May 2020 period, the proportion of the population aged 16–24 receiving these payments doubled for both males and females (from 6.0% to 11.9% for males and from 5.2% to 11.0% for females)

- By March 2021, the proportion of young females in receipt of unemployment payments reduced to 7.9%, while, for males, it reduced to 8.8%.

Figure 8: Proportion of young people aged 16–24 receiving unemployment payments, by sex, March 2020 to March 2021

Chart: AIHW.

Source: AIHW analysis of JobSeeker Payment and Youth Allowance recipients, monthly profile on data.gov.au.

JobKeeper Payment

The Australian Government introduced the JobKeeper Payment in March 2020 as a temporary wage subsidy to help keep businesses trading and people employed during the COVID-19 pandemic.

- The JobKeeper Payment was initially $1,500 per fortnight until 27 September 2020.

- The JobKeeper Payment was extended from 28 September 2020. The rate of payment was also tapered, and 2 tiers of payment introduced. Employers were able to claim either $1,200 or $750 per fortnight per eligible employee, based on their hours worked in the reference period.

- The payment rates changed in January 2021 to $1,000 and $650, respectively. The program ended on 28 March 2021.

- From May 2020, those aged 16 or 17 also had to be independent from their parents, or not be studying full-time, to be eligible for the payment as well as satisfying the other eligibility requirements.

Young people aged 15 to 24 experienced the largest drop in the employment to population ratio (elsewhere in this report referred to as the employment ratio) of all age groups between March and May 2020; a fall of 10 percentage points compared with a fall of 4 percentage points for the whole working age population aged 15–64 (ABS 2021b). Young people aged 15–24 made up 14% of the total employed population in April 2020 (ABS 2021b). However, of employees who received JobKeeper in April 2020 (the first month of payments), only 12% were aged 24 or under (ATO unpublished). The proportion remained at 11–12% until October 2020, when it dropped to 10%. By February 2021, 9% of those receiving the JobKeeper Payment were aged 24 years or under. This underrepresentation may reflect the eligibility rules for JobKeeper. A significant share of young people were employed as casuals and to be eligible for JobKeeper, casual employees had to be employed on a regular and systematic basis for at least 12 months.

Underrepresentation of young people on the JobKeeper Payments is consistent with their considerably higher receipt of income support payments than other age groups (as discussed in the Government payments during COVID-19 section).

Data development opportunities

Income support data are considered the most comprehensive source of data of those requiring government financial assistance in Australia.

The AIHW is enhancing and expanding its use of income support data to fill information gaps and provide a deeper understanding of how certain cohorts – in particular, disadvantaged and vulnerable populations – interact with the income support system. It will continue to work with the DSS and other partners to enhance the use of income support data to achieve a better understanding of health and welfare experiences and outcomes for Australians.

The AIHW is also using Data Over Multiple Individual Occurrences (DOMINO), a longitudinal researchable database on income support payments and characteristics, to examine the long-term welfare outcomes and transitions for vulnerable and disadvantaged young people. Two linkages have been successfully completed, and have shown the value of being able to view a young person’s experiences from a broader perspective. These are:

- children who have experienced out-of-home care – by linking DOMINO with state and territory out-of-home care data (see Income support receipt for young people transitioning from out-of-home care)

- young people leaving youth justice supervision – by linking DOMINO with the Youth Justice National Minimum Data Set (release date yet to be announced).

As well, the AIHW is collaborating with Australian, state and territory governments to pilot test a National Disability Data Asset (NDDA). The NDDA aims to employ data sharing and linkage to support improved policy development, program design and service delivery for people with disability. This pilot phase includes 5 test cases which all make use of DOMINO data to identify people receiving the DSP and other relevant payments as one of several study cohorts of interest.

Where do I find more information?

For more information on youth engagement and unemployment, see:

For more information on other topics related to income and finance among Australia’s young people, see:

For more information on income support, see:

For information on:

-

Indigenous young people and income, see Section 2.08, Income in Aboriginal and Torres Strait Islander Health Performance Framework (HPF) report 2020 and Section 3.3, Income in Aboriginal and Torres Strait Islander adolescent and youth health 2018.

For information on how factors relating to income, finance and employment can affect children aged 0–14, see:

- Income, finance and employment in Australia’s children.

For general technical notes relating to this report, see also Methods.

ABS (Australian Bureau of Statistics) 2015. Frameworks for Australian social statistics, Jun 2015. ABS cat. no. 4160.0.55.001. Canberra: ABS.

ABS 2019. Disability, ageing and carers, Australia: summary of findings, 2018. ABS cat. no. 4430.0. Canberra: ABS.

ABS 2020. Education and work, Australia, 2020. Canberra: ABS.

ABS 2021a. Labour force, Australia, April 2021. Canberra: ABS. Viewed 11 June 2021.

ABS 2021b. Labour force, Australia, detailed, April 2021. Canberra: ABS. Viewed 11 June 2021.

Parliamentary Library 2019. Measuring overlap between the unemployed and people ‘on the dole’. Canberra: Parliamentary Library. Viewed 04 February 2021.

Parliamentary Library 2020. COVID-19: impacts on casual workers in Australia—a statistical snapshot. Canberra: Parliamentary Library.

Australia's youth: